Global X 2021 US Outlook and International Opportunities

In 2020, annual outlooks quickly became obsolete as the COVID-19 pandemic caught the world by surprise. Nearly a year later, we believe massive stimulus efforts, vaccine development and distribution, and new political agendas put us on a likely more predictable path to recovery. Yet if 2020 taught us anything, it is to never underestimate the unpredictable. In this 2021 outlook, Global X’s CIO and Research teams provide our insights and expectations for the year ahead, covering topics from the macroeconomic landscape, to disruption amid a return to normalcy, interest rates and income investing, and investing abroad.

Trends to look out for in 2021

- Growth may lead in the broader cycle, though Value may stand to benefit from the reopening of the economy and may have a strong year

- Small caps could stand out should a strong U.S. economic recovery take hold

- ESG supporters in the White House could accelerate demands for greater action against climate change, and more widespread support for ESG and sustainable-themed investing

- Biden’s policies may align with many disruptive themes that COVID-19 accelerated, providing longevity to these theme’s recent rallies

- Fixed income may remain a challenge amid a low rate environment, promoting greater interest in alternative income asset classes like preferreds and EM debt, or income strategies like covered calls

- The US dollar may continue to weaken, causing investors to increase allocations to cheaper, and in some cases faster-growing foreign markets.

A Recovery at Risk

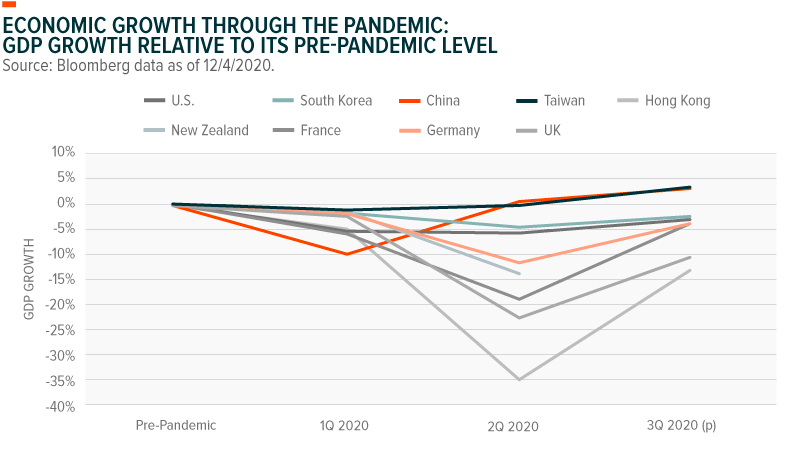

The events of 2020 cannot be understated: they were staggering. The global economy essentially shut down, resulting in a depression-like drop in GDP. In the U.S., GDP contracted at an annualized rate of 5% in Q1 and a shocking 31.4% in Q2, before a massive 33.1% swing higher in Q3.1

As a long 2020 ends, a clear pullback in economic activity is evident in the US and many European countries with COVID-19 cases rising again. The deceleration in job growth is likely related to rising COVID-19 cases as much of the US population heads inside for the winter. Many people are falling behind, without much to help them bridge the gap. According to as recent Census Bureau survey, nearly 9 million renters said they were behind on rent and basic utilities. Additional fiscal stimulus programs could potentially provide a booster shot to the economy.

Both the International Monetary Fund (IMF) and the G-20 warn that the global recovery is potentially at risk of derailing despite upbeat vaccine news driving equity markets to new all-time highs. While the market is focused 3–6 months out when greater vaccine availability is likely, the economy looks languished and in much need of a jolt. Currently, global growth is expected to have contracted -4.1% in 2020, followed by a 4.9% rebound in 2021.2 However, uncertainty in these forecasts is high.

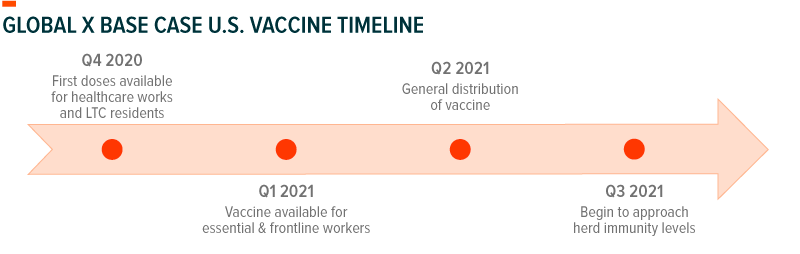

We must recognise that despite general optimism surrounding 2021, the global economy is still weak and a return to pre-pandemic GDP levels will take years. But the initial vaccinations are already under way and we expect widespread distribution by Q2. Provided effective distribution occurs, it is reasonable to expect the economy to fully reopen by 2H 2020. In addition, if monetary and fiscal stimulus remain robust to support consumers and small business through potentially a few more quarters of closures, the economy will be in a much better position upon re-opening. Finally, in 2021, we expect the Biden Administration to implement new approaches and ideas, ones that could propel certain themes, including infrastructure development, climate mitigation, as well as potentially reinvigorate domestic and international economic activity.

The Support the Economy Needs

The US’ uneven response to the COVID-19 crisis outlasted the relief that the US$2 trillion CARES Act provided. As a result, the economy needs another booster shot to buy it time while the vaccine gradually makes its way through the country. The start of Joe Biden’s presidency could provide a fresh voice to stimulus negotiations and federally funded programs that boost the demand side of the economy and promote structural change. But aside from a slimmed down stimulus package, we do not expect much more from what will likely be a split government in 2021, pending the results of the Senate run-off election in Georgia.

Undershooting fiscal stimulus is a key risk. For the US to recover, more needs to be done to protect the lifeblood of the economy: the individual consumer and the small business.

The Consumer

As a consumption-driven economy, the U.S. depends on the mass consumer to sustain economic growth. But middle- to low-income consumers remain particularly vulnerable to COVID-19, both physically and financially. Reinstating federal unemployment insurance and some form of rental assistance is critical for this group to make it through to mass distribution of the vaccine and a wide economic reopening.

CARES Act checks helped in the short term, but wages for the middle class have been stagnant for decades. Pre-pandemic, real average wages had about the same purchasing power they did 40 years ago, and any wage gains skewed toward the highest-paid workers. People can only hold out for so long, and many people are burning through what savings they did have. And most American do not own stocks, meaning the wealth inequality gap widened significantly this year as markets rallied. Fed data from 2016 show that only about 14% of families are directly invested in the markets. Roughly 52% have some market participation, but mostly through 401(k) plans.3

A lingering question for the economy is how consumers who can spend will spend when fully reopened. Typical spending on restaurants, vacations, and live entertainment have not been options for many people this year. This type of spending does not accumulate as pent-up demand, though. We do not expect many consumers to double-up on eating out, leisure travels, or concerts in 2021. An initial surge when the economy gets fully turned on is likely, but consumer fundamentals continue to deteriorate.

The Small Business

Adaptation was key in 2020. For companies to survive, they needed to change their business models on the fly. Becoming digital-first, through online ordering and payments was a wise and necessary move that helped many businesses thrive. But for most small businesses, particularly those in the service industry, pivoting was not an easy option. These businesses need help, and many have not received enough, creating fundamental weakness throughout the economy.

Small businesses drive the U.S. economy, as they employ about 47.3% of all private employees.4 The CARES Act initially provided US$350 billion for its Paycheck Protection Program (PPP), all funds of which were claimed by April. Congress subsequently added another US$310 billion to the program. June’s PPP Flexibility Act also gave businesses more options on how they could allocate loans. But as the pandemic re-intensifies and with new regional lockdowns in effect during the all-important holiday season, small businesses are closing and filing for bankruptcy at an increased pace as large portions of the economy remained closed and stimulus programs expire.5

A Fed-supported Market

At the start of the pandemic, the government’s plan essentially involved spending the US out of this crisis. And in some ways, it worked, at least for some time. The CARES Act kept consumers afloat and the Fed backstopped risk assets with whatever-it-takes support. Importantly, the Fed supported corporate debt, which reduced default risks and restored normal market functions following the deterioration in financial conditions resulting from the lockdowns. The Fed also cut benchmark interest rates to near zero, reducing borrowing costs for business. We expect the Fed to remain supportive for some time, with current Federal Open Market Committee (FOMC) projections showing rates remaining at this level through at least 2023.

For markets, the adage rang true: Don’t bet against the Fed. With their wheels greased, markets skyrocketed to new highs in 2020 and investors saw their wealth increase significantly. The latest flow of funds data from the Fed suggests that the household sector increased wealth by US$3.8tn between Q2 and Q3.6 The massive stimulus package shifted control of risk assets from the public domain to individuals. Low interest rates and inflation encouraged investors to purchase risk assets because— they were not so risky.

U.S. Equities in 2021

Adequate vaccine distribution and stimulus could lead to a robust recovery in the second half of 2021, drive corporate profits closer to 2019 levels, and generate strong equity returns. Value and small cap stocks have a good chance to outperform in the short term should a comprehensive reopening commence, particularly in the early stages. Some of the most loved sectors of the economy including Information Technology and Consumer Discretionary may take a breather with Value stocks supported by positive vaccine news, but their secular trends will continue. Micro shifts in leadership from Growth to Value since September are evident. However, a more robust shift requires bringing the virus under control and a booster shot in the form of additional fiscal stimulus.

The big question in the short term is what a Biden presidency can accomplish if the Republicans keep the Senate. However, we expect Biden to make full use of the executive powers at his disposal, which could become stimulus-like and be supportive of equities. We expect his administration’s policies to align with many of the disruptive themes that COVID-19 brought to light (discussed more in Investing in Disruption).

We are also watching the value proposition of having ESG allies in the White House as society increasingly demands action on climate change and scrutinises corporate value systems. In 2020, ESG strategies often generated significant alpha and continued to entrench in investor decision-making. In many ways, a global health crisis is a perfect advertisement for ESG’s merits. COVID-19 exposed systemic risks in the broader economy that ESG highlights; risks such as convoluted supply chains that delay personal protective equipment deliveries and how corporations tend to their employees’ health and wellness. COVID-19 brought the social component to corporate board room like never before.

Thematic Investing: Disruption to Continue into 2021

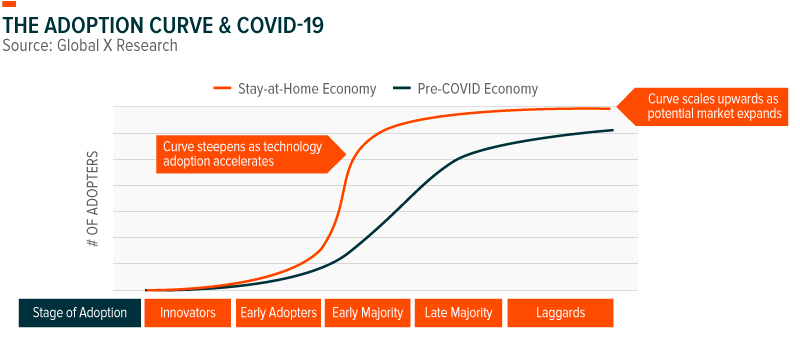

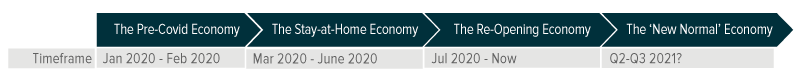

The COVID-19 pandemic acted as an accelerant for a number of paradigm-shifting structural trends which were still in their early innings entering 2020. Years of disruption took place in weeks and months as consumers, businesses, organisations, and governments rapidly adapted to a socially distanced world where large swathes of the global population faced stay-at-home orders. Areas like cloud computing, e-commerce, and video games and esports benefitted greatly, providing digital mediums for remote work, consumption, and leisure.

Though the pandemic rages on, there is a light at the end of tunnel that we expect to reach in 2021. Encouraging vaccine trials and emergency authorisations mean that millions could soon be inoculated against the dangerous virus. If successful, such progress should facilitate a transition from the Re-Opening Economy to the New Normal Economy. The New Normal Economy is not a return to 2019. Instead, it describes a post-pandemic world featuring many of the structural changes that solidified in 2020 – more flexible work arrangements, widespread e-commerce, and digitalisation across numerous sectors – despite in-person activities recommencing.

2021 will also be a year marked by political change, especially in the U.S. where the incoming Biden Administration’s plans for infrastructure spending, climate change mitigation, and cannabis deregulation could meaningfully impact a number of themes’ trajectories. Below, we identify several key investment themes for 2021 and delve into how they might fare in the year to come.

Cloud Computing

Cloud computing underpins 2020’s successful work-from-home experiment. Through the cloud, at-home employees could virtually access their regular suite of applications and files and collabourate with their colleagues over video and text chat. We expect enterprises to continue relying on cloud-based Software-as-a-Service (SaaS) as virus fears keep employees out of the office for the first half of the year and many organisations embrace remote work as part of the longer-term New Normal. Already, many large organisations like Facebook and Square announced permanent or hybrid work-from-home policies. And while new customer growth may decelerate from 2020 levels, we expect upselling and re-pricing opportunities to contribute to solid top-line growth rates for cloud companies.

Robotics, Artificial Intelligence, and the Internet of Things

Robotics, Artificial Intelligence (AI), and the Internet of Things (IoT) were also critical themes for business continuity across a variety of sectors. In industrial settings, we expect the adoption of these technologies to continue at a strong pace in 2021 as decisionmakers seek to mitigate supply chain risks through reshoring and to improve safety and efficiency through automation. These technologies also saw significant adoption in health care in 2020, enabling disease surveillance and contact tracing, labour-free hospital disinfecting, and contactless patient care and monitoring. Projections for 2021 service robot sales reflect high expectations for the continued adoption of robotics in non-industrial capacities like hospitals, hotels, and food-service. Looking at sub-segments, the International Federation of Robotics expects cleaning robot sales to reach 28,000 in 2021, up 47% year-over-year (YoY) and medical robot sales to reach 16,000, up 33% YoY.7

Video Games & Esports

Technology-based disruption also occurred at the consumer level in 2020 as many individuals spent their newfound at-home leisure time in the expansive virtual worlds offered by video games and esports. New video game consoles from Sony and Xbox and more robust cloud gaming offerings on Google Stadia and Amazon Luna should offer tailwinds to this theme in 2021. Additionally, we expect esports and streaming viewers and the convergence of social media and gaming to continue growing the share of entertainment dollars spent on gaming, which reached approximately 11% in 2020.8

E-commerce

2020 also saw a major shift in retail consumption from brick-and-mortar to e-commerce. Through Q3 2020, e-commerce retail sales were up 36.7% YoY in the U.S., while overall retail was up 7.0%.9 Additionally, previously untapped e-commerce areas like food and beverage experienced notable penetration and growth. The U.S. grocery segment, for example, is on track to achieve 53% YoY growth, reaching 131 million consumers and making it 2020’s fastest growing e-commerce segment.10 We expect e-commerce to continue growing in 2021, driven by the sticky behaviours established in 2020. Many consumers are now e-commerce-first shoppers, habitually turning to the internet, rather than physical stores, to make discretionary and recurring purchases. Additionally, we anticipate that underpenetrated segments like autos will see a sales shift to e-commerce as technologies like augmented and virtual reality help bridge the gap between physical and virtual shopping experiences.

FinTech

Entering 2020, FinTech and e-commerce faced many of the same headwinds. Both offered compelling tech-driven solutions to inefficiencies but needed to overcome engrained consumer behaviours to grow further. And similar to e-commerce, FinTech adoption accelerated as consumers grappled with the pandemic reality. Digital payment systems experienced greater use as integration with online retail platforms and a surge in e-commerce sales drove heightened transaction volumes. Contactless payment volumes also accelerated amid social distancing and virus mitigation efforts. In our view, these technologies underpin many of the new consumer behaviours embraced during the pandemic that are unlikely to go away anytime soon. Additionally, many vendors spent the pandemic months building out costly digital and contactless payment infrastructure. We expect these systems to remain in-place moving forward, facilitating a shift away from physical cash and credit card transactions, which still dominate in the U.S. As in-person activities like dining-in and live events eventually return, contactless payments could ultimately become the de-facto consumer payment solution due to the progress made in 2020.

CleanTech

2020 is on the verge of becoming one of the hottest years on record. Some projections show that the global average temperature in 2020 is 0.75°C higher than in 1980, and under current policies the world could warm 4.1°C above pre-industrial levels by 2100.12 This comes on the back of recent decarbonisation commitments from China, Japan, Korea, Canada and the EU to reduce emissions, and before a climate-conscious Biden Administration takes over in the U.S. President-elect Biden has explicitly mentioned plans to decarbonise the U.S. power sector by 2035 and achieve net-zero emissions by 2050.11 75% of warming comes from emissions, and humans are responsible for half of such emissions since the industrial revolution. CleanTech is a collection of technologies that can mitigate emissions. For example, a shift to renewable power could contribute to 52% of emissions reduction, energy efficiency tech could contribute 27%, and electrification could contribute 21%.

2020 did not go as planned. In less than a year, we experienced disruption typical of several years. Yet, this trying time proved to be a proving ground for myriad emerging themes, many of which are now fully engrained in our day-to-day. 2021 will hopefully be a year marked with more certainty, but regardless, we expect the Stay-at-Home Economy to have a lasting impact on the advancement of several disruptive themes.

Interest Rates & Income in 2021: Income Needs Exacerbated

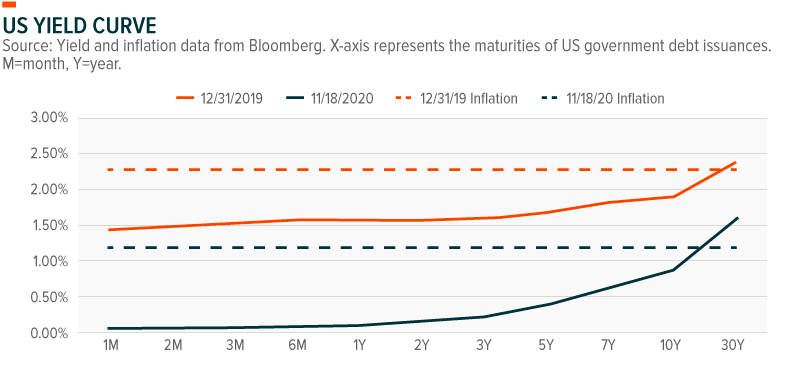

While the pandemic became an economic crisis due to stifling lockdown measures, central banks successfully fended off the treat of it becoming a financial crisis. The Fed and other major central banks implemented historic levels of monetary stimulus, slashing policy rates and infusing liquidity into financial markets via asset purchases. Specifically, the Fed added over US$6 trillion to its balance sheet, buying a range of fixed income securities, including treasuries, mortgage-backed securities (MBS), corporate bonds, and even fixed income exchange-traded funds (ETFs). As a result of these extraordinary monetary policies, asset prices around the world rallied and yields fell considerably across the yield curve.

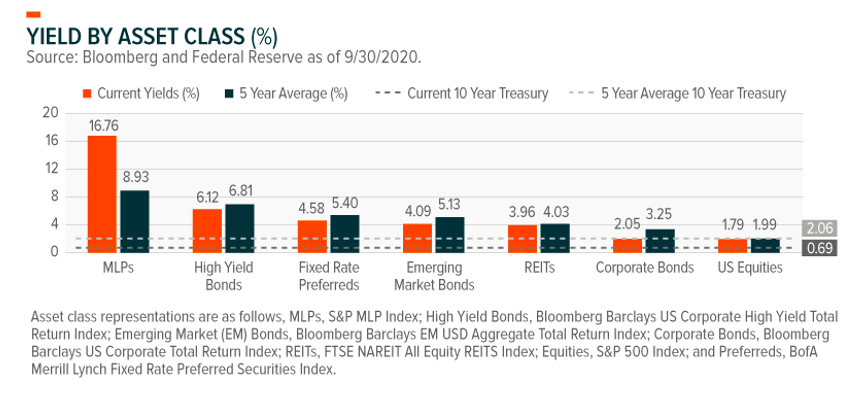

But for investors in 2021 these actions present several challenges. In the near term, income-seeking investors, such as retirees, have less income to work with. Most major income asset classes are yielding well below their longer-term averages. For investors to achieve a specific yield target, such as 4%, these lower yields often mean stretching risk tolerance into higher credit risk or longer duration areas of the market. In the medium to long term, concerns over rising interest rates and rising taxes weigh on investors’ minds.

Eventually, the Fed could raise rates if inflation begins to regularly exceed its 2% target, which would present a headwind for most income-oriented asset classes. Meanwhile, speculation of potentially higher taxes to fund the massive local, state, and federal deficits created by the pandemic could also affect a wide range of yield-focused securities.

Given the challenges and uncertainty facing income investors, we identify three areas that could play important roles in investor’s portfolios in 2021: Covered Calls, Preferreds, and Emerging Market Bonds.

Covered Calls

While volatility skyrocketed in early 2020, topping 80% across the Nasdaq 100, S&P 500, and Russell 2000, it ultimately tapered with the Cboe Volatility Index (VIX) settling to the low 20s by mid-December and averaging around 26% in Q4.13 But even as markets seemed relatively calm by year-end, this implied measure of volatility still stood much higher than 2019 figures. For comparison, the VIX averaged about 15% in 2019 and never hit 26% at the close.14

Elevated levels of volatility can often be perceived as higher risk, and therefore a negative for equities. But volatility can also be harnessed into an asset. Options premiums are priced based on expected volatility, with higher levels making options more expensive to buy and more rewarding to sell. Covered call strategies, where an investor buys stocks on an index and sells a call on that index, can therefore generate higher option premiums during periods of higher volatility. With a new administration in the White House, vaccine distribution challenges, and lofty equity valuations, we believe higher average volatility could continue well into 2021 and support allocations to covered call strategies.

Preferreds

Preferreds are junior on a company’s capital structure to traditional debt instruments. This means that, all else equal, if a company were to issue both senior bonds and preferred shares, the preferred shares would have higher credit risk and higher coupon payments. Preferred yield can look even more attractive on an after-tax basis. While bond and REIT income are taxed as ordinary income, preferred yield is often treated as qualified dividend income (QDI). This difference is potentially material, as ordinary income can be taxed at the highest marginal rate of 37%, while qualified dividends are taxed at a maximum of 23.8%. This difference could loom large as local, state, and federal government policy makers consider revising tax codes to reduce deficits in wake of the pandemic.

Preferred issuers are often investment grade banks, with 61% of the preferred market composed of financials issuers.15 Given their concentration in financials, the same factors that affect bank health, like default rates and balance sheet strength, frequently drive preferreds. Following the global financial crisis, regulators established new controls to mitigate the risk of major bankruptcies, such as increasing capital requirements. Additional precautions were instituted for the COVID crisis, with the Fed restricting banks from conducting share buybacks or increasing dividend payments. The European Central Bank even suggested banks stop paying common dividends altogether. But preferred coupons were exempt from these regulations and the credit-riskiness of banks appears on solid footing, as capital levels remain high.

EM Bonds

As the Fed signaled its lower for longer rate policy and odds of additional fiscal stimulus increased, the dollar weakened substantially. From June 30th to December 14th, the dollar fell by nearly 7%.16 A weak dollar tends to benefit USD-denominated debt issuers and commodity exporters. Emerging market (EM) bonds tend to sit at the intersection of both. Many EMs depend on high commodity prices to fund government activities. In addition, the high prevalence of USD-denominated EM debt means a weaker dollar helps EM governments and corporates afford their coupon payments.

The dollar could continue to weaken after a nearly uninterrupted decade-long rise following the financial crisis. Growing government debt, a commitment to low interest rates, and a global economic recovery could continue to weigh on the dollar, providing further support for EM debt.

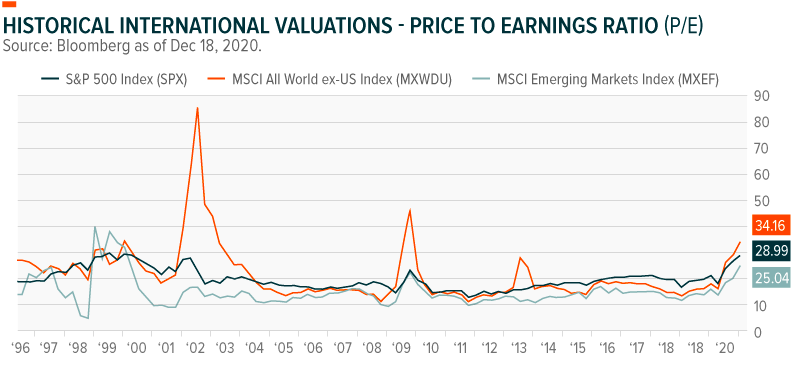

International Opportunities

Following essentially a decade-long bull run, US equity indexes are at or near all-time highs and touching valuations not seen since 1999. At the same time, continued economic weakness in the US, a ballooning federal deficit, and rock bottom interest rates for the foreseeable future, have many investors forecasting the US Dollar to continue weakening beyond its 10% fall in 2020. For many investors, these factors are pointing to renewed interest in foreign equity markets which feature pockets of lower valuations, strong economic growth, and appreciating currencies.

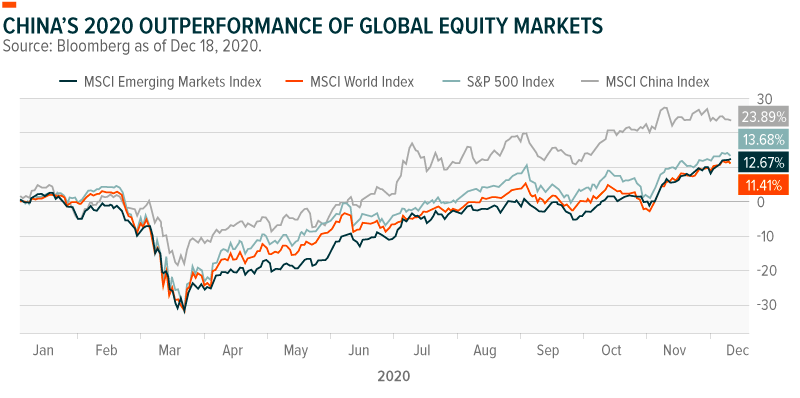

Despite the pandemic’s global reach, different approaches to containing the spread of the virus resulted in substantial economic divergence across countries and regions. Certain countries like China, and neighbouring countries in Asia, were able to contain the virus quickly, setting their economies on faster paths to recovery that are likely continue into 2021. But as vaccine distribution accelerates in the first half of the new year, these pandemic-driven divergences may narrow, and new factors will come into play. China’s global leadership, new policies in international trade, rebounding commodity prices, and an acceleration of internet- and consumer-driven retail segments are all likely to factor into country and regional growth in 2021.

Asia Shines

China Leading Asia Bulls: As the only major economy to boast an economic expansion in 2020, we expect China to lead robust growth in Asia in 2021. China swiftly and aggressively contained the COVID-19 pandemic, allowing the country to re-open much faster than the western world. As such, the Chinese economy not only recovered, but also returned to growth versus 2019’s pre-pandemic figures in key segments like industrial production and retail sales by August. With factories open, wages returned, and consumer confidence rebounded. During the peak of the pandemic, spending on stay-at-home discretionary goods and services, such as education and technology, ticked up. But later in the year, as confidence continued to grow and consumers became more fixated on on-screen appearance, spending on jewellery and cosmetics also began to rise. Equity market performance reflects the success of the Chinese economy and is closing the year up approximately 26% versus 13% in the US.17 More specifically within China, the Information Technology and Health Care sectors were the best performers this year, up approximately 64% and 55% this year, while the Consumer Discretionary and Communication Services sectors also boosted China’s performance.18

While China’s domestic containment of the virus has helped its economy recover, struggles to combat the virus outside of the country may drive further growth in early 2021. Many factories have been converted to meet higher global demand for personal protective equipment (PPE), a majority of which global markets import from China. In addition, China provides the world with approximately 80% of active pharmaceutical ingredients, which are likely to be used in certain vaccines and treatments, benefitting the country’s burgeoning health care sector.19

Developed Asia Recovery Opportunities: While China had the strongest recovery globally this year, we expect the sharpest GDP recoveries next year will be in the greater Asia region. Japan and Southeast Asia present compelling valuation and recovery opportunities. Despite recent spikes in infection rates, the virus has been relatively contained in Japan, Korean and Hong Kong. And at current valuations, they represent substantial discounts to US equities. US stocks trade at roughly 21.8 forward price-to-earnings (PE), while Japanese and Hong Kong equities are trading at 17.2 and 17.0 forward PE, respectively.20 Meanwhile, valuations are even cheaper in China at 15.0, in Korea at 12.9, and greater APAC ex-Japan which has a forward PE of 14.9.21 Despite these low valuations, the Asia region is expected to see 6% growth in 2021.

The region is also poised to benefit from greater regional trade. Just weeks ago, the Regional Comprehensive Economic Partnership (RCEP) was signed by regional powerhouses China, Japan, Korea, and Australia – as well as ASEAN member states Indonesia, Vietnam, Malaysia, Singapore, and Thailand. Collectively, these countries represent a third of global population and economic output. RCEP’s regional integration has the potential to generate US$209 billion annually to global incomes and contribute US$500 billion to world trade by 2030.22 Not only does the agreement have potential to boost global trade by lowering trade barriers across the region, it heralds in more dialogue and greater cooperation between China, Korea, and Japan which will be critical to working towards regional security in the long run.

Europe

A Continental Recovery: An early recovery from within Europe’s core markets help backstop the periphery’s prospects but presents an opportunity in and of itself with the broad markets expected to see 4% growth next year. Core and Peripheral European markets alike may benefit from additional fiscal stimulus provided by the EU recovery fund and the ECB in a way unlikely to be rivaled by smaller individual countries outside the region. And despite the fallout expected from its split with the UK over coming year, the Eurozone’s restored ties with the US under a friendlier Biden Administration could further boost its growth prospects.

As a core European leader, Germany is beginning to show signs of its own recovery and has been outperforming broader Europe since May, with German equities up +11.14% YTD versus broad Europe which is up +3.31% YTD.23 German manufacturing and industrial production are growing at record pace, propelled by Germany having the lowest infection and mortality rates on the continent and a general recovery in the global auto industry. As the global economy begins to reopen with vaccine distribution, Germany is likely to see an even greater surge in demand for manufacturing, which makes up roughly a fifth of its GDP.

European peripheral countries including Greece, Portugal, and Spain are also showing early signs of a recovery, with sovereign yields dropping below zero in Portugal and Spain for the first time in history in last few weeks of 2020. As peripheral countries in the Eurozone, all three markets are heavily reliant on the tourism industry which could see a dramatic rebound over the course of the next 18 months with the rollout of vaccines and an initial spike in pent-up travel demand.

Rest of World

Commodity Rebound Presents EM Opportunities: While emerging markets have broadly underperformed developed markets over the last decade, investors may want to reconsider allocations to these markets in 2021 as they climb out of their most recent COVID-induced slumps. In particular, commodity exporters look especially well positioned as oil prices and industrial metals, like copper, are beginning to rebound. As global economic activity picks up, demand for these commodities is likely to surge, creating upwards price pressure until supply is eventually brought back online. In addition, a weakening US dollar helps support higher commodity prices as they are often quoted in dollars. EMs including the UAE, Saudi Arabia, Kuwait, and Nigeria are exhibiting some gains already from recovering oil prices in the MENA and Africa regions, while Mexico and Chile in the Latam region could benefit from stabilization in the oil market and a rebound in copper.

Despite the global upheaval and economic distress caused by COVID-19, U.S. markets delivered another a record year, closing out nearly 10 years of global outperformance and leading to valuations nearing those of the late 90s. But as the U.S. economy comes to terms with an expanding deficit, persistently-low interest rates, and a likely weakening dollar in 2021, this could prompt investors to consider shifting into Asian, European, and commodity-driven Emerging Markets to take advantage of lower valuations, stronger forecasted economic growth, and appreciating currencies.

Conclusion

2020 did not go as planned, to say the least. The very foundation of our society and economy was shook as millions around the world lost their lives, loved ones, or livelihoods amid a devastating pandemic. Yet despite this bleak backdrop, several bright spots emerged that gives us confidence in our resilience. Scientists, doctors, and researchers around the world successfully developed cutting edge vaccines in record time that will not only facilitate a return to some sort of normalcy, but also potentially mitigate the risk of future pandemics. Disruptive technologies were quickly adopted across businesses, organisations, schools, and health providers to virtualise in-person experiences. Leaders across the world, from politicians and bureaucrats, to business heads and community organisers helped slow the spread virus and support those in need.

But the work is far from over. COVID-19 continues to spread while pharmaceutical companies race to produce billions of vaccine doses. Governments continue to contemplate new fiscal and monetary measures to support a weakened global economy. And newly established habits continue to solidify as structural changes in work and life and reshape our experiences.

While all may not go as planned, effective stimulus and rapid vaccine distribution establishes a clear path for a global societal and economic recovery in 2021. One that could conclude the COVID-19 pandemic, reopen the economy, and set the world on a new path influenced by the lessons learned over the last twelve months.

This document is not intended to be, or does not constitute, investment research