European Thematic UCITS ETFs Report – March 2021

The Global X research team is pleased to release the European Thematic UCITS Report for March 2021. The report recaps Global X’s classification system for disruptive themes and the thematic ETFs that track them. It also provides industry-level analysis of thematic investing ETFs, looking at new launches and closures, assets under management (AUM) movements, and fund flows.

Click here to download the European Thematic UCITS ETFs Report March 2021

European Thematic UCITS ETF Landscape – March 2021 Recap

At the end of March 2021, there were 61 thematic UCITS ETFs totalling US$20.2bn in assets under management (AUM), declining by 2% on the month. The overall monthly decline in UCITS thematic ETFs was led by the disruptive technologies and physical environment categories, while the AUMs in the changing demographic category rose slightly on the month (1%).

In March, UCITS Thematic ETFs saw significantly lower net inflows compared to the previous months, with US$14.4m of net inflows versus US$3.1bn in February.

- Big data themes continued to attract the largest net inflows in March (US$226m). Most of the net new inflows went into machine learning thematic ETFs.

- Flows into e-commerce themes were strong in March (US$114m), as well as flows into climate change themes (US$97m) such as resource scarcity themes (US$78m). US e-commerce grocery sales reached US$96bn in 2020, representing 12% of all e-commerce sales, according to eMarketer. Following pandemic induced momentum, segment sales are expected to reach US$188bn by 2024, up 202% from 2019 and representing a 24.7% CAGR.

- Robotics recorded massive net outflows on the month (US$506m). Macro concerns and the value rotation are driving most of the negative sentiment in Tech.

Global X’s Thematic Classification System

Global X’s research team established a thematic classification system that provides a consistent framework for identifying disruptive themes and categorising the thematic ETF space. Often, we have seen conflicting definitions of thematic investing in the media and financial world, which leads to confusion about which ETFs are thematic and what themes they are tracking. With the introduction of this classification system, we hope to provide more clarity around disruptive themes and their related ETFs.

Defining Thematic Investing

Global X defines thematic investing as the process of identifying powerful disruptive macro-level trends and the underlying investments that stand to benefit from the materialisation of those trends.

By nature, thematic investing is a long term, growth-oriented strategy, that is typically unconstrained geographically or by traditional sector/industry classifications, has low correlation to other growth strategies, and invests in relatable concepts.

Notably, thematic investing does not consist of ESG, values-based, or policy-driven strategies, unless they otherwise represent a disruptive structural trend (e.g. climate change). Further, funds that adhere to traditional sector or industry classifications, or that are used primarily to gain exposure to cyclical trends (e.g. currencies, valuations, inflation) are not considered thematic. Finally, alternative asset classes, such as listed infrastructure, MLPs, and ubiquitous commodities are not considered thematic.

Classifying Themes

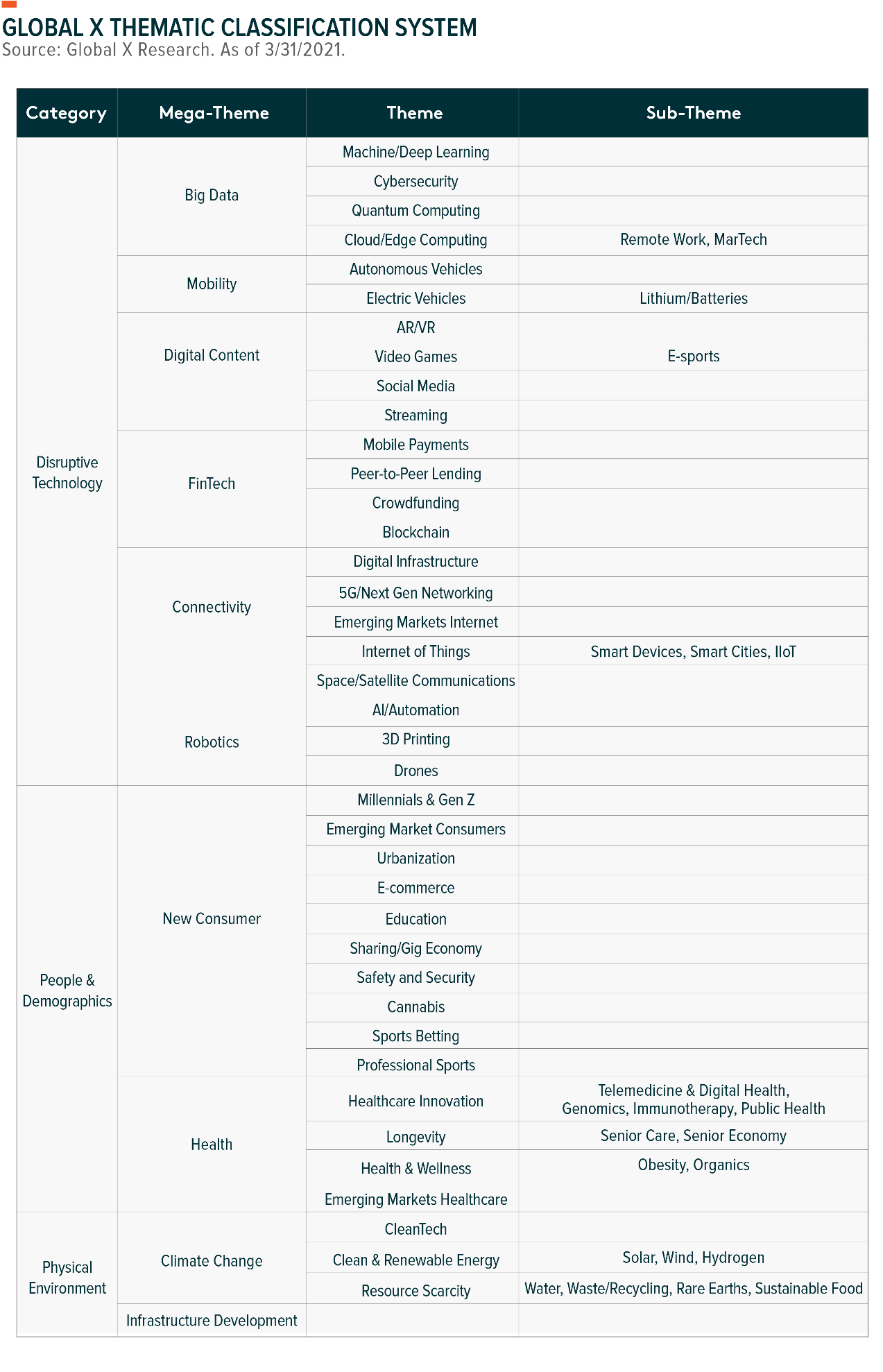

Global X’s thematic classification system consists of four layers of classifications: 1) Categories; 2) Mega-Themes; 3) Themes; and 4) Sub-Themes, with each layer becoming sequentially narrower in its focus.

‘Categories’ is the broadest layer and represents three fundamental drivers of disruption: exponential advancements in technology (Disruptive Technology), changing consumer habits and demographics (People & Demographics), and the evolving physical landscape (Physical Environment).

One layer down are ‘Mega-Themes,’ which serve as a foundation to multiple transformative forces that are causing substantial changes in a common area. Conceptually, Mega-Themes are a collection of more narrowly targeted Themes. For example, Big Data is a Mega-Theme that consists of Machine/Deep Learning, Cybersecurity, Quantum Computing, and Cloud/Edge Computing.

Further down, we identify ‘Themes’ as the specific areas of transformational disruption that are driving technology forward, changing consumer demands, or impacting the environment. There are currently 39 themes in the classification system.

‘Sub-Themes’ are more niche areas, such as specific applications of themes or upstream forces that are driving themes forward.

Thematic ETFs can target a specific category, mega-theme, theme, or sub-theme. Our categorisation process seeks to find the best fit for a specific ETF, analysing its methodology, holdings, and stated objectives. The thematic classification system is reviewed quarterly to consider new potential categories, mega-themes, themes, or sub-themes. As a new ETF launches or changes its strategy, its classification is evaluated immediately.

Conclusion

In an uncharted era of new technologies disrupting existing paradigms, demographics reshaping the needs of the world’s population, shifting consumer behaviors forcing changes to existing business models, and dramatic changes in our physical environment, we find that there is a growing need for a consistent framework to track these themes and the investment vehicles providing access to them.

This document is not intended to be, or does not constitute, investment research