Ethereum: The Basics

Editor’s Note: We included a glossary for all terms highlighted in orange.

Bitcoin’s creation in 2009 marked the first successful application of blockchain technology as a finite-supply decentralized currency. Significantly, it was open to anyone. Bitcoin inspired developers to discover broader tools and applications powered by the security, transparency, and scalability of blockchain technology. While the Bitcoin network provided a base for a medium of exchange, a young programmer saw it as a method capable of challenging centralized entities across the economy.

In 2013, at just 19, Vitalik Buterin published the Ethereum whitepaper, in which he introduced a novel, general-purpose blockchain network that allows developers to build programable conditions and applications. In essence, Buterin created a system of programmable money that revolutionized how people think about, create, and deploy blockchain technology.

What to Know About Ethereum, Its Key Components, and How it Works

Because of its growing status and potential investment implications, this report answers basic questions about the Ethereum network.

- What is Ethereum? A decentralized blockchain with smart contract functionality.

- What is Ether (ETH)? The native currency of Ethereum.

- What are nodes? Computers running an Ethereum client to validate transactions and blocks.

- How does mining work? Special nodes solve a mathematical puzzle to create the chain’s next block.

- When does true settlement occur? When a transaction has a sufficient number of confirmations.

- What are smart contracts, and why are they important? Programmable contracts based on pre-defined conditions.

- What are decentralized applications (DApps), and why are they important? Applications built using smart contracts.

- What’s ahead for the Ethereum network? A transition to a consensus mechanism that can make the network more scalable and environmentally friendly.

- Why is ETH valuable? It dictates the network’s economy.

- Why Ethereum now? The largest and most adopted smart contract blockchain offers value potential and growth.

Ethereum: A Blockchain with Smart Contract Functionality

Ethereum’s launch in July 2015 introduced a novel blockchain with a built-in Turing-complete language, which is a programming language that can be used to embed logic and complete more advanced transactions than simple payments. The introduction of this language has allowed developers to create and integrate applications into Ethereum, serving as the base layer of an open ecosystem capable of hosting smart contracts and decentralized applications (DApps).

Smart contracts comprise much of Ethereum’s value proposition. A smart contract has predefined criteria that self-execute a response based on programmed conditions, and the agreement is recorded in the blockchain. Smart contracts eliminate the need for a third-party intermediary

DApps are front-end and user-targeted applications created and deployed from smart contract programmability. These programable contracts are used to create decentralized financial service applications (DeFi) and non-fungible tokens (NFTs), which represent the digital ownership of unique assets. Smart contracts are also used to create and coordinate decentralized governance entities called decentralized autonomous organizations (DAOs). The universe of DApps within the network represents the Ethereum ecosystem.

The Ethereum network uses fully transparent blockchain technology to record transactions and track states on the ledger. Network participants can find a consensus state, which is where they agree on the blockchain’s distributed ledger, by independently validating transactions and blocks against the protocol rules. Blocks are individual data structures built from an aggregate transaction list and include a reference to its parent, or previous, block.

The Ethereum Virtual Machine (EVM), Ethereum’s distributed state machine, is responsible for maintaining the network’s data structure and standards. In essence, the EVM defines the rules for calculating a transition in state between blocks. A transition in state could be a simple change in an account balance, or it could be the result of a more complex smart contract interaction.

Ether (ETH): The Native Cryptocurrency That Powers the Ethereum Network

Ether (ETH) can be used to send simple payments, similar to bitcoin, but it is more akin to a commodity than a currency because it is primarily used to pay for decentralized computation on Ethereum. All transactions and smart contract deployment on Ethereum cost a variable fee to be paid in ETH. A simple payment is typically cheaper than a smart contract interaction. This payment scheme creates a natural demand for ETH, as Ethereum DApp end-users must purchase ETH to interact with the platform.

ETH has no physical representation; it is a digital bearer asset owned by whoever possesses the corresponding private key. Similar to Bitcoin, Ethereum uses public-key cryptography and digital signatures to prevent bad actors from spending someone else’s ETH. For a deeper dive into public-key cryptography and digital signatures, see Bitcoin: The Basics.

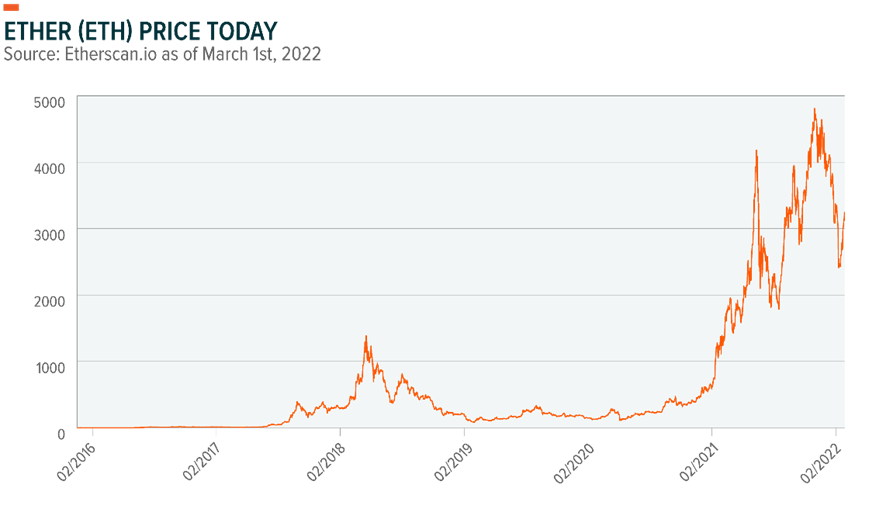

ETH first went on sale on September 2, 2014, priced at 2,000 ETH per bitcoin (BTC). Currently, ETH is the second-largest cryptocurrency with a total market cap of $356 billion.1

Nodes: The Computers Validating Transactions and Securing the Network

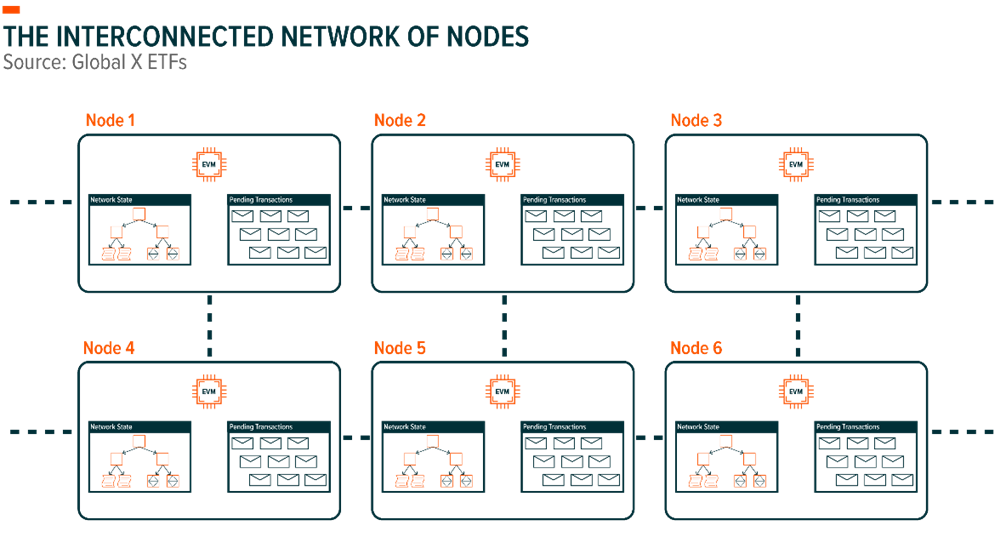

Nodes are the computers in the Ethereum network running an Ethereum client. An Ethereum client is the software that implements the Ethereum protocol, or the network’s rules. The Ethereum network is an aggregation of connected nodes, each of which verifies that the transactions and blocks received are valid under the protocol rules before being added to the blockchain.

Transactions alter the state of data within the network, and they generally involve the transfer of digital assets or smart contract execution. All transactions must include an ETH-denominated transaction fee known as a gas fee, which represents the cost of publishing, validating, executing, and storing the transaction on the blockchain.

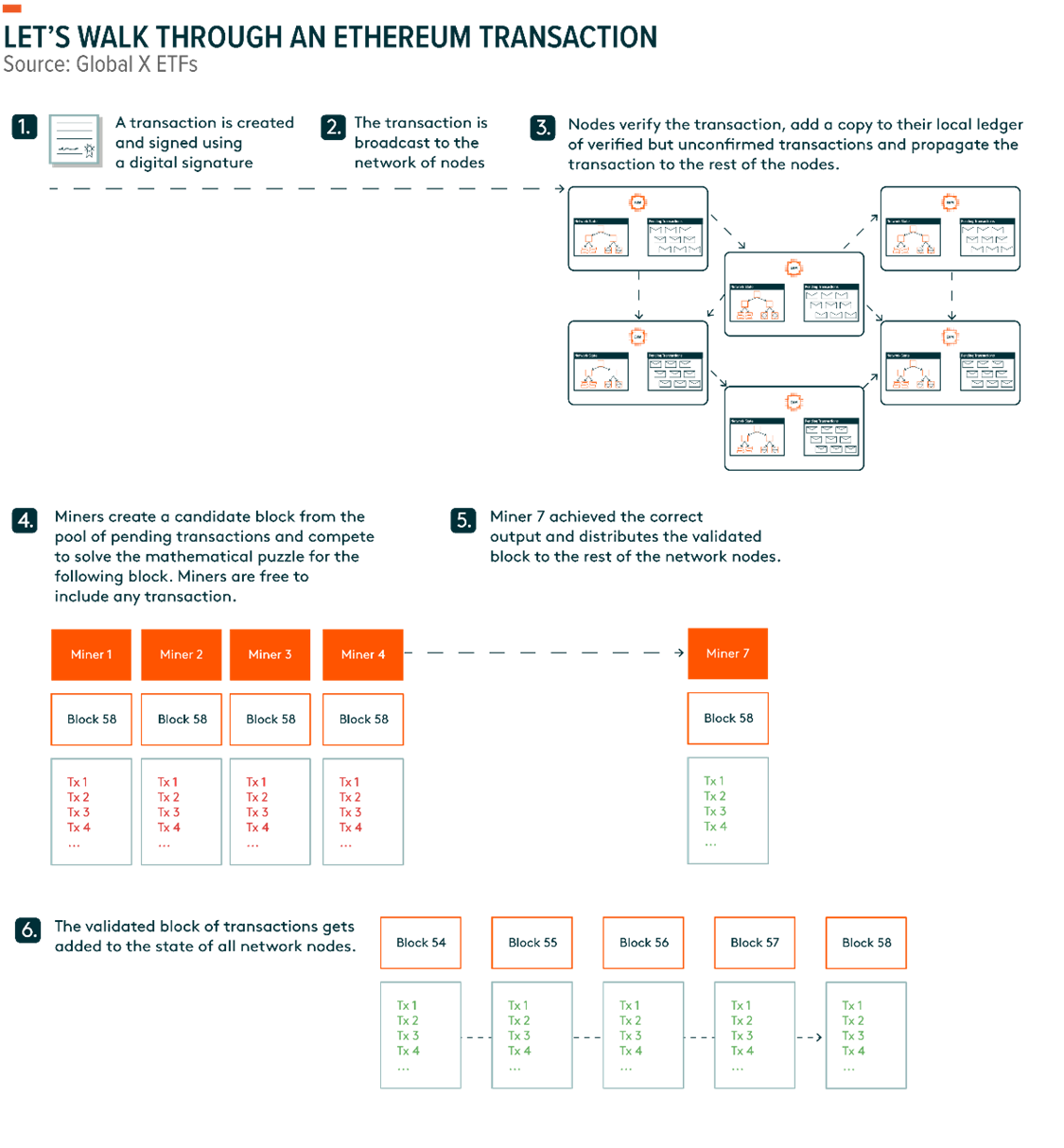

Once a transaction is digitally signed by a user’s private key, it is broadcasted to the network of connected nodes. When a node receives a new transaction, the Ethereum client independently verifies the validity of this transaction against a comprehensive set of criteria outlined in the protocol rules, including an evaluation of the digital signature. If the transaction is valid, the node saves the transaction within its local pool of pending transactions and further propagates it to all of their neighbor nodes. This network of interconnected nodes makes it possible for transactions to be distributed, validated, and recorded by all participants in a matter of seconds.

Mining Nodes: Special Nodes that Solve a Mathematical Puzzle to Create the Next Block

All Ethereum nodes independently verify transactions, but mining nodes, the miners, are a special type that aggregate transactions into the blocks that are recorded onto the blockchain for settlement. In that sense, mining nodes are distinct because they create blocks of transactions on the chain.

Each node maintains a pool of verified but pending transactions known as the mempool. Transactions are removed from the mempool once a miner includes them in a mined block. Mining nodes dedicate large sums of computational resources in a competition to be the first to solve a challenging mathematical puzzle. The solution to the puzzle is known as a Proof-of-Work, the consensus mechanism that secures the integrity of the network.

The puzzle is solved by brute force computation, where miners iterate different inputs through a cryptographic hash function searching for a rare output, or hash. Ethereum relies on a different cryptographic hash function than bitcoin, and miners are not in direct competition with each other. The Proof-of-Work is difficult to find, but any node can trivially verify that the miner expended the computational resources to find the solution. In the same way that a transaction is considered valid only if it has a valid digital signature, a candidate block requires a Proof-of-Work to become a valid block. Achieving the particular output through Proof-of-Work ahead of all other participants allows a miner to validate, record, and propagate the candidate block.

Once a miner becomes the first participant to solve the mathematical puzzle of the next block, they broadcast the validated block through the network. Each node verifies the validity of the newly received block and then adds it to their copy of the blockchain. The receipt of a new valid block resets the mining game. All miners create a new candidate block of transactions and try to be the first to solve the puzzle for the next block to be included in the blockchain. The block times, which are typically between 12 and 14 seconds, dictate this constant flow of new blocks. Additionally, the block size is limited, and not all pending transactions are included in a block.

Miners are financially incentivized to be the first to solve this puzzle. The miner who first sends a new block with a valid Proof-of-Work can claim the 2 ETH block reward and a portion of the gas fees inside the block. Additionally, by setting the order of transactions in their blocks and due to front running tactics, miners can generate an incremental revenue stream known as miner extractable value (MEV).

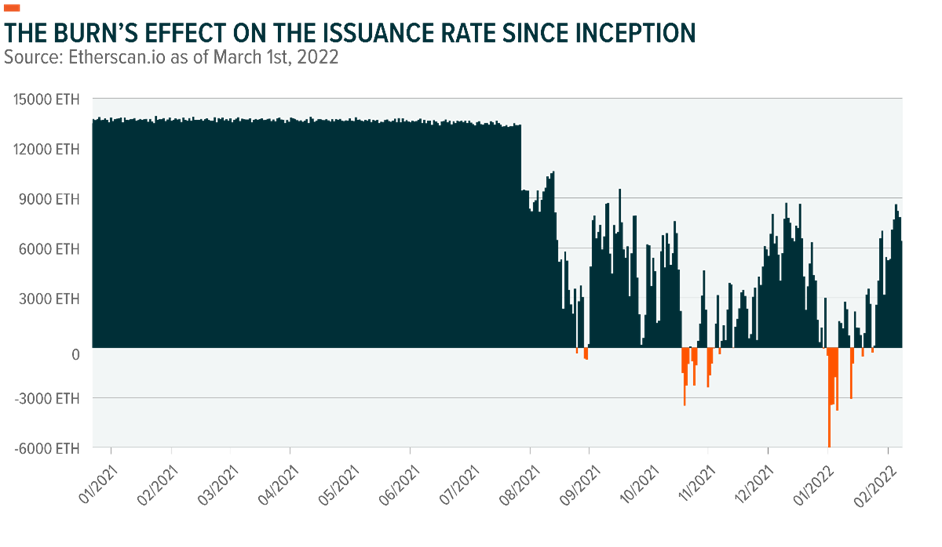

Gas fees in a block can be broken down into a base fee and a tip, both of which fluctuate in price with block space demand. The tip is paid directly to the miner as an incentive to prioritize the inclusion of a transaction in a block. The base fee resembles a share buyback, in that it is burned and the corresponding ETH is removed from the circulating supply.

Ethereum Improvement Proposals (EIPs) are designed to incentivize network participants and builders to constantly improve the Ethereum network. One such proposal was this gas fee structure. Implemented in August 2021 through Ethereum Improvement Proposal 1559 (EIP-1559), it created a direct correlation between network usage and ETH issuance.

EIP-1559 creates value for ETH holders because the burning mechanism reduces the net supply issuance rate. As more transactions are conducted on-chain, more gas is burned, which has the potential to reduce or eliminate the impact of the new ETH supply created from block rewards. If network demand is high and the burning mechanism outweighs the new issuance from block rewards, ETH can become a deflationary asset. To date, more than 1.9 million ETH have been burned since the rollout of EIP-1559, reducing ETH’s net issuance by more than 68%.2

The increased popularity of NFTs and the transaction volume they generate has created more demand for block space, increasing the amount of ETH being burned. NFT marketplace OpenSea has been the largest contributor to burned gas fees since the EIP-1559 rollout with a total of 230,041 ETH.3

True Settlement: When a Transaction Has a Sufficient Number of Confirmations

A transaction is often referred to as settled when it’s included in a block. But because certain scenarios can cause the blockchain to fork temporarily and reorganize in the short term, certain conditions must be met for true settlement.

True settlement occurs after a sufficient number of confirmations are received, meaning blocks added to the chain on top of the block that includes a specific transaction. Given that blocks are linked together with each newly mined block referencing the prior block’s hash, transactions become more secure and immutable as the number of blocks they’re buried beneath increases. For context, popular centralized exchanges typically consider a transaction to be valid after 20 to 50 confirmations are recorded, which should only take a few minutes with Ethereum block times.

For a malicious actor to reverse a transaction, they would need to go back to the block that contains the transaction that they want to manipulate. So, if a transaction had 50 confirmations, they would need to go back 50 blocks. They would then need to re-mine that block and the other subsequent blocks on a forked chain and find a valid Proof-of-Work for each block. At the same time, all good actors following the protocol rules would be mining and extending the main chain, which is the chain with the most cumulative mining work on it.

To overcome this block deficit versus the main chain, the malicious actor would need to control more than 50% of the total network’s computational power for a sufficient period of time. In addition, the malicious actor would face material risk because if they failed, they would waste their electricity without any ETH rewards.

Smart Contracts: The Programmable Infrastructure for DApps

Smart contracts offer the ability to script self-executing programs and agreements into Ethereum via specific programing languages that adhere to EVM standards. Developers can use a proprietary programing language Solidity, which was created to facilitate access to script tools for less-advanced participants. Developers can also use more advanced languages such as Vyper and Yul.

Said another way, smart contracts are programmatically executed contracts based on code. Data feeds, conditions, rules, and agreements embedded in the contract automatically trigger a pre-defined outcome without the need for a trusted intermediary to execute the contract. Any decentralized application can deploy a smart contract and compose functionality, such as supporting asset swaps or lending primitives.

Ethereum smart contracts are activated and deployed by submitting the contract as a transaction. They also have ETH balances that can trigger transactions through the network once the conditions of the contract are met. Because the network is open source, a library of implemented smart contracts is available for developers to reference, which enhances the composability of application development.

Smart contracts often incorporate real-world data feeds as input variables to determine a contract’s output. Oracles are the entities that facilitate the connection and interoperability between blockchains and external systems. Oracles allow smart contracts to execute based on input data that is not natively available on the blockchain. Common examples include price data, weather data, election results, internet of things (IoT) sensor readings, ID verification for know your customer (KYC) standards, and verifiable random functions.

Because oracle-provided data can determine the output of many smart contracts, allowing a centralized entity to provide this information would defeat the purpose of using a trustless blockchain. Chainlink is a good example of a decentralized oracle network designed to solve this problem. It relies on a network of independent oracle nodes that are financially incentivized to deliver accurate real-world data on-chain in a trustless fashion.

DApps: Applications Built Using Smart Contracts

Smart contracts allow decentralized applications to create protocols with varied use cases and rules. DApps use the Ethereum blockchain for data storage and security, and they use smart contract technology for application logic. In essence, a DApp is just like an app with a user interface that’s hosted on the web, but a smart contract that runs on a decentralized network of computers facilitates the DApp’s backend computation.

This feature gives DApps resiliency because the execution of the code does not depend on a centralized cloud provider. The Ethereum network includes a range of DApps, including financial applications, governance structures, supply chain management projects, file storage, and non-fungible tokenization initiatives.

Decentralized financial services applications are prominent within the Ethereum DApp ecosystem. Some of these DeFi protocols feature native tokens, and many of the top DeFi apps comply with ERC-20 standards. Popular stablecoins such as USDT, USDC, and DAI also use ERC-20 token standards. ERC-20 standards allow developers to build interoperable and fungible tokens under the same guidelines and compatibility framework, which creates optimal conditions for application and smart contract composability.

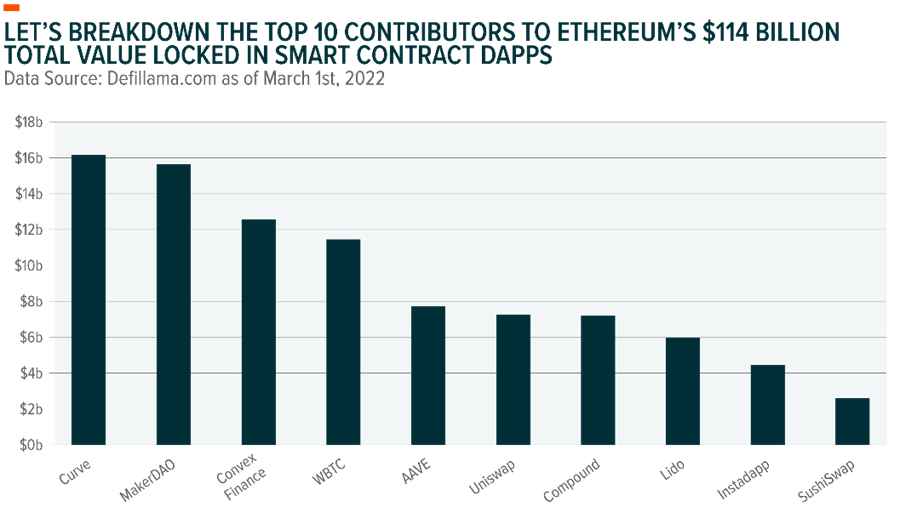

DeFi applications decentralize many traditional financial transactions, such as borrowing and lending, asset exchange, derivatives, insurance, and asset management. Two of the most popular applications today are Uniswap and Aave. Uniswap is a non-custodial, open-source, decentralized automated market maker that provides liquidity pools for buyers and sellers looking to exchange assets. Uniswap allows individuals to act as a market maker by depositing liquidity into trading pools, earning transaction fees from the users’ trades against their liquidity. In January 2022, Uniswap liquidity pools traded approximately $58 billion in volume.4 Aave is a decentralized, non-custodial liquidity and money marketplace for borrowing and lending digital assets. For example, a market participant can use Aave to get an instantaneous asset-backed loan on their digital assets.

Another popular smart contract application includes an alternative Ethereum token standard. ERC-721 standardizes the creation of non-fungible tokens. NFTs are non-interchangeable tokens that cannot be replicated, meaning no two tokens are the same. To date, digital art is the predominant use case for NFTs. But given their broad potential scope, we expect more creative applications of NFTs to emerge in areas such as play-to-earn concepts in the gaming sector, real estate tokenization, ticketing, experiences, identity tags, exclusive access, memberships, and supply chain timestamps.

On-chain decentralized autonomous organizations (DAOs) also use Ethereum’s blockchain infrastructure and smart contract technology for voting rights and decision-making. Popular use cases include DeFi DAOs, where participants can trade digital assets for governance tokens. Token holders can vote for asset allocation and investment decisions from the treasury of accumulated assets, and the rewards from such allocations can be paid out to the token holders.

What’s Ahead for the Ethereum Network: Updates That Facilitate Scalability

Considering the growth of the Ethereum network, developers have agreed to a roadmap with several upgrades. These updates include a change in consensus mechanism in an attempt to make the network more scalable and environmentally friendly.

The Shift from Proof-of-Work to Proof-of-Stake

Previously referred to as Ethereum 2.0, the Ethereum Consensus Layer is Ethereum’s upgraded roadmap that includes changes to the network as it shifts into its new state. This upgrade allows for better scalability with more modest hardware and energy needs.

Proof-of-Work provides strong security guarantees, but it requires significant hardware and energy. Proof-of-Stake requires minimal energy in comparison. Validators in a Proof-of-Stake consensus are analogous to miners in a Proof-of-Work consensus. Validators are responsible for ordering transactions, creating new blocks, and attesting to the blocks that other validators create.

Instead of using electricity to prevent network manipulation, Proof-of-Stake requires validators to post ETH as collateral to secure the network. When validators post their assets, they know that their assets will be seized if they act maliciously or fail to perform their responsibilities, a process known as slashing. The risk of slashing incentivizes validators to follow the protocol rules and act in the network’s best interests. To become a validator, market participants must stake 32 ETH. Smaller market participants can participate in liquid staking pools through platforms like Lido, aggregating smaller amounts of ETH into 32-ETH increments and splitting the rewards accordingly.

Validators can be broken down into two categories: proposers and attestors. Proposers are chosen at random from the set of validators to propose the next block in the chain. Validators who are not chosen as proposers must attest to the proposal. Attestors review the proposed block and attest that it is valid under the protocol rules. For their participation, proposers and attestors are incentivized with ETH rewards. However, their staked assets are at risk if they act maliciously or fail to perform their responsibilities. Explicitly malicious behavior or deliberate collusion will result in a validator losing their entire stake. Less malicious acts, such as failing to validate due to a server outage, can result in only a small percentage of the stake being slashed.

The Solutions Used to Scale Ethereum

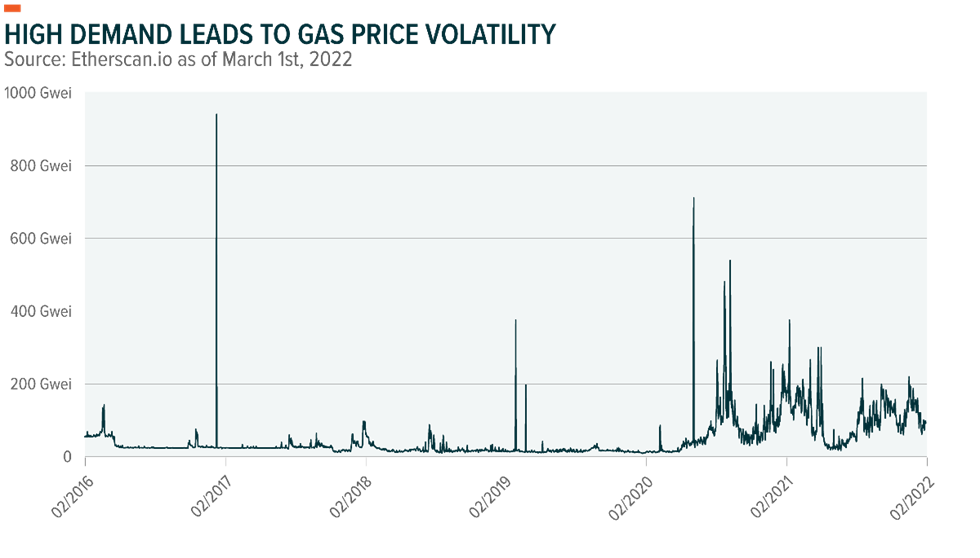

The Ethereum network has hit capacity limitations due to its growing user base interacting with an increasing number of DApps. Greater demand for Ethereum limited block space has increased the volatility of gas prices in recent years and made the network prohibitively expensive for all but the largest market participants.

Ethereum gas fees are denominated in Gwei, which represents one-billionth of an ETH. Exorbitant gas fees have led to users seeking alternative methods of capacity and cost reduction.

EIP-1559 offers a better pricing structure with more gas price predictability, but it does not guarantee that gas prices decrease. Currently, the solutions used to scale Ethereum cost-effectively include on-chain scaling and off-chain scaling. On-chain scaling involves finding methods that improve cost and throughput on the Ethereum base layer. For example, as part of the Ethereum Consensus Layer rollout, the Ethereum network plans to introduce shard chains. Shard chains refer to the process of splitting a database into multiple sections horizontally to reduce network congestion and increase the number of transactions per second. A shift to Proof-of-Stake is a prerequisite for sharding. In a Proof-of-Work system, sharding would dilute the security properties and allow malicious miners to corrupt individual shards more easily.

Off-chain scaling aims to build alternative scaling protocols on top of Ethereum, which is referred to as Layer 1 (L1). Solutions implemented outside of Ethereum are referred to as Layer 2 (L2). Layer 2s ultimately derive security from the mainnet, the primary Ethereum network. These applications generally process individual transactions in a separate state, and they communicate with the Ethereum mainnet for settlement in various ways, depending on the type of solution.

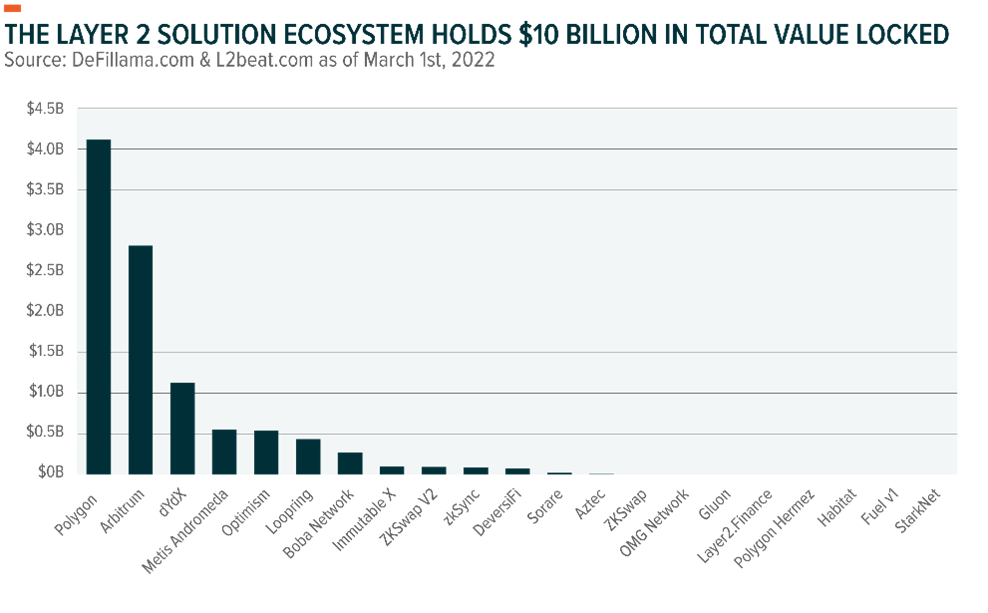

L2 solutions are increasingly popular because they can help process small transactions faster and cheaper while using the Ethereum mainnet for security and transparency. Polygon, which helps developers build scalable DApps with minimal transaction fees, is one of the predominant L2 solutions. Competing smart contract platforms like Solana have had success trading a degree of decentralization for enhanced transaction throughput, however, L2 solutions offer an inexpensive way to transact while remaining in the Ethereum ecosystem. L2s have a sizable amount of total value locked (TVL) or the overall value of crypto assets in their platforms.

ETH’s Value: It Fosters a Growth-Oriented Economy for the Network

Acting as the settlement currency, ETH derives its value from the demand of the Ethereum network. ETH is commonly used to:

- Pay for transaction or gas fees.

- Interact with DeFi DApps.

- Pay for the deployment of smart contracts into the blockchain.

- Primary unit of account in NFT marketplaces and trading.

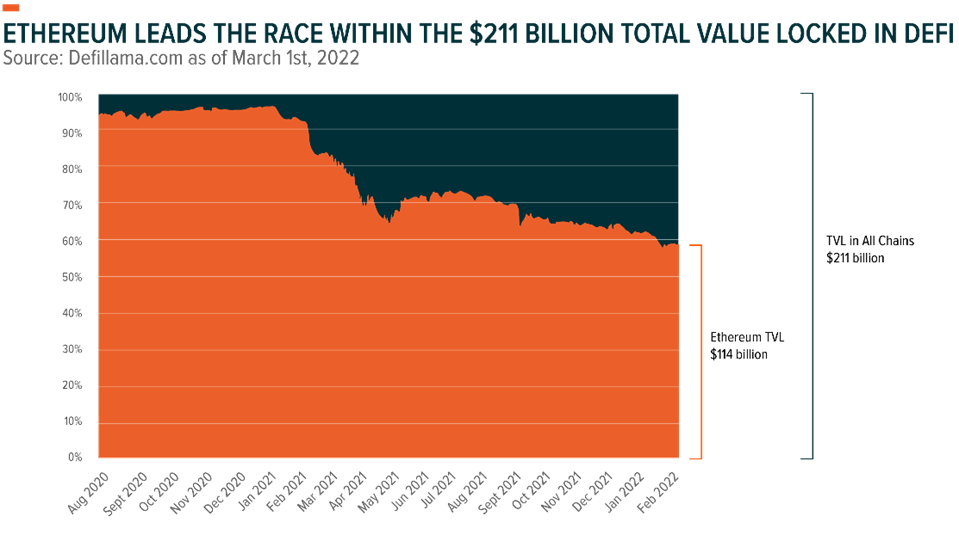

With about $114 billion, Ethereum leads the crypto landscape in total value locked within DApps.5 In DeFi, total value locked is an important metric because it provides insight into the monetary value deposited in the applications and serves as a reliable gauge of sentiment and growth. Locking assets within protocols indicate growth, utility, and user conviction in the ecosystem. Additionally, roughly 9.7 million ETH, the equivalent of about $28 billion, is locked under the Proof-of-Stake validator contract to secure the network in its future state: further reducing the amount of ETH in circulation.6

What is great about Ethereum is that the Total Value Locked is distributed among many DeFi DApps.

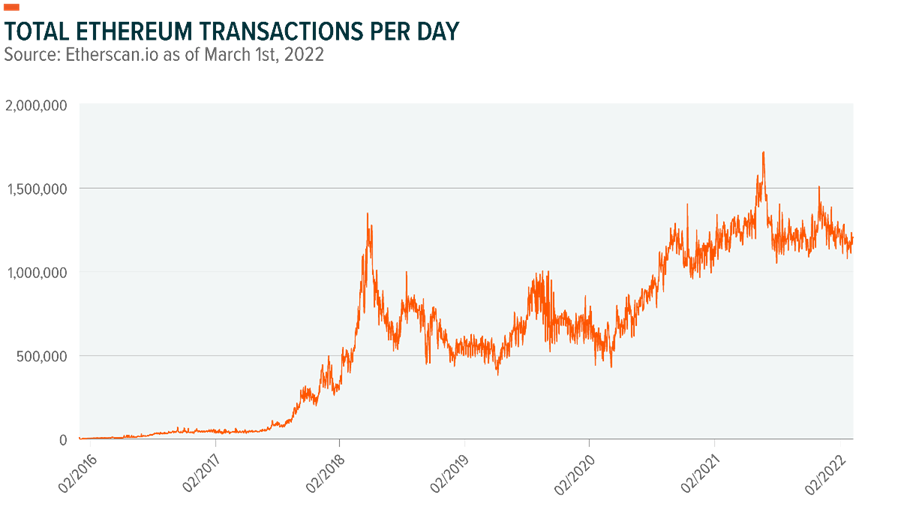

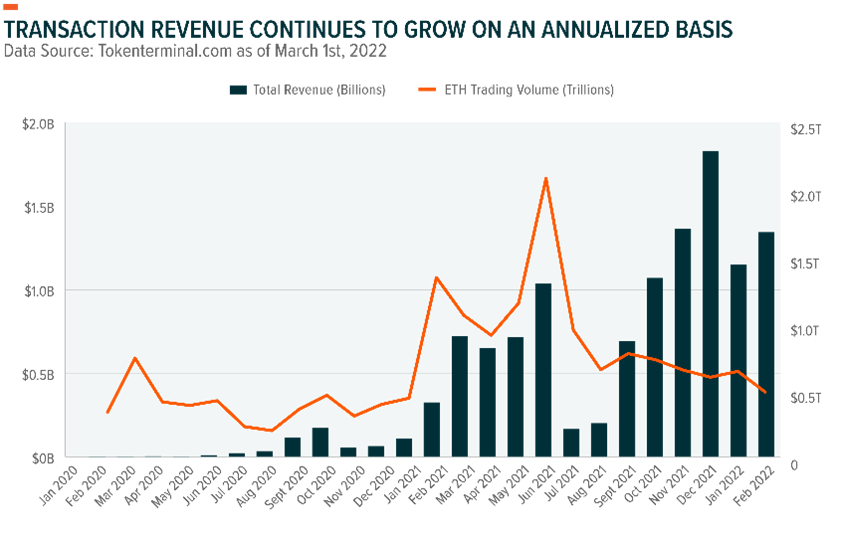

Additionally, on-chain metrics such as the number of wallets and the number of daily transactions have increased over time, signaling demand for the Ethereum ecosystem. The number of transactions directly correlates with the transaction fees paid.

In 2021, Ethereum generated $9.9 billion in revenue via user transaction fees paid and ETH transaction volume totaled $11.5 trillion.7

Theoretically, ETH’s supply is unlimited because there is no limit on coins that can enter circulation in the form of block rewards. EIP-1559 altered ETH’s monetary policy because it allows for a variable block reward issuance ratio. A variable ratio is possible because of the effect transaction volume has on the amount of ETH removed from circulation.

With the burning mechanism, the variable issuance rate can decline as network demand increases, and it can cause the token’s float to decrease as transaction demand continues to rise. The impact of the burning mechanism on gas fees and annual issuance adds to the scarcity of in-demand ETH.

Currently, Ethereum’s annual network issuance is approximately 4.5%, with 2 ETH per block awarded.8 Over time, the block reward curve can continue to decrease in the transition to an improved and more scalable version of Ethereum.

Why Ethereum now: A Smart Contract Blockchain with Mechanisms to Create Value and Scalability

To understand Ethereum’s growing appeal and value is to recognize what Buterin articulated in his whitepaper: the potential to expand the blockchain’s decentralized properties programmatically. For investors interested in exposure to Ethereum, the first successful application of a programmable blockchain, we expect that:

- The value locked within its ecosystem, the utility and interoperability of tokens and smart contracts, and the growing transaction count and its effect on burning ETH can continue to drive value.

- Upgrades such as the transition to Proof-of-Stake and on-chain and off-chain scaling advancements, including the Ethereum Consensus Layer rollout and improvement in Layer 2 applications, give Ethereum scalability. These upgrades will also attract more developers to this growing ecosystem due to its network effect, further increasing demand for ETH’s utility.

Ethereum’s adaptive features also position it well to play a central role in disruptive movements like the evolution of the internet to Web 3.0, which at its core is a user-owned blockchain ecosystem. Considering developments like these and the demand that they could create for ETH, we view this digital asset and the blockchain network that it fuels as having meaningful growth potential.

This document is not intended to be, or does not constitute, investment research