European Thematic UCITS ETFs Report – December 2021

The Global X research team is pleased to release the European Thematic UCITS Report for December 2021. The report recaps Global X’s classification system for disruptive themes and the thematic ETFs that track them. It also provides industry-level analysis of thematic investing ETFs, looking at new launches and closures, assets under management (AUM) movements, and fund flows.

Click here to download the European Thematic UCITS ETFs Monthly Report for December 2021

European Thematic UCITS ETF Landscape – 2021 Recap

At the end of 2021, there were 82 thematic UCITS ETFs totalling about US$41bn in assets under management (AUM), up 47% from December 2020. Themes in disruptive technologies recorded a 49% increase in AUM in 2021 compared to the end of 2020, followed by themes in the people & demographics category (47%) and physical environment category (43%).

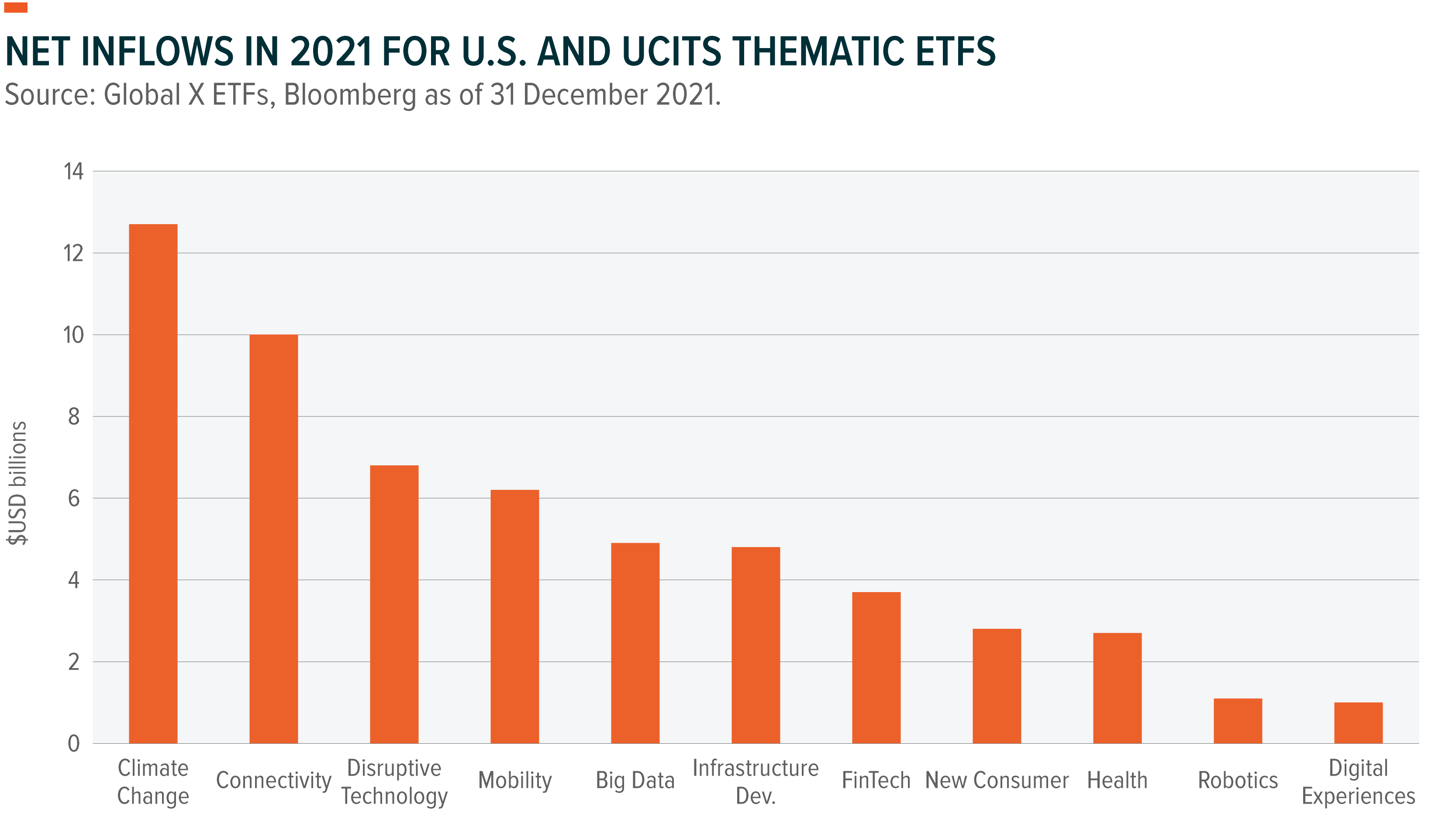

In 2021, UCITS Thematic ETFs recorded US$12.5bn of net inflows, while U.S. Thematic ETFs attracted US$44.3bn. The top five megathemes in terms of global net inflows1 in 2021 were Climate Change related themes (US$12.7bn), Connectivity (US$10bn), broad Disruptive Technologies (US$6.8bn), Mobility (US$6.2bn), and Big Data (US$4.9bn).

2021 was marked by the announcement of unprecedented fiscal stimulus to support growth in the U.S. and in Europe, the mass deployment of Covid-19 vaccines globally, a renewed commitment from the U.S. and other major economies to fight against climate change at the COP26 conference, and rising inflationary pressures amid rising energy prices and supply chain disruptions.

Undeniably, the key theme in 2021 was Climate Change which attracted the largest global net inflows after the U.S. officially rejoined the Paris Agreement on Climate Change in February. This was also heightened by rising commitments globally to fight climate change at the UN COP26 climate conference in November. The bulk of net inflows went into CleanTech & Renewable Energy themes and Mobility themes like Electrical Vehicles.

In addition, investors poured money into themes related to Disruptive Technologies, Connectivity and Big Data that are poised to benefit from the digital transition propelled by massive public spending in the U.S. and Europe. We also saw large net inflows into the U.S. Infrastructure Development theme, following the announcement of President Biden’s US$1tr Infrastructure Investment and Jobs Act.

Conversely, as concerns about the spread of the Delta variant eased in Q2 and Q3 last year, consumer confidence improved with the reopening of the economy. As a result, the typical stay-at-home themes like Cloud Computing, E-commerce, and Video Games saw net outflows in the last quarter of 2021. However, rising Omicron fears and the return of social distancing measures might lead to a rebound in flows in 2022.

December 2021 Recap

At the end of December 2021, there were 82 thematic UCITS ETFs totalling US$41.2bn in assets under management (AUM), increasing 0.2% on the month. Themes related to People & Demographics and Disruptive Technology saw an increase in AUMs of 2.7% and 1.3%, respectively. However, physical environment themes saw a slight decline in AUMs ( -2.4%) led by Climate Change-related themes.

- In December, UCITS Thematic ETFs recorded US$446m of net inflows, after attracting US$823m in November

- Big Data themes attracted the largest net inflows this month (US$210m), with the bulk of net new inflows going into cybersecurity themes (US$134m), following the approval of US$1bn of Cyber funds as part of US$1.2tn infrastructure package to fund state and local cybersecurity efforts

- Climate change themes continued to attract large net inflows (US$187m), led by resource scarcity themes (US$228m). However, the clean & renewable energy themes saw US$59m in outflows on the month, possibly impacted by the failure to pass Biden’s Build Back Better (BBB) plan in the U.S. which contained some US$555bn in clean energy investments

- Electric Vehicles (EV) theme also continued to benefit from an increased investors’ interest for sustainably-themes garnering US$66m of net inflows this month

- Connectivity theme saw the largest net outflows this month (US$148m), led by outflows in Emerging Markets Internet (US$128) possibly reflecting the adverse effect from the Biden administration adding more Chinese companies to the U.S. trade restriction list, so-called Entity List

Global X’s Thematic Classification System

Global X’s research team established a thematic classification system that provides a consistent framework for identifying disruptive themes and categorising the thematic ETF space. Often, we have seen conflicting definitions of thematic investing in the media and financial world, which leads to confusion about which ETFs are thematic and what themes they are tracking. With the introduction of this classification system, we hope to provide more clarity around disruptive themes and their related ETFs.

Defining Thematic Investing

Global X defines thematic investing as the process of identifying powerful disruptive macro-level trends and the underlying investments that stand to benefit from the materialisation of those trends.

By nature, thematic investing is a long term, growth-oriented strategy, that is typically unconstrained geographically or by traditional sector/industry classifications, has low correlation to other growth strategies, and invests in relatable concepts.

Notably, thematic investing does not consist of ESG, values-based, or policy-driven strategies, unless they otherwise represent a disruptive structural trend (e.g. climate change). Further, funds that adhere to traditional sector or industry classifications, or that are used primarily to gain exposure to cyclical trends (e.g. currencies, valuations, inflation) are not considered thematic. Finally, alternative asset classes, such as listed infrastructure, MLPs, and ubiquitous commodities are not considered thematic.

Classifying Themes

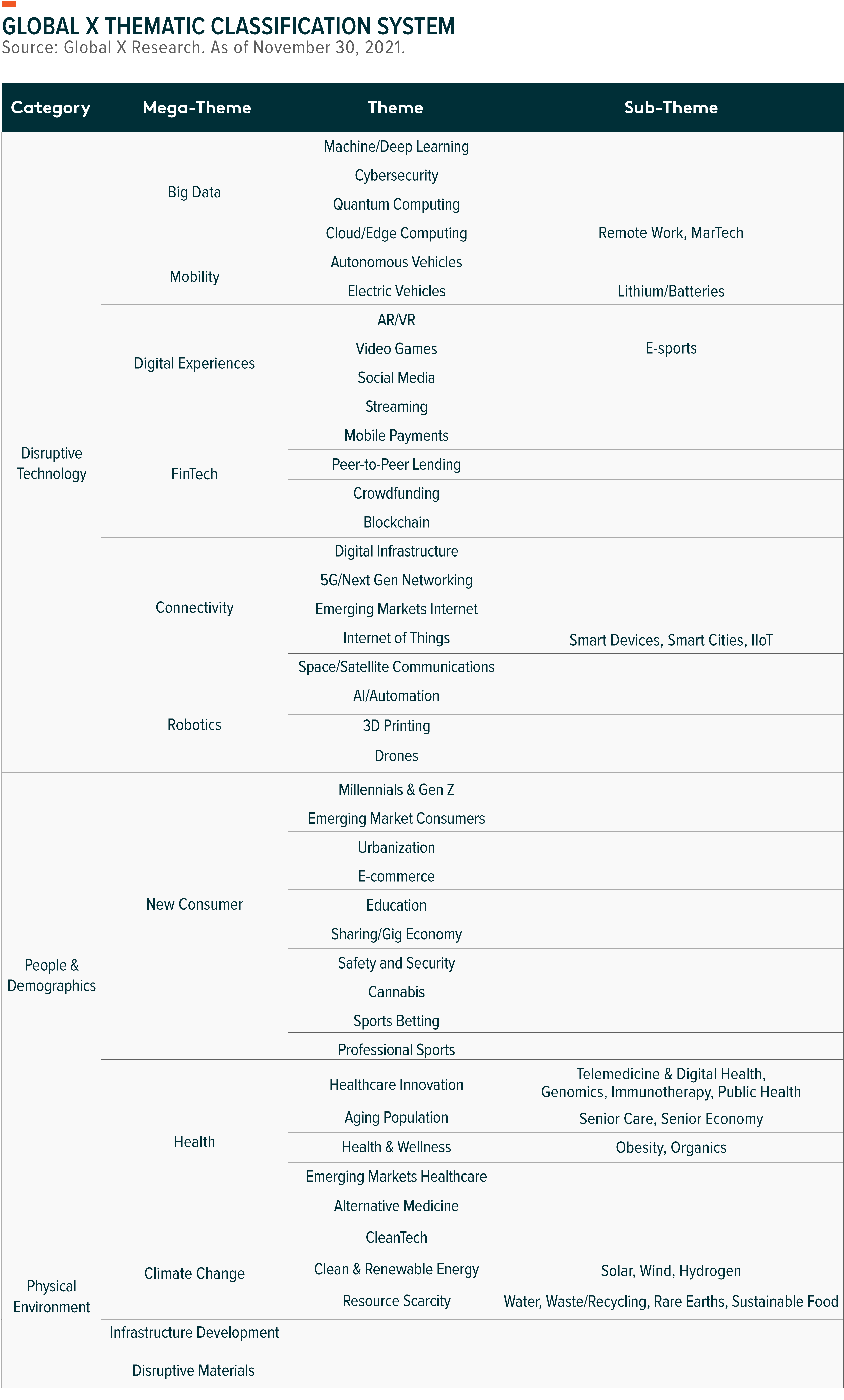

Global X’s thematic classification system consists of four layers of classifications: 1) Categories; 2) Mega-Themes; 3) Themes; and 4) Sub-Themes, with each layer becoming sequentially narrower in its focus.

‘Categories’ is the broadest layer and represents three fundamental drivers of disruption: exponential advancements in technology (Disruptive Technology), changing consumer habits and demographics (People & Demographics), and the evolving physical landscape (Physical Environment).

One layer down are ‘Mega-Themes,’ which serve as a foundation to multiple transformative forces that are causing substantial changes in a common area. Conceptually, Mega-Themes are a collection of more narrowly targeted Themes. For example, Big Data is a Mega-Theme that consists of Machine/Deep Learning, Cybersecurity, Quantum Computing, and Cloud/Edge Computing.

Further down, we identify ‘Themes’ as the specific areas of transformational disruption that are driving technology forward, changing consumer demands, or impacting the environment. There are currently 40 themes in the classification system.

‘Sub-Themes’ are more niche areas, such as specific applications of themes or upstream forces that are driving themes forward.

Thematic ETFs can target a specific category, mega-theme, theme, or sub-theme. Our categorisation process seeks to find the best fit for a specific ETF, analysing its methodology, holdings, and stated objectives. The thematic classification system is reviewed quarterly to consider new potential categories, mega-themes, themes, or sub-themes. As a new ETF launches or changes its strategy, its classification is evaluated immediately.

Conclusion

In an uncharted era of new technologies disrupting existing paradigms, demographics reshaping the needs of the world’s population, shifting consumer behaviors forcing changes to existing business models, and dramatic changes in our physical environment, we find that there is a growing need for a consistent framework to track these themes and the investment vehicles providing access to them.

This document is not intended to be, or does not constitute, investment research