Inflation Reduction Act and CHIPS Act Likely to Build More Momentum for U.S. Infrastructure

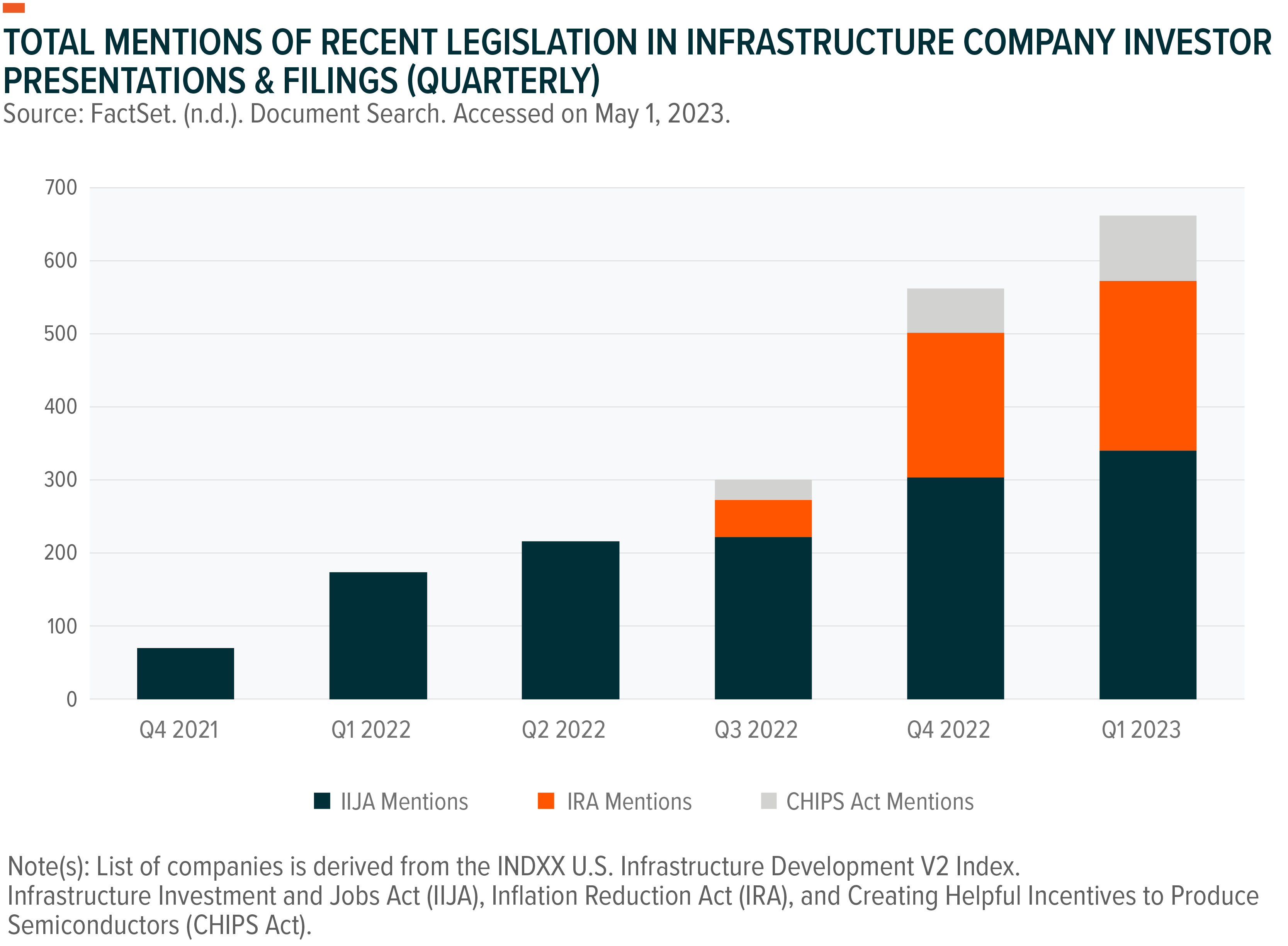

Since its passage in late 2021, the Infrastructure Investment and Jobs Act (IIJA) has been hailed as a major step toward rebuilding America’s infrastructure. In our view, the IIJA is indeed a generational investment that has only just begun to impact companies in the infrastructure space. Perhaps because of the IIJA’s notoriety, discourse on how other recent legislation might contribute to U.S. infrastructure seems lacking. The Inflation Reduction Act (IRA) and Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act are designed to bolster U.S. competitiveness in disruptive technologies such as renewable energy, batteries, and electric vehicles (EVs), as well as semiconductors. Both packages are likely to encourage build-out of manufacturing capacity, distribution networks, and other domestic supply chain assets.

Key Takeaways

- The IRA and CHIPS Act provide various production and investment incentives for disruptive technologies, which could increase demand for infrastructure development in the United States.

- Companies across the U.S. infrastructure space increasingly highlight the IRA and CHIPS Act as likely sources of future tailwinds.

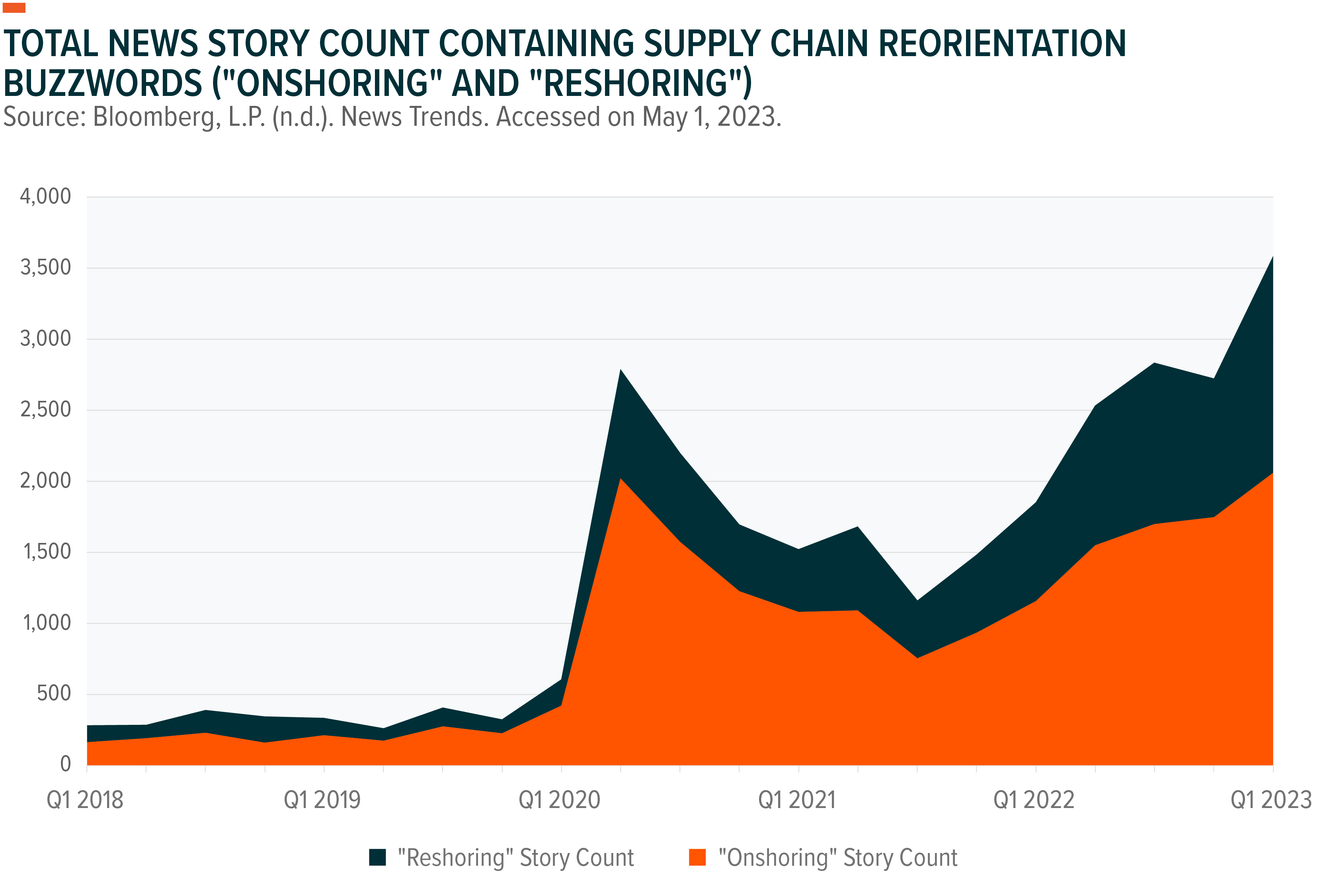

- Recent legislation reflects a broader trend of bringing supply chains back to the United States.

The IRA and CHIPS Act Necessitate New Construction

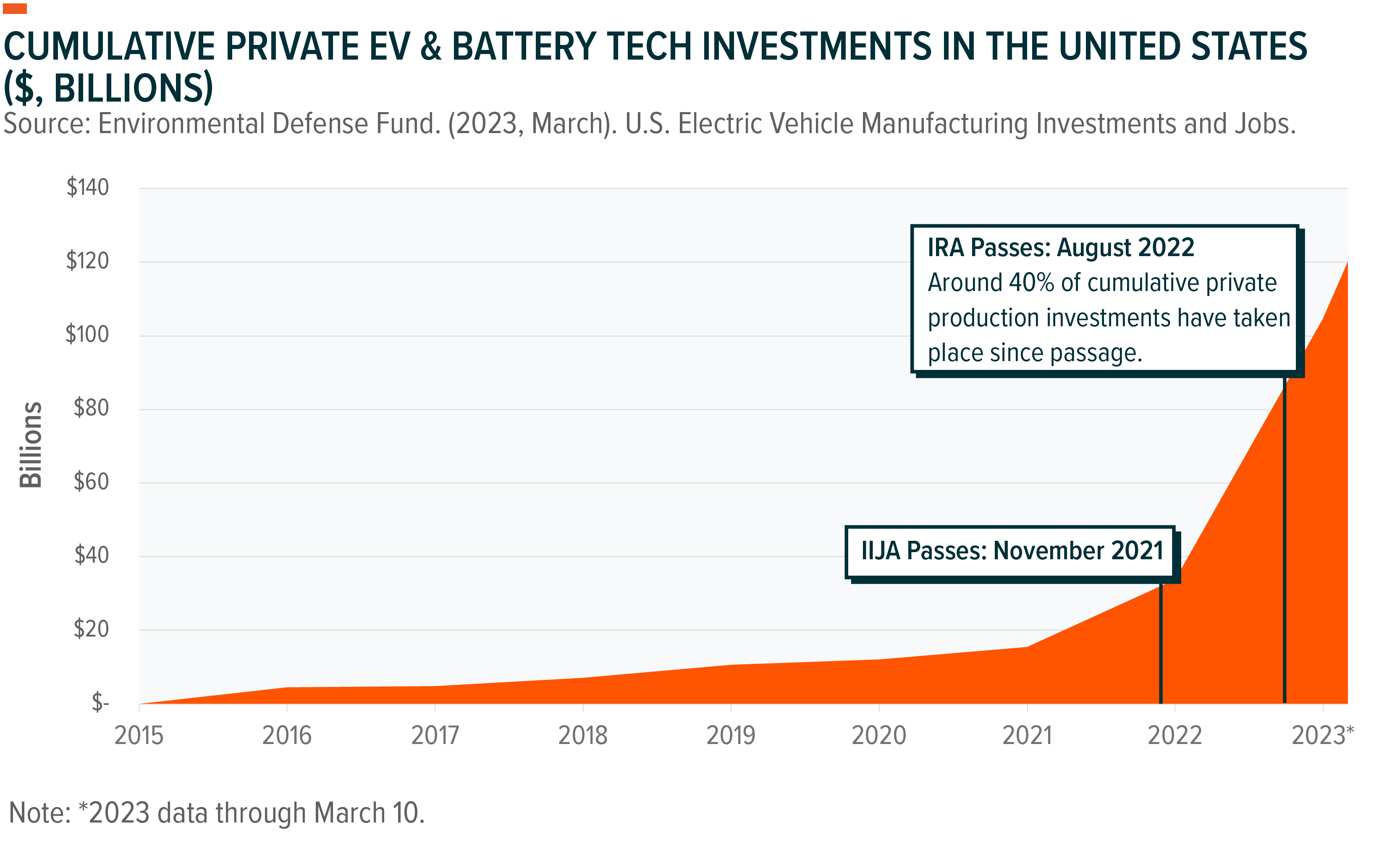

The Inflation Reduction Act is the United States’ largest-ever investment in combatting climate change, providing around $370 billion to bolster sustainability efforts, increase energy security, and lower energy costs.1 The bill uses tax credits as the main mechanism to attract clean tech and renewable energy manufacturing to the United States, and there’s evidence that the strategy is working.

According to the White House, since the IRA’s passage in August 2022, “at least $45 billion in private-sector investment has been announced across the U.S. clean vehicle and battery supply chain.”2 An estimated $150 billion has poured into the country for utility-scale clean energy initiatives, more than the total spent between 2017 and 2021.3 Some of these investments were in the works before the bill’s passage, but in our view the IRA is largely responsible for the deluge of domestic spending on clean tech investments in recent months.

Besides production and manufacturing incentives, IRA investment can trickle down to infrastructure companies in several ways. For example, to accommodate increasing renewable energy capacity, the grid requires upgrades. Renewable energy sources such as solar and wind, are intermittent and dependent on the availability of natural resources. As a result, transmission infrastructure and energy storage capacity are critical to manage fluctuations in output. The Department of Energy (DoE) estimates that electricity transmission capacity must expand 60% by 2030 to keep the Biden Administration’s goal of 100% clean electricity by 2035 within reach.4 Building thousands of miles of these transmission lines could stimulate demand across the infrastructure value chain.

Another way for IRA investment to flow into the infrastructure sector is that the bill supports energy efficiency measures that could catalyse demand for retrofitting existing structures to comply with new and future standards.

The CHIPS Act incentivises the construction of new domestic semiconductor manufacturing. The bill doles out $50 billion to boost U.S. competitiveness in semiconductors, including $39 billion in direct spending on chip production.5 Compared to the IIJA and IRA, the CHIPS Act is in the earliest stages of implementation, as applications for funding opened in March 2023. However, since its passage in August 2022, over $210 billion in private investments toward semiconductor projects have been announced in 20 states according to the Semiconductor Industry Association.6

Infrastructure Spending a Big Topic of Discussion on Earnings Calls

Management guidance from U.S. infrastructure companies continues to point to late 2023 for when the benefits from the IIJA, IRA, and CHIPS Act are likely to begin in earnest. Although the IIJA, IRA, and CHIPS Act remain in their early stages, corporate mentions have intensified in recent quarters.

Jacobs Solutions (Construction and Engineering):7 During the FQ1 2023 earnings call, management predicted that funding from the IIJA, IRA, and CHIPS Act could hit full strength by the end of 2023, with maximum funding overlap to continue for 4–5 consecutive quarters.

Sempra Energy (Utility/Construction and Engineering):8,9 During the Q3 2022 earnings call, management said that the IRA’s emphasis on electrifying the grid could act as a “major driver” of demand for transmission and distribution. On the Q1 2023 earnings call, management reiterated the demand outlook for transmission and distribution, and expressed a desire to participate in other initiatives funded by the bills, such as hydrogen hubs and energy storage projects.

United Rentals (Equipment):10, 11 During the Q4 2022 earnings call, management identified the IIJA, IRA, CHIPS Act, and general onshoring trends as likely drivers of demand. On the Q1 2023 earnings call, management suggested that spending has begun to make an impact but that most tailwinds related to legislation were ahead.

Rockwell Automation (Equipment):12 During the FQ2 2023 earnings call, management noted that the outlook for the company’s EV & battery segment and its semiconductor operations looked strong, due in part to recent legislation. Management explained that growth in these industries could boost the use cases for automation and relevant equipment.

Nucor (Materials):13 During the Q1 2023 earnings call, management estimated that, combined, the IIJA, IRA, and CHIPS Act “have the potential to generate up to 8 million tons of incremental steel demand per year over the balance of this decade.”

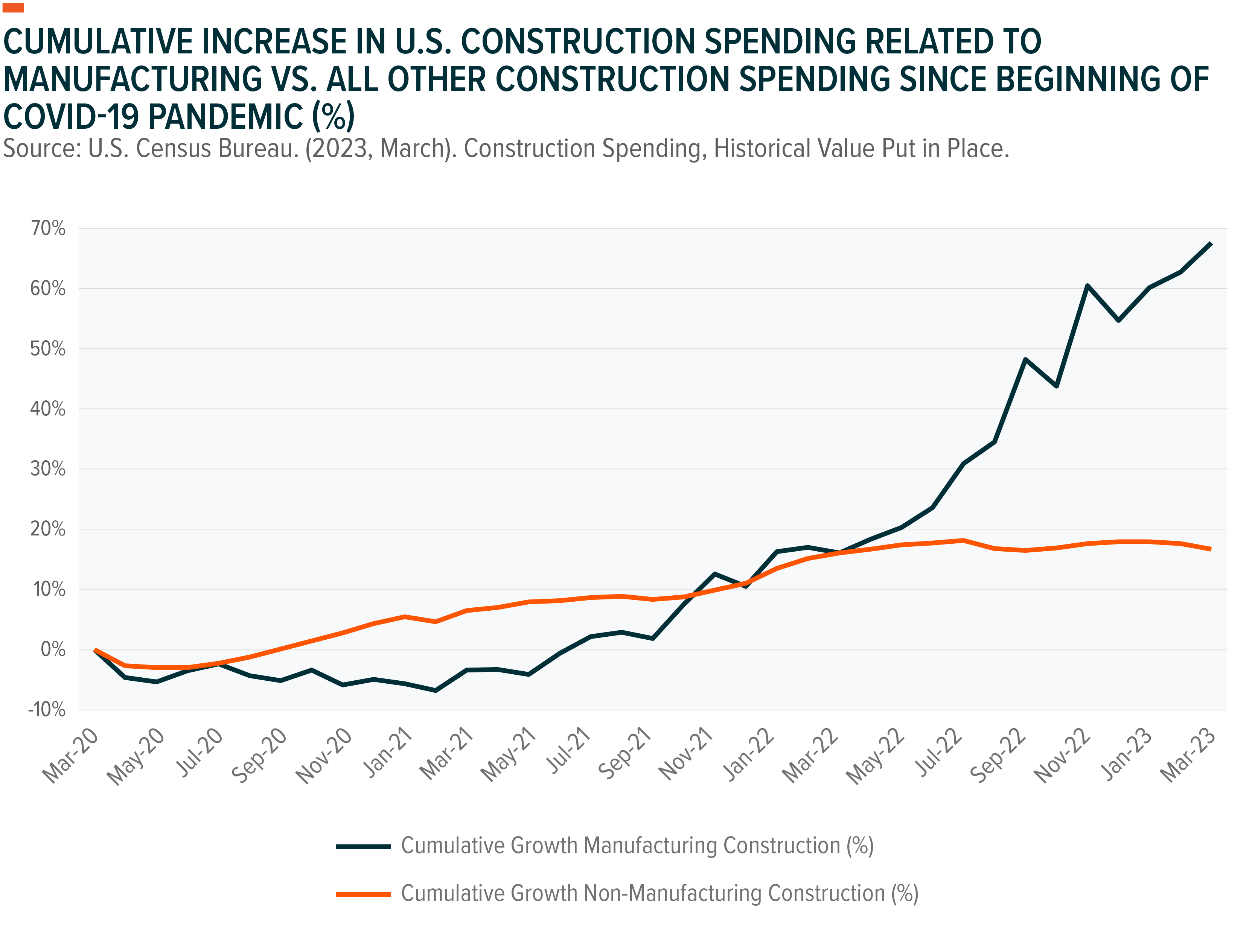

Supply Chain Reorientation Likely to Keep Manufacturing Spending High

The COVID-19 pandemic, Russia’s invasion of Ukraine, and the fallout from these black swan events have U.S. companies reconsidering their decentralised supply chains and looking for security in domestic capacity. Supply chain localisation is an increasingly common topic in corporate presentations and news stories in the United States. By the end of Q1 2023, the prevalence of supply chain reorientation buzzwords such as “reshoring” and “onshoring” in news stories increased by almost 9 times relative to pre-pandemic levels.14

It’s not just talk, as increased construction activity related to manufacturing is already an ongoing, multiyear trend. As of March 2023, construction spending on manufacturing was nearly 70% higher cumulatively compared to the beginning of the pandemic, about 4x the pace of growth in other construction activity.15 Furthermore, total U.S. construction spending related to manufacturing reached $108 billion in 2022, an all-time high.16

Conclusion: Multiple Opportunities for the U.S. Infrastructure Space

Conclusion: Multiple Opportunities for the U.S. Infrastructure Space

The IIJA, IRA, and CHIPS Act add to already structurally strong demand for infrastructure development in the United States. The IIJA sets up to provide a generational boost to construction demand, and there could be overlap with IRA and CHIPS Act measures that look to reconstitute U.S. disruptive technology supply chains. With this historical legislative support, companies across the U.S. infrastructure space are poised to benefit over the next several years.

This document is not intended to be, or does not constitute, investment research