Cloud Computing Update: Zoom Out to Focus on the Big Picture

2022 was a year of macro and geopolitical shocks. The market responded to these events as one would expect – a highly correlated, cross-asset selloff. In a deteriorated economic environment, conventional wisdom calls for organizational cost management, including software spending. Yet, underneath the turmoil, software and data centre verticals experienced a net positive growth year.1 Spending in both of these segments continued to lead the growth of the overall IT market, albeit at a decelerating pace. More importantly, for 2023, the pace of growth is expected to pick up as organizations seek to realize operational efficiencies and implement cost management tools. These dynamics allow us to believe that cloud computing spending has become a profit centre instead of a cost centre for organizations. Combined with current, historical low valuations, the patient investor may see this as a unique opportunity.

Cloud computing is still in its early stages. Macroeconomic conditions could slow the pace of cloud adoption in the near term, but they likely won’t derail its long-term trajectory. We expect existing or soon-to-be cash-flow-generating cloud computing companies to continue to exhibit high levels of immunity. Meanwhile, low valuations forcing industrywide M&A is a trend that will likely continue.

Key Takeaways

- Enterprise software growth slowed to single digits in 2022 as buyers responded to the slowing economy. Yet, double-digit growth is expected to make a comeback in 2023.

- While the runway to further growth remains healthy, we believe cloud companies will likely have to focus on unit economics and profitability to keep investors calm in 2023.

- Valuations sliding to record lows kept deal activity high in 2022, and more deals are likely in 2023 with private equity and big tech companies expected to lead the way.

2022 Forced a Cloud Demand Reset

The cloud computing theme’s COVID-19 boost waned in 2022. Rising interest rates and looming macroeconomic uncertainty pushed enterprises to evaluate spending plans, negatively affecting IT budgets. Non-critical IT spending faced increased scrutiny. Certain applications that were popular during the pandemic, such as marketing, communications, analytics, customer support tools, were likely deprioritized in the return to the new normal.

Despite these headwinds, global IT spending grew slightly in 2022.2 Further analysis shows that software spending continued to grow at 8.0%, while data centre systems grew at 10.4%.3 In an inflationary world, software and technology is something that we can rely on as a deflationary force, enhancing productivity and streamlining business processes. Meanwhile, infrastructure needs are resurfacing as enterprises attempt to keep up with massive data generation and plan for longer-term IT moves to the cloud.

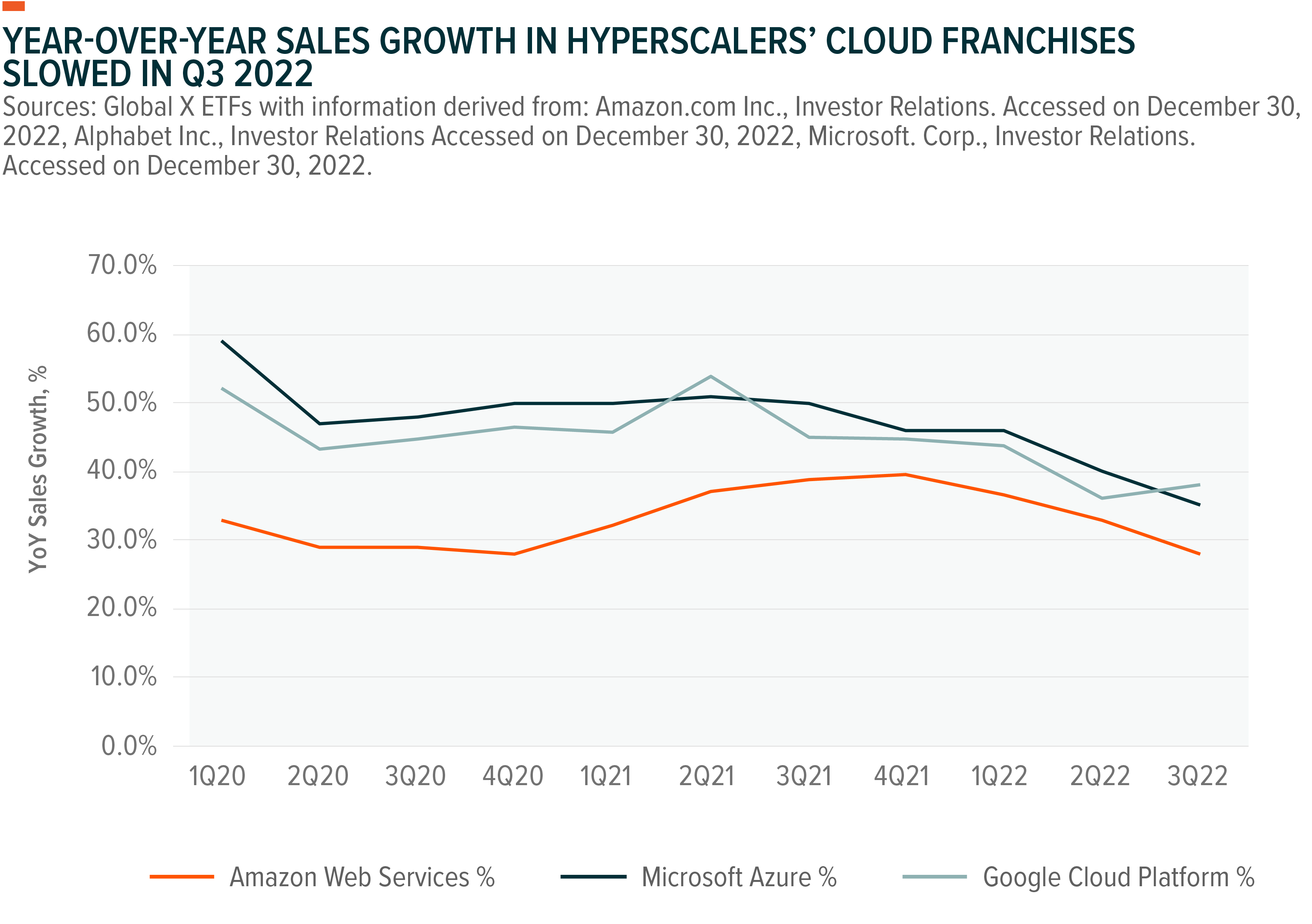

A deeper look at cloud computing businesses evidences the positive growth in recent months. For example, in Q3 2022, the three leading public cloud companies reported net positive revenue growth, although lower than the near-40% revenue growth just a quarter before. Amazon Web Services grew 28% year-over-year (YoY), Microsoft Azure grew 35% YoY, and Google Cloud Platform grew 38% YoY. 4,5,6 Similarly, growth for leading software-as-a-service (SaaS) businesses decelerated but still exhibited double-digit figures. Sales growth during the latest reported quarter for Coupa Software reached 16.9% YoY, Workday reached 20.5% YoY growth, while Salesforce’s growth was 14.2% YoY. 7,8,9

Market Likely to Spotlight Cash-Flow in 2023

SaaS companies rose to prominence in a low interest rate environment where capital was available and relatively cheap. With monetary policy now decidedly hawkish, recent performance suggests investors are anxious about the capital-intensive operations run by several cloud companies in their growth phases. While the SaaS model can deliver tremendous unit-economic efficiency, we believe that companies focusing on profitability in 2023 can go a long way towards building investor confidence.10

Company managements continued to highlight profitability as a key focus looking ahead. Microsoft reaffirmed its commitment to keeping headcount growth muted. “Expect to see our operating expense growth moderate materially through the year, while we focus on growing productivity of the significant headcount investments we’ve made over the last year”, said the company’s CFO Amy Hood on the Q3 2022 earnings call.11 Salesforce CFO highlighted a similar focus on controlling costs.12 So did Coupa Software, Zoom, and many others.13,14 Easy bookings comps in 2023 could also boost earnings surprises.

Moreover, stock-based compensation, which can sometimes be dilutive to public shareholders, is another critical factor to watch, in our view, as companies continue to pay salaries above market averages in an effort to retain talent. We believe that profitable companies will be able to replace stock components with cash rewards, boosting investor confidence. Parallelly, improvements in distribution models, upselling and cross selling more products, and sobering sales and marketing spending could further help build a favourable case with investors.

Low Valuations Driving Significant Deal Activity

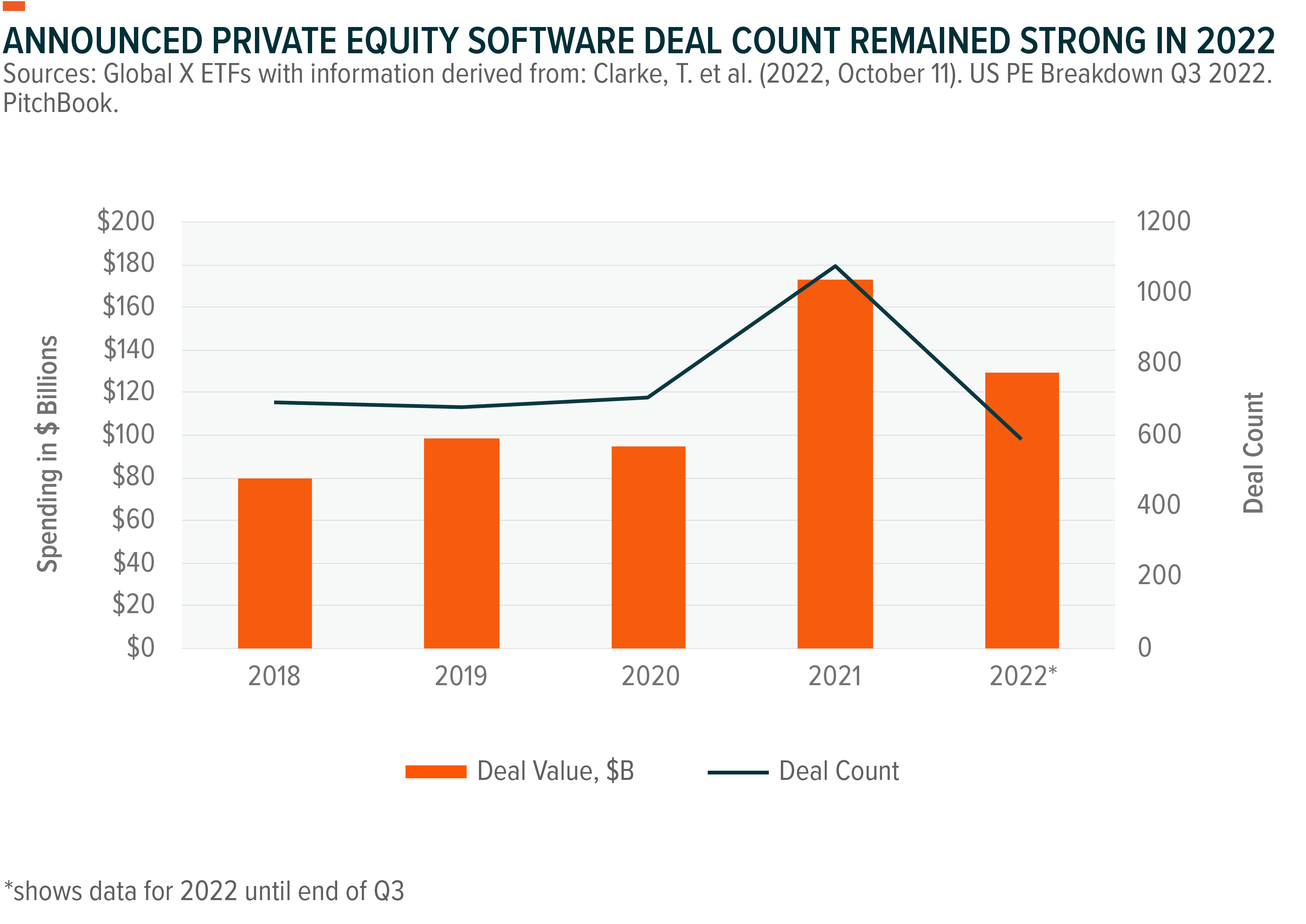

Low valuations have been attracting a flurry of buyers, spurring mergers and acquisitions (M&A). In fact, cloud computing companies were responsible for six of the 10 largest technology deals in 2022.15

Buyers are primarily emerging from two areas. First, software-focused private equity shops. For example, Thoma Bravo and Vista Equity Partners were prolific acquirers throughout the year.16, 17, 18 Most recently Thoma Bravo expressed interest in acquiring Coupa Software in a $8 billion deal.19 Similarly, Vista Equity Partners acquired Citrix Systems for $16 billion, and KnowBe4 for $4.6 billion earlier in the year.20, 21 Cybersecurity remains one area where deals have been happening at a significant premium to market averages.22 Lower valuations increase the likelihood of more deals.

Second, big tech companies that want to fill gaps and add capabilities within their cloud franchises were active buyers in 2022.23 IBM’s acquisition of Red Hat for $34 billion is a prime example.24 The trend could continue, especially as infrastructure services get commoditized. Hyperscalers could move up the stack to acquire platforms and applications to lock-in vendors.

Conclusion: Chugging Down a Long Road

The pandemic was an anomaly, and the return to normalcy has cloud adoption reverting to the mean. As enterprises rebalance their technology requirements, we expect demand to remain strong, but at lower rates than in 2020 and 2021. In our view, cloud computing’s long-term growth potential is intact. In 2022, global IT spending topped $4.4 trillion, and it is expected to grow another 5.1% in 2023.25 Of that spend, cloud technologies can directly address $3.6 trillion.26 Cloud spending is expected to top $490 billion in 2022; that suggests penetration of less than 15% of total IT spending.27, 28 By 2030, we estimate penetration can top 30%. There are near-term hurdles to overcome, but the long-term opportunity is bright, we believe.

This document is not intended to be, or does not constitute, investment research