How To Read The Tech Sell-off

January is usually an interesting month in terms of positioning. In most Januarys over the past 14 years, retail investors plow into U.S. equities while institutional investors and hedge funds sell. We will wait and see what the data holds for 2022, but lots of news compounded by the unique circumstances surrounding the progression of the Covid pandemic has caused a rout in Technology stocks. Historically, Financials, Energy and Industrials have typically seen the biggest average inflows in January.1

While many companies are no longer facing mandatory shutdowns owing to regional regulations surrounding the world of Covid, many companies are struggling with staffing and the recent omicron surge will only compound labour shortages and perhaps exacerbate supply chain issues. Additionally, you now have a Fed that has to proactively fight inflation, not just by tapering, but by reducing their balance sheet and raising interest rates sooner than anticipated. And with the expectation of a reduction of the current rather large Fed balance sheet, long rates are rising with the 10-Year Treasury now about 1.89%2 as of this publication. The confluence of events of higher rates and tighter labor conditions are hurting growth stocks more so than value stocks. Growth companies rely on future growth and higher interest rates translates to future earnings being discounted at higher rates, combined with higher borrowing costs, the market expects lower margins. The most vulnerable growth companies are those with weaker balance sheets reliant on the whims of the capital markets.

Cash is king, bigger is better and tech should never be left for dead

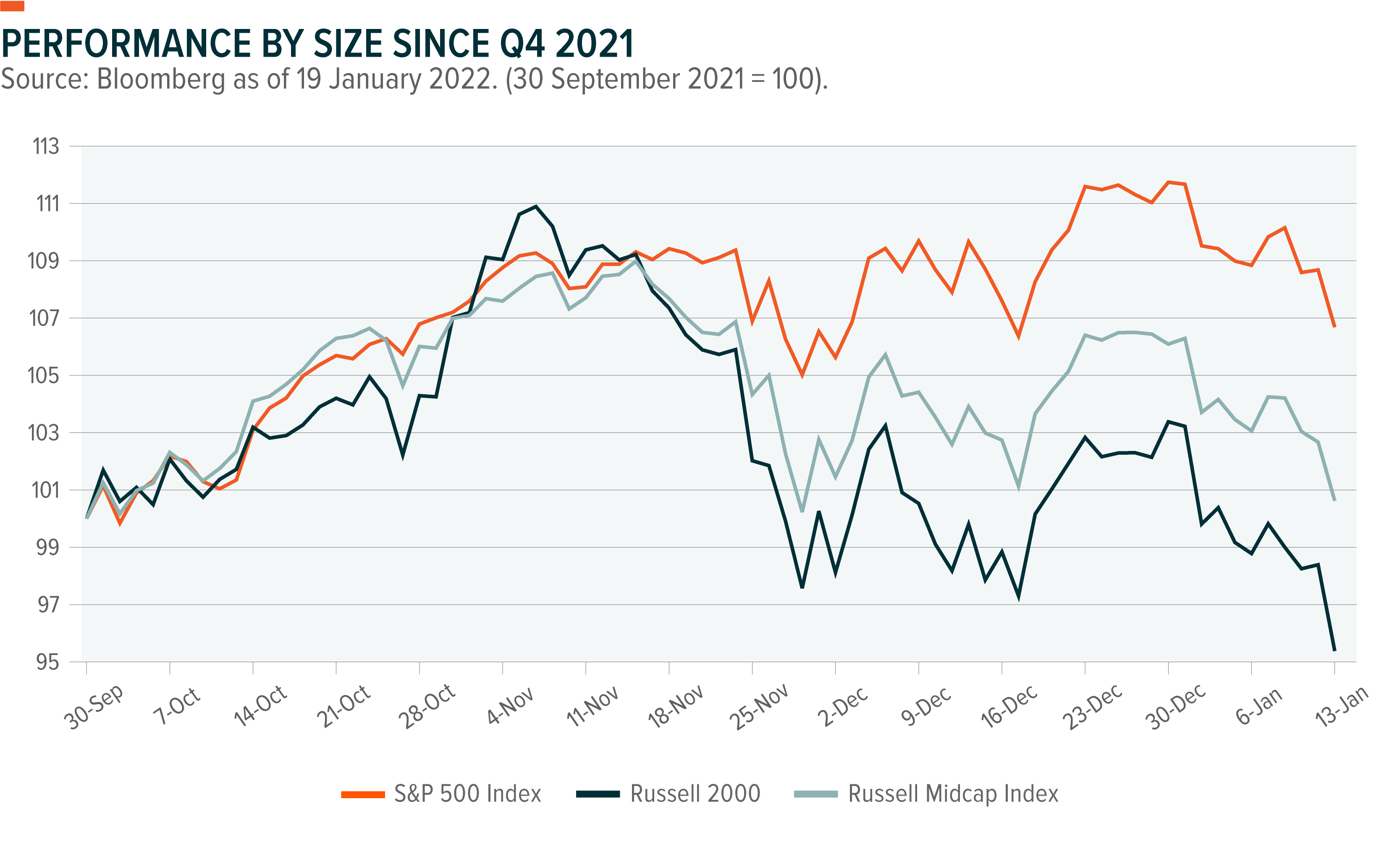

Growth stocks have come under pressure as bond yields climbed driven by expectations of a more hawkish policy environment. The Nasdaq lost 7.27%3 since the beginning of the year, while the MSCI ACWI Index lost 2.87%4, and the S&P500 lost 3.97%5 weighed down by Information Technology and Communication Services sectors.

The most established larger well capitalised technology companies, while will initially be caught up in a rotation out of technology, will have the most resiliency. Market-cap indexes, which are dominated by mega cap technology are able to navigate higher rates and the associated volatility. Conversely, equally weighted indices tend to be more exposed to lower market cap companies and will be forced to sell the winners and buy the losers upon rebalancing.

Without Information Technology, where would we be? While sector valuations are typically high and very high in certain subsets, the sector has generally reflected a strong ability to pass on pricing pressure while being less impacted by supply chain bottlenecks. We expect the semiconductor shortage to drag into 2022, while the demand for chips should remain elevated amid the global digital revolution. We expect to see themes like Lithium & Battery Tech benefitting from greater investment in chip design and manufacturing alongside attempts to reshore strategic components of the chip industry to domestic markets.

The Psychology of a sell-off

What the market loves is certainty and even when the known is known, that may not be enough. With the release of the December FOMC minutes, which were more hawkish than investors expected, the Fed acknowledged upside risks to inflation and the potential need for earlier hikes in policy rates and the Fed’s taper. Given the hawkish policy environment resulting from the inflationary backdrop, no doubt technology would sell-off. However, we expect the selloff in tech to abate as investors adjust to higher policy rates. Technology is integrated into our economy and the evolution of our economy will go unabated. We expect inflation data to improve in the latter part of 2022 (Omicron may cause a two-month shock exacerbating labour supply issues).

Positioning

Given the macroeconomic backdrop, and should the Covid-19 situation improve, we expect equity markets to be more selective in 2022 with a focus on valuations, fundamentals, and quality. Margins are expected to remain a key focal area into 2022 as industries that have pricing power should do better in an inflationary environment. With rising yields, we currently favor cyclical sectors with above average purchasing power. Financials, Industrials and Materials are the most positively correlated with rising real yields. These are cyclical sectors that benefit the most from improving economic growth and higher yields. Thus, themes that are naturally exposed to these sectors such as U.S. Infrastructure Development should benefit from these economic conditions.

Energy and Real Estate are two other areas investors may want to consider this year because business models in these sectors are often able to pass through inflation costs to customers. Global growth expectations could certainly slow towards the latter stages of 2022, resulting in lower equity returns than the levels seen in recent years. Themes like Data Center REITs could benefit from cyclical tailwinds on top of the structural transition to a more digital world.

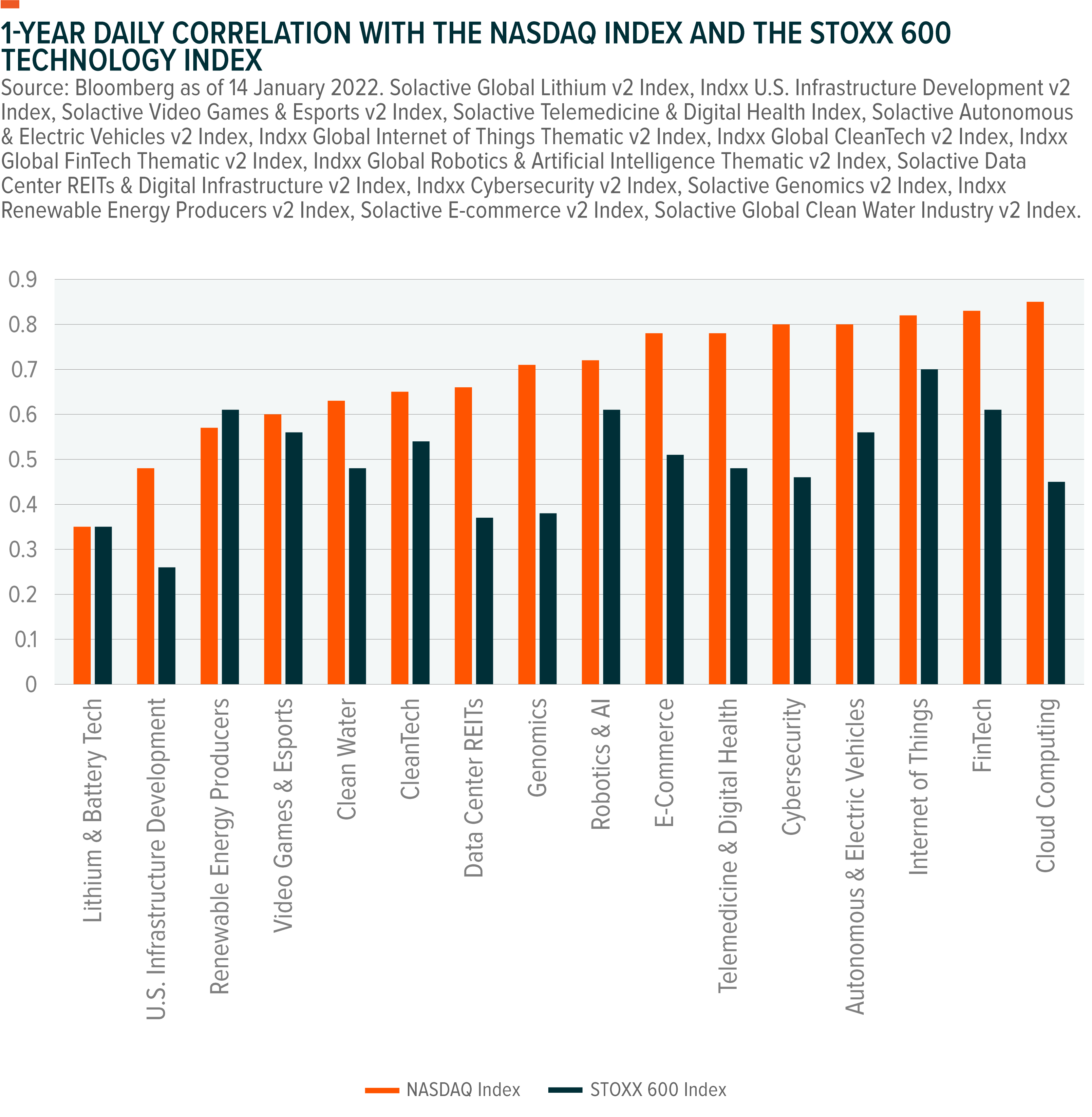

The story on tech is evolving, but in the short run, we do expect continued volatility as the market adjusts to higher interest rates (both policy and long rates). Certain disruptive technology themes are good diversifiers from broader tech exposures. Lithium & Battery Tech, Video Games & Esports, or Data Centers REITs have the lowest correlation with the broader Nasdaq index or Stoxx 600 Index. Besides, climate related themes or U.S. Infrastructure Development also provide diversification benefits.

This document is not intended to be, or does not constitute, investment research