Four Digital Health Companies Transforming the Healthcare Industry

Healthcare in the United States is a massive market, and the U.S. spends roughly $37 trillion a year on treating chronic illnesses alone.1 Given the size and complexity of this market, there is significant friction in the system and inefficiencies abound. Against this backdrop, we see substantial white space for digital health companies. By leveraging wearable technology, artificial intelligence, machine learning, and other modern technology, digital health companies are offering new and innovative solutions that have shown promise in terms of both cutting costs and improving patient outcomes.

Key Takeaways

- Omnicell: Already a major player in the retail pharmacy space, Omnicell is working to leverage its position to drive adoption of its tech-enabled services model to help bridge the gap among siloed healthcare sectors.

- Teladoc: Although the adoption curve for telemedicine services has flattened post COVID-19, the pandemic introduced millions of people to telemedicine, and there still appears to be a long runway for growth.

- iRhythm: A leader in the cardiac monitoring space, iRhythm’s product suite has gained traction with key stakeholders, namely physicians and insurance companies.

- Masimo: More and more, data is emerging as a key to improving patient outcomes, and Masimo now offers hospital-quality monitoring at home.

Omnicell: Automating Pharmacy Dispensing

Omnicell is a provider of autonomous pharmacy services, which include automated medication compounding and dispensing technologies. Technological advancements in robotics, artificial intelligence (AI), and machine learning have allowed the development of more sophisticated and efficient pharmacy automation systems, enabling better inventory management across all care settings.

The firm’s growing suite of products and services helps lower costs, save staff time, and eliminate human error via automated medication storage, retrieval, dispensing, and compounding. Its product line up also helps improve inventory management across the healthcare value chain, allowing automated tracking and restocking of inventory. Omnicell’s product offerings provide a unique solution to ongoing challenges in the healthcare industry: over $500 billion in costs are related to nonoptimal medication adherence, and 85% of U.S. hospitals are facing shortages of experienced pharmacy technicians.2

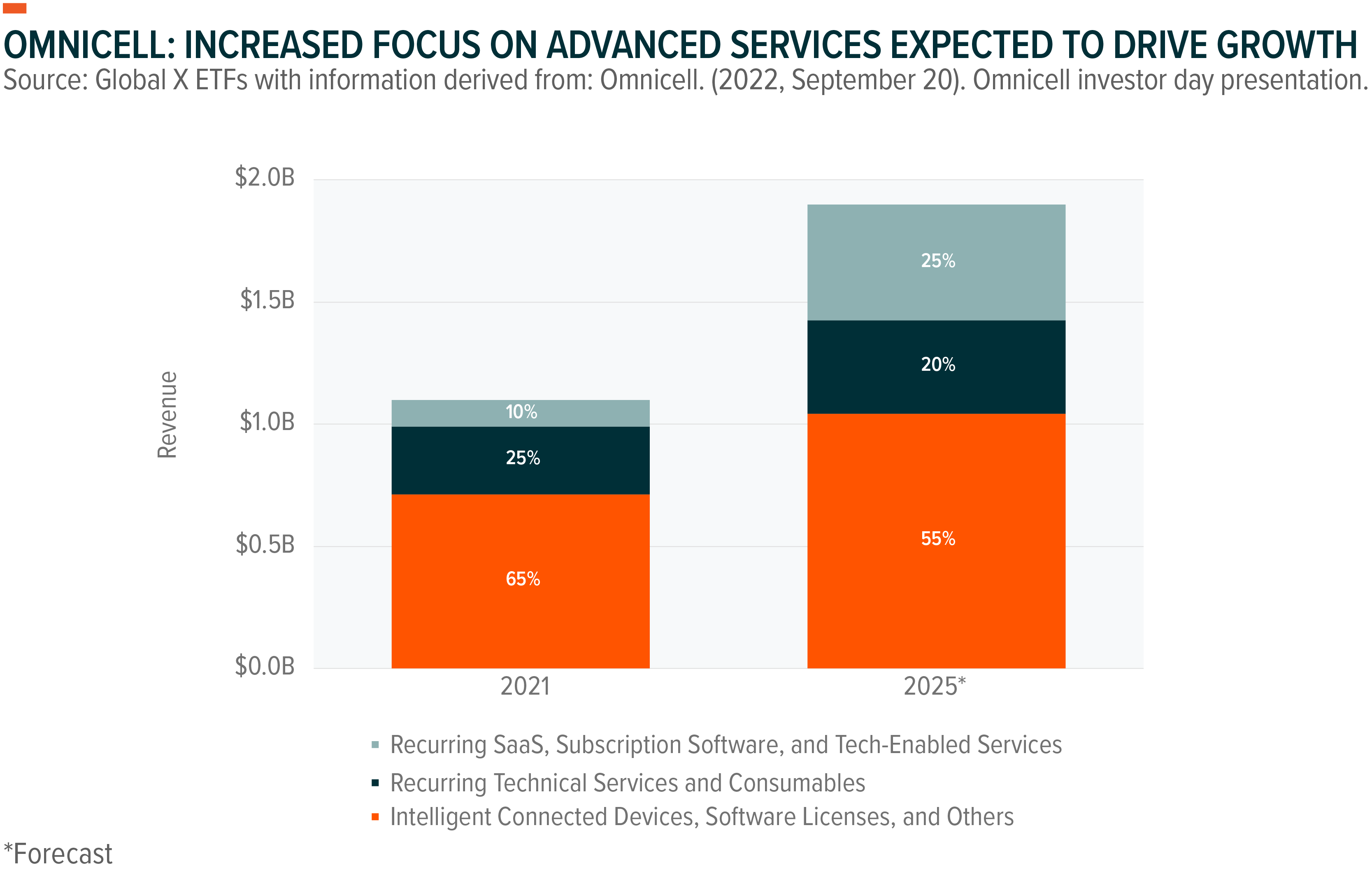

Aided by the clear need for improved pharmacy management, Omnicell achieved a record-breaking $1.3 billion in sales in 2022, and projects to reach $1.9 billion in annual revenues by 2025.3, 4 All in all, Omnicell estimates a significant market opportunity, with a total addressable market of over $90 billion across four key segments: retail pharmacies, point of care, specialty pharmacy services, and central pharmacies.5

SaaS: Moving Beyond Autonomous Pharmacy Services

Notably, Omnicell looks to double down in its software as a service (SaaS) and tech-enabled services model, leveraging the success of its Advanced Services and Cloud Platform organizations. Given the siloed nature of the healthcare sector, Omnicell has seen notable success with its platform-based approach to medication management, and forecasts Advanced Services will make up 18% of 2023 revenues, up from just 6% in 2020.6 Omnicell seeks to increase that proportion to 20-30% of total revenues by 2025, with an estimated 7-10% market share for its Advanced Services portfolio.7 The diversification of revenue is also expected to boost margins considerably over time.

Outpatient Care: Building Off Success in the Retail Pharmacy Sector

At the core of Omnicell’s offering, the firm intends to improve medication management across the entire care continuum. Currently, points of care are often siloed – emergency departments, physician offices, retail pharmacies, and the like – leading to high healthcare costs and low medication adherence. Patients not taking medications as prescribed can account for up to 50% of treatment failures and up to 25% of annual hospitalizations in the U.S.8 This represents a $100 billion cost for the U.S. each year.9

Omnicell’s EnlivenHealth platform is the only fully integrated patient-engagement service on the market, transforming how retail pharmacies and health plans engage and communicate with patients, coordinate care, and ensure medication adherence. The program has already seen a 90% adherence performance rate, a 10% increase in prescription volume, and 9% fewer hospitalizations and emergency department visits.10 Omnicell is leveraging its impressive installed base in the retail pharmacy sector – including medication management systems across 80% of the U.S. retail pharmacy sector – to drive increased adoption of EnlivenHealth.11 As of 2022, EnlivenHealth engages with 78% of retail pharmacies in the U.S., and Omnicell projects EnlivenHealth could bring in $1.1 billion in recurring revenue, at its peak.12

Point of Care: Integrating with Electronic Health Records

Omnicell’s integrated workflow across the inpatient care system has seen great success thus far. In the point-of-care setting – whenever a patient sees a care provider face-to-face – Omnicell’s medication dispensing systems offer advanced technology to streamline the medication dispensing processes and integration with data from electronic health records (EHRs). EHR integration allows for a seamless prescribing and filling process, with the ability for physicians to remotely preselect medications directly from a patient’s profile for faster retrieval of medication at Omnicell’s automated dispensing cabinets.

The firm’s group of dispensing systems have shown a 54% reduction in nurse medication retrieval time, 74% time savings, and 30% greater inventory capacity.13 Through its comprehensive medication management platform, Omnicell currently boasts a 50% installed base in U.S. hospitals, with 150 sole source contracts of the top 300 U.S. health systems.14

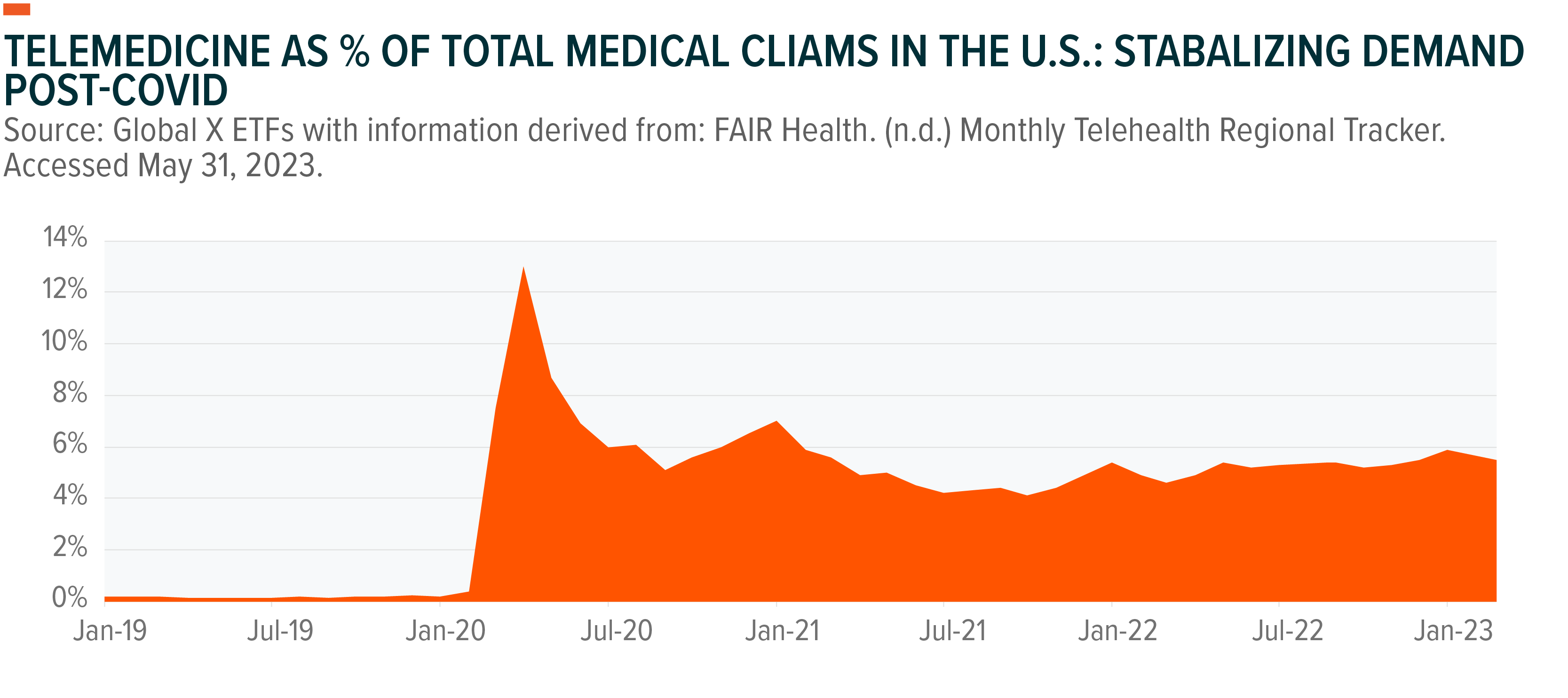

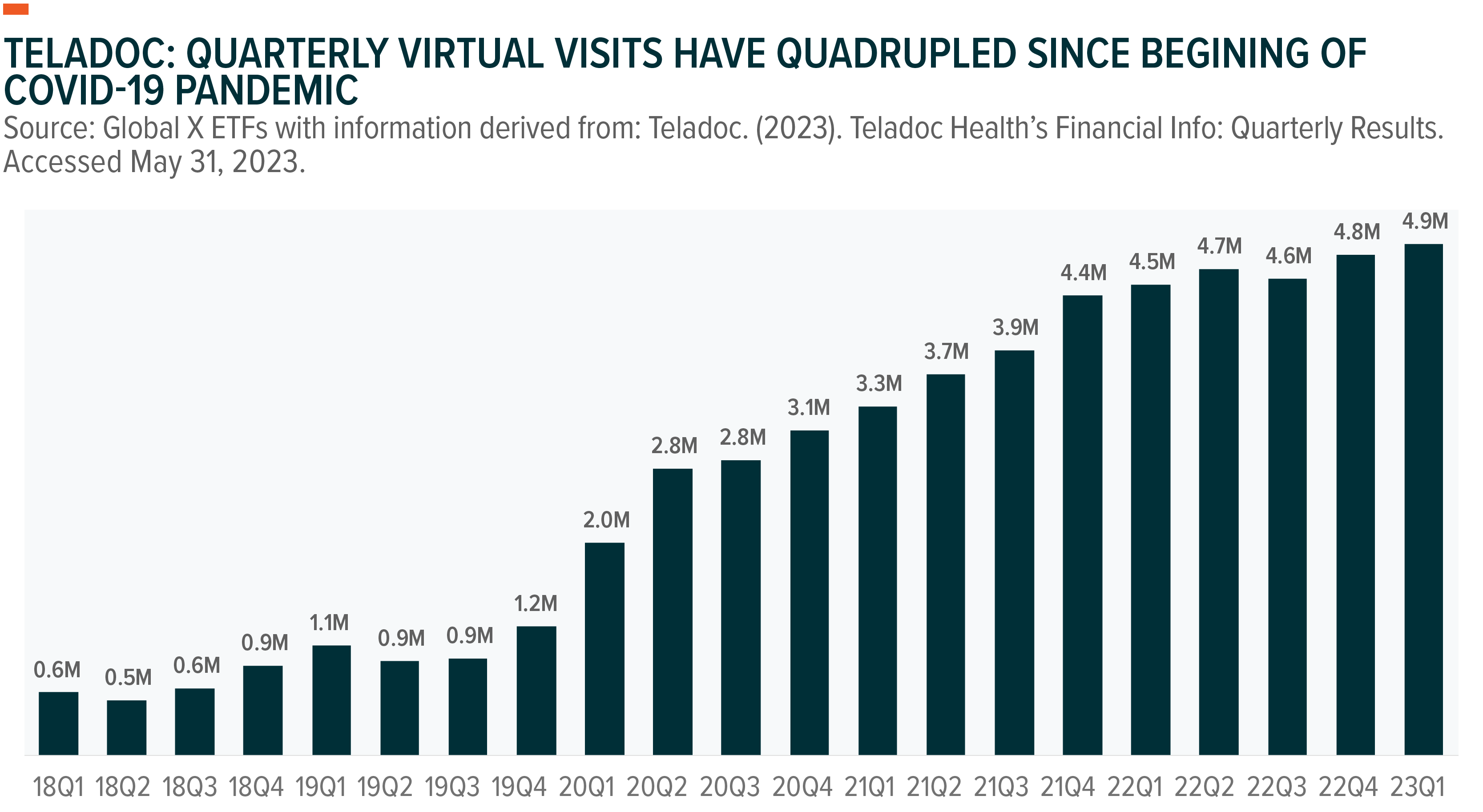

Teladoc: Finding Avenues for Growth in a Post COVID-19 World

The COVID-19 pandemic spurred the rapid adoption of telemedicine, introducing the technology to a much wider pool of patients. Telemedicine firm Teladoc has seen significant adoption due to the surge in virtual care demand and has laid a framework to disproportionately benefit from long-term demand for virtual care.

A slower adoption curve for telemedicine services than we saw during the pandemic notwithstanding, Teladoc’s virtual care platform now serves 80 million members, resulting in 18.5 million visits and 500 million digital health interactions with 30,000 providers in 2022.15 Teladoc now targets 2023 annual revenues of $2.55-2.68 billion, representing 7-11% annual growth.16

Primary Care: A Focus on Prevention

Currently, an estimated 100 million Americans don’t have a primary care physician (PCP) – an important factor in managing and preventing chronic illnesses and identifying risk factors for serious conditions.17 Teladoc’s P360 offering, focused on comprehensive primary care, has quickly grown in popularity with enhanced care coordination, free same-day medication delivery, and in-home phlebotomy services.

The firm recently published key figures for the program. Prior to enrolment, 65% of participants did not have a PCP.18 Thirty-one percent of total participants were overdue for colorectal screenings, and 20% of female participants were overdue for cervical screenings.19 Improvement in screening adherence can play a key role in disease prevention.

Patients joining Teladoc’s P360 platform were able to diagnose conditions earlier and, subsequently, manage their disorders better, according to the company’s data. Specifically, 37% of patients with diabetes were previously undiagnosed, while the figure stood at 25% for those with hypertension.20 Additionally, 56% of P360 members with hypertension lowered their blood pressure since joining the program.21

Chronic Care: Where Most Healthcare Dollars Are Spent

To compliment Teladoc’s existing primary care offering, the firm is doubling down on the chronic care segment to aid in the continuous care of patients living with chronic illnesses like diabetes, congestive heart failure, and chronic obstructive pulmonary disease (COPD). An estimated 75% of all healthcare spending in the United States is allotted to chronic illnesses, which results in an overall cost of $37 trillion per year.22 This equates to about a fifth of the U.S. gross domestic product.23 Teladoc looks to utilize its comprehensive at-home offering to improve patient outcomes for a growing number of individuals, and it is seeing success with its efforts. As of Q1 2023, Teladoc’s chronic care program enrolled 1.03 million individuals as of Q1 2023, up from 0.91 million a year prior.24

Most recently, Teladoc announced it is expanding its chronic care platform to include prescribing obesity drugs such as Novo Nordisk’s Wegovy (colloquially known as Ozempic) and Eli Lilly’s Mounjaro. The obesity treatment space is expected to grow to $50 billion in sales by the end of the decade, up from $2.7 billion today.25 For more information on the obesity treatment space, see Diabetes Management: Massive Addressable Market Spurs Innovative Solutions.

Up until the announcement, Teladoc was providing services to diabetes and hypertension patients through Livongo, the chronic care platform it acquired in 2020. With the recent expansion into obesity, a key precursor to diabetes and cardiovascular diseases, Teladoc will now cater to a much larger market, unlocking a potential $200 million revenue opportunity.26

Mental Health: The Fastest-Growing Segment of Telemedicine

Mental health, the fastest-growing segment of telemedicine, continues to drive significant revenue growth. As of February 2023, around two thirds of all virtual medical health claims were for mental health conditions.27 Teladoc’s direct-to-consumer behavioural health subsidiary, BetterHelp, raked in $1 billion in revenue in 2022, making up 42% of the firm’s total annual revenues and representing 41% annual growth.28 Last year, BetterHelp had over 45 million interactions between 1 million patients and 25,000 therapists.29

The mental health segment is expected to continue to be a key contributor for Teladoc, as its strong competitive presence should provide a stable revenue stream as the firm continues to expand its footprint across primary care and chronic care. These two segments are expected to require ongoing integration with other digital health services to help drive continued adoption.

iRhythm: A Leader in the Cardiac Monitoring Space

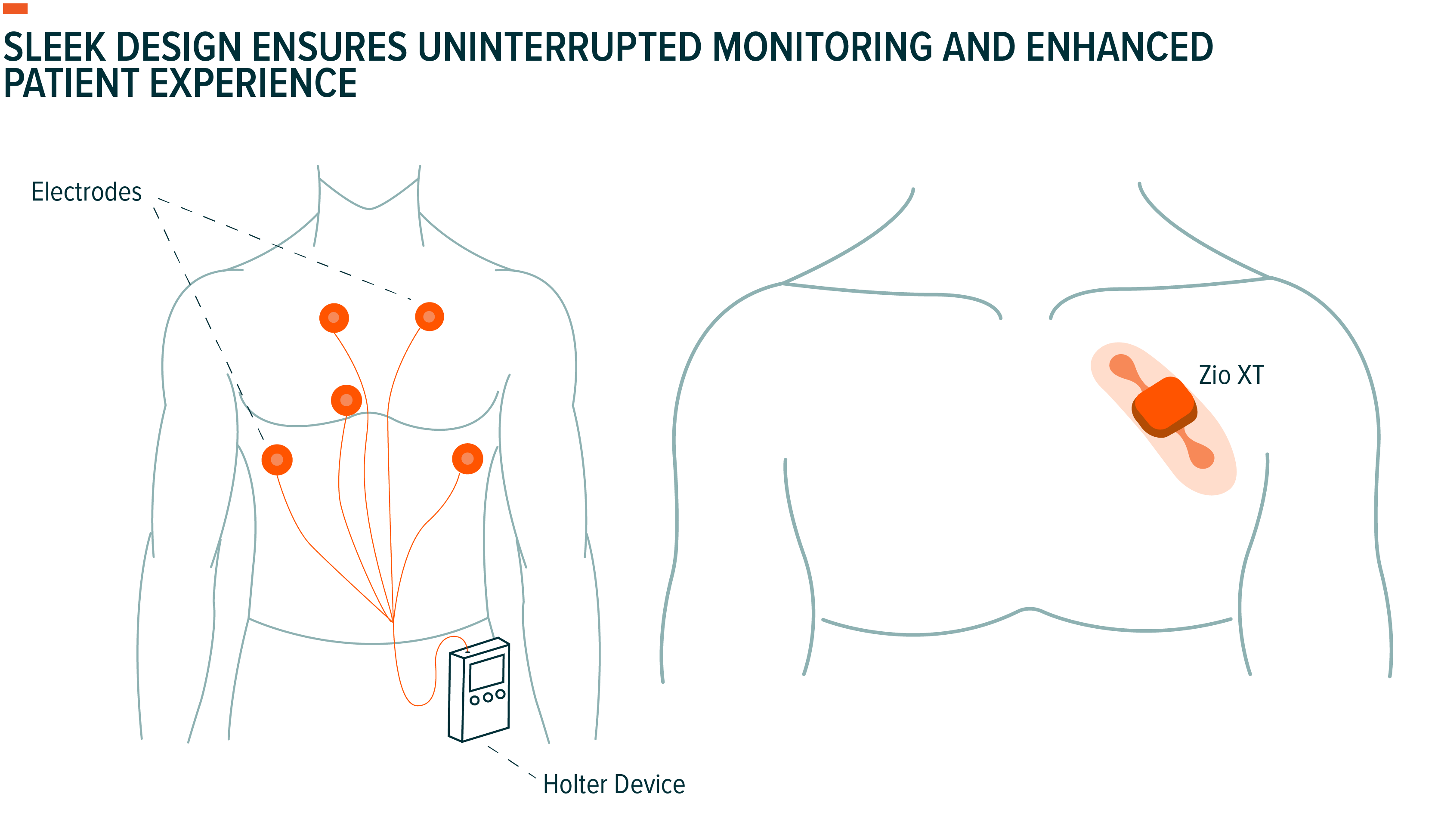

iRhythm Technologies is a leading player in the cardiac monitoring industry for arrhythmias – or irregular heartbeats. The firm’s flagship product, the Zio System, utilizes artificial intelligence (AI) and machine learning (ML) algorithms to detect and diagnose irregular heart rhythms via a small, wearable patch that can be worn throughout the day. The firm’s industry-leading design has resulted in longer wear times and 98% patient compliance, leading to more accurate data and a faster time to diagnosis.30 An estimated 11 million individuals in the U.S. have arrhythmias and an average of 160,000 deaths each year are associated with atrial fibrillation (Afib) – a form of cardiac arrhythmias.31

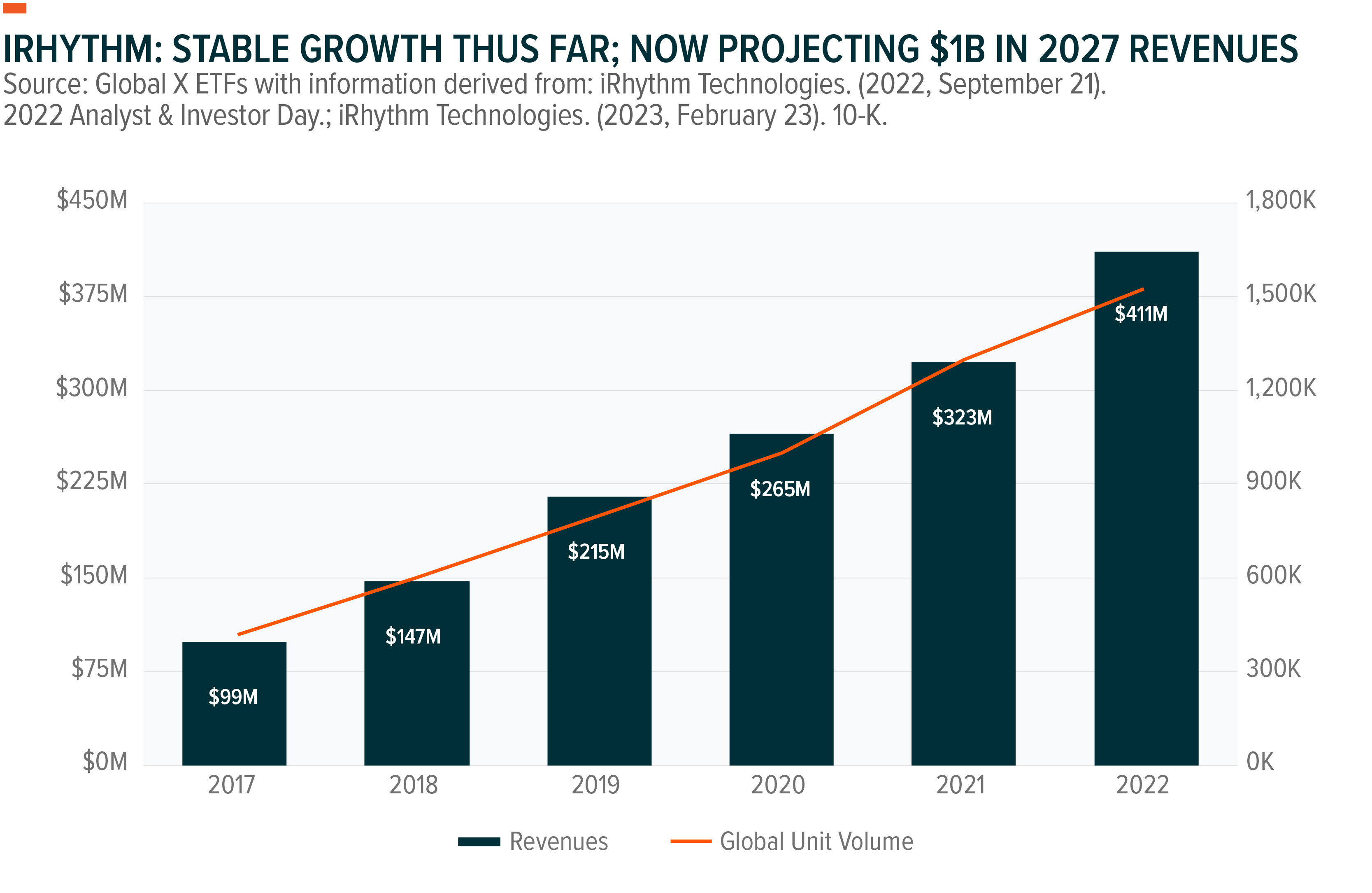

iRhythm has reportedly served 6 million patients and has collected 1.5 billion hours of curated electrocardiogram data.32 Its success thus far has helped the firm achieve $411 million in revenues in 2022 and 1.5 million sensors sold thus far.33 iRhythm now projects 2023 revenues of $480-490 million, a 17-19% annual growth rate, aided by a robust product pipeline.34 By 2027, the firm looks to achieve over a billion dollars in annual revenue.35

Product Lineup: Gaining Traction with Physicians and Insurers

iRhythm currently offers two monitors for arrhythmia detection. The Zio XT patch monitor revolutionized the ambulatory cardiac monitor (ACM) industry, allowing for continuous heart rate monitoring for up to 14 days of normal, everyday activities. The firm also offers the Zio AT patch, which includes Bluetooth technology for mobile cardiac telemetry. iRhythm has successfully achieved strong insurance coverage, with 70% of commercial and Medicare patients being eligible to receive the Zio XT with an out-of-pocket cost of less than $50.36

The firm now hopes to leverage its success thus far to a wider pool of patients. iRhythm’s next-generation Zio monitor was approved in 2021 and is currently under limited market release in the U.S. The new monitor is 72% smaller, 62% lighter, and 23% thinner.37 The new device has also shown a 3.8% improvement to its predecessor’s diagnostic yield.38

Along with Verily, Alphabet’s life sciences group, iRhythm has also recently received FDA approval for the Zio Watch, a new AI-powered smartwatch system that offers clinical-grade data. The watch analyses patient data, and a report is sent to the patient’s physician for review. The watch is expected to launch in 2024.39

Competitive Landscape: Zio Stands out in a Crowded Field

The cardiac monitoring industry has multiple options for monitoring cardiac rhythm, though the ACMs have penetrated less than 30% of the total addressable market.40 Traditional ECGs record the electrical activity of a patient’s heart for only 10 seconds. The ECG can reveal important information about heart health – such as lack of sufficient blood flow and whether the walls of the heart are too thick – though it provides insufficient data to make a diagnosis for cardiac arrhythmias.

A recent study showed that the Holter monitoring device, which requires a small ECG device with electrodes (small, plastic patches that stick to the skin) that are placed on the chest and abdomen, was used in over 54% of patients.41 The Holter device can be used for up to two days, though it has been shown to detect only 47% of arrhythmias, on average.42 In comparison, iRhythm’s Zio has shown to detect 99% of arrhythmias.43

Although there are other long-term cardiac monitors (LTCMs) on the market like the Zio, these have shown to be 20% less likely to detect a specific arrhythmia and 3.51 times more likely to require a retest within 180 days the Zio System.44 In a recent study presented at the American College of Cardiology’s Annual Scientific Session, the Zio XT was also associated with the highest diagnostic yield, lowest retesting rates, fastest time to clinical diagnosis, and lowest risk of hospitalization compared to all other ACMs.45

Significant Runway for Growth

Beyond an industry-leading group of devices and a robust product pipeline, iRhythm is also taking significant steps to further expand its potential market. Currently, 14 million primary care patients are estimated to have heart palpitations and have suspected cardiac disease.46 An additional 12 million individuals in the U.S. are at high risk of undiagnosed arrhythmias.47 However, only an estimated six million ACM tests are performed in the U.S. each year.48

iRhythm has also identified several adjacent market opportunities:

- Sleep Apnoea: The sleep apnoea prevalence as of 2022 is estimated to be over 40 million individuals in the U.S., though 90% of them remain undiagnosed.49, 50 Eighty percent of Afib patients also have sleep apnea.51

- Heart Failure: An estimated 8.4 million individuals in the U.S. currently suffer from heart failure.52 Afib is a known precursor to heart failure, and 25% of heart failure patients have Afib.53

- Hypertension: iRhythm estimates a total of 166 million individuals suffer from high blood pressure.54 Up to 90% of Afib patients also have hypertension.55

The firm’s success in the U.S. market and continued reimbursement traction strengthens its potential in international markets. iRhythm estimates the OUS opportunity to be north of a billion dollars, with particularly strong potential in Europe, the U.K., and Japan.56

Masimo: Offering Hospital-Grade Monitoring at Home

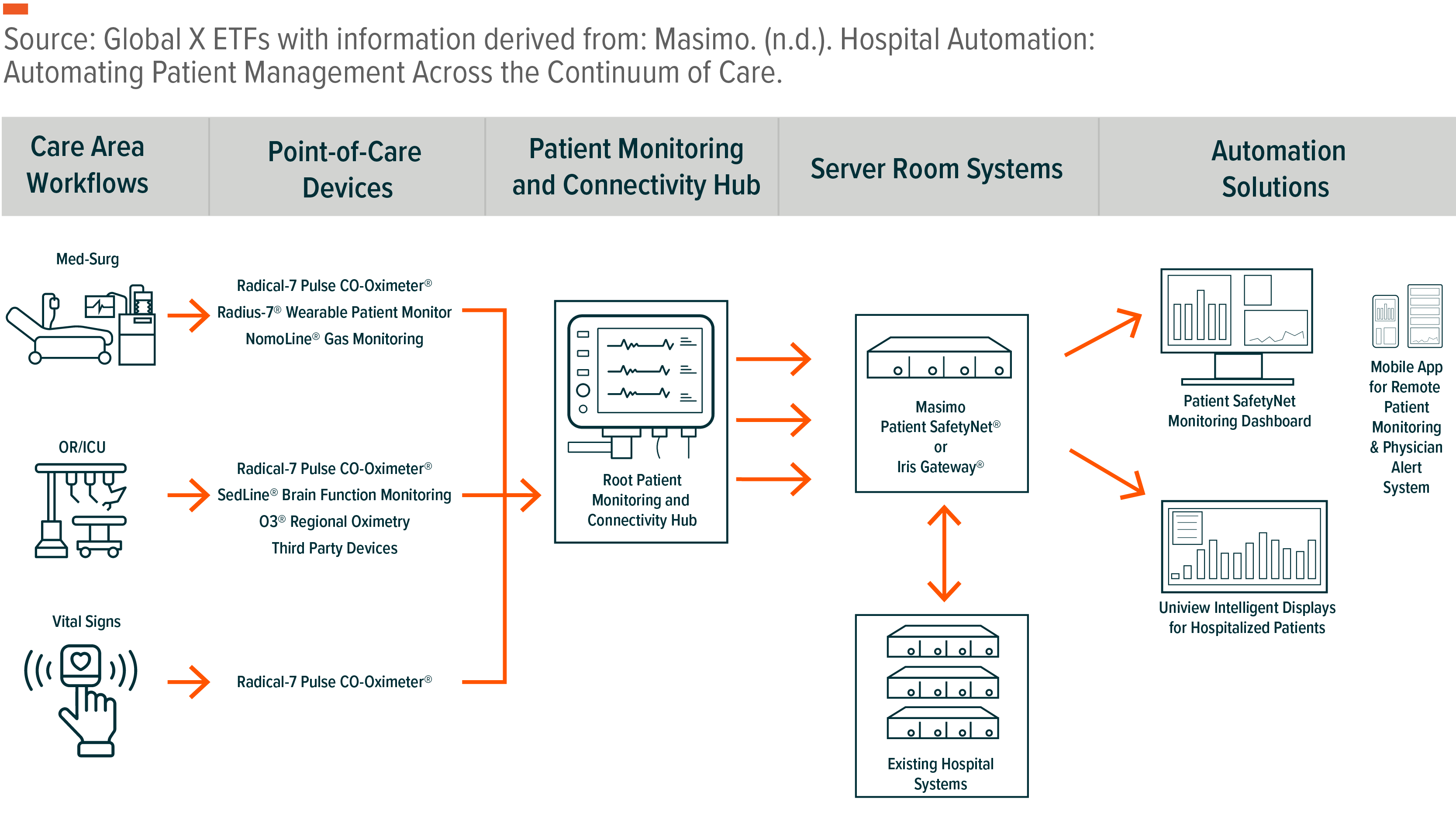

Medical technology firm Masimo is focused on non-invasive patient monitoring technologies, hospital automation, and consumer products. Originally known for its pulse oximeters, devices to measure oxygen levels of the blood, Masimo has since expanded to a wide range of patient monitoring offerings for use in the hospital and at home. Remote monitoring has become increasingly popular, particularly with the COVID-19 pandemic, as it offers a seamless, automatic way to transmit data to patients and physicians.

Given its strong presence in the sector, Masimo reported 11% consolidated revenue growth in 2022, fuelled by strong adoption trends in both professional and consumer health.57 Masimo now forecasts its revenues to expand at a 7-9% compound annual growth rate through 2028 via increased consumer healthcare products and distribution channels, as well as expanding its sizable footprint in the professional health setting.58

Professional Health

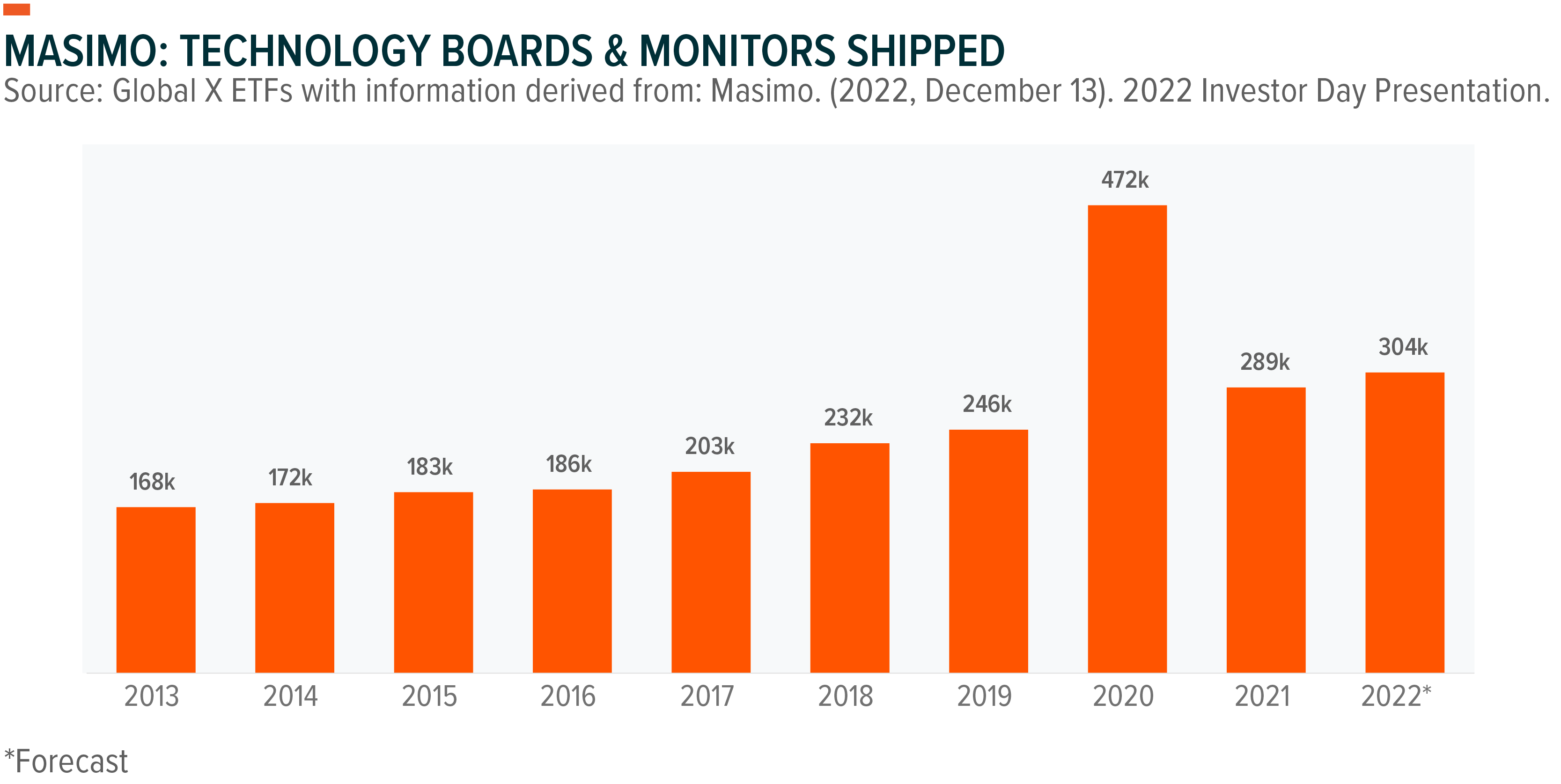

Masimo has solidified its lead in the patient monitoring market, with nearly 2.5 million technology boards and monitors shipped over the last 10 years to facilitate non-invasive monitoring of patients across the continuum of care, such as intensive care units (ICUs), recovery units, and long-term care facilities.59

Masimo’s SET Pulse Oximetry has been used to monitor over 200 million patients a year around the world and makes up 79% of its healthcare revenues.60 Pulse ox is a crucial measure of how well the lungs are working and flags potential deterioration in lung function. It can be used, among other things, to see how effective lung treatment has been, if a ventilator is needed to help with breathing, and to monitor if a patient has stopped breathing during sleep. In a hospital setting, the SET pulse oximeter has shown a 50% reduction in ICU transfers of patients for post-surgical patients.61

Leveraging its market position in pulse oximetry, Masimo has expanded its professional healthcare portfolio to aggregate data from its suite of products – such as brain, respiratory, cardiovascular, sedation, and temperature monitoring – and over 300 third-party devices – such as anaesthesia machines and ventilators.62 Powered by a comprehensive view of the patient’s vitals, an integrated display alerts physicians of patients in distress and facilitates coordinated care. Masimo’s system also automates charting, automatically feeding in patient information into electronic medical records (EMRs).

Consumer Health

Leveraging its success in patient monitoring in hospitals and care facilities, Masimo has quickly solidified its position in the consumer healthcare industry. Its at-home pulse oximeter, MightySat, measures five key vital signs via a wireless finger monitor. When used in the home, the MightySat resulted in 77% fewer deaths and 87% fewer hospitalizations, with an average cost reduction per patient of $11,472.63

Given its success with the MightySat and W1 biosensing smartwatch, Masimo plans an aggressive 2023 with a host of new consumer healthcare products. Its next generation biosensor watch, Freedom, is currently available for preorder and it enables the continuous reading of key health data like blood oxygen saturation, hydration index, pulse rate, heart rate, and respiration rate.

Masimo also recently unveiled its new Stork baby monitor, designed to offer parents insights into their baby’s health data. The Stork monitoring ecosystem consists of a boot with sensor, video camera, and mobile app and marks the firm’s entry into the $1.5 billion baby monitoring market, growing 9-15% annually.64 The boot is embedded with sensors to monitor oxygen saturation, pulse rate, and temperature.

Expanding Consumer Strategy via Sound United Acquisition

Masimo acquired Sound United in 2022, a leading home theatre and personal audio provider, in hopes of expanding its consumer facing strategy. Since the acquisition, Masimo is underway to connect its health monitoring technology to Sound United’s existing entertainment systems to enable them to collect, share, and display health information across Sound United’s 4 million installations of its multi-room home entertainment operating system (HEOS).65 Along with Masimo’s cloud, the HEOS devices could also be leveraged to host telehealth sessions from the home over existing home TV and audio systems.

The Sound United acquisition also allows Masimo to soon make a play in the $85 billion hearables market.66 Masimo recently announced the introduction of its Adaptive Acoustic Technology (AAT), which can measure cochlea response to sound and automatically generate a unique hearing profile, adapting acoustic sound and music.

Conclusion

With an aging population, rapidly increasing healthcare costs, and strained budgets for organizations like Medicare, it’s becoming increasingly clear that the U.S. needs to spend its healthcare dollars more efficiently. A data-driven approach that leverages rapidly evolving technologies such as artificial intelligence, machine learning, and automation could be key to improving patient outcomes while also potentially lowering costs. Given the clear need for innovation, these four companies are leading that charge, though the digital health and telemedicine space continues to rapidly evolve to further improve patient outcomes.

This document is not intended to be, or does not constitute, investment research