Infrastructure Investments to Spur Europe’s Digital and Green Transition

For the first time in history, all the world’s major economies have initiatives ready that can support digital innovation and progress toward a net zero economy. This structural shift will profoundly change the way we work, live, and invest. A global technological revolution with sustainability a major focus is no longer seen as a black swan event, but rather a near-term reality with the potential to disrupt traditional sectors. This blog focuses on Europe’s digital and clean transition and details the themes that will play a pivotal role in building economic resilience across the region.

Key Takeaways

- Unprecedented fiscal stimulus has the potential to create powerful structural changes across Europe.

- Themes that will likely play a pivotal role in Europe’s twin digital and clean transition include Renewable Energy, Cleantech, and Connectivity.

- Themes that will likely benefit the most from the transition include Autonomous & Electrical Vehicles, Telemedicine & Digital Health, Cybersecurity, Cloud Computing, and Robotics & Artificial Intelligence (AI).

Europe has unveiled multiple fiscal plans to support the COVID recovery and its green and digital transition. Combined, the Multiannual Financial Framework (MFF) for 2021–2027 and the Next GenerationEU (NGEU) represent about €2 trillion of spending over the next seven years.1 One third of these investments will finance the European Green Deal, an ambitious project that aims for the European Union (EU) to be carbon neutral by 2050. Achieving this goal requires a major overhaul of European infrastructure, spanning energy production, food consumption, transport, manufacturing, and construction.2

Investors can find cyclical exposure to the infrastructure development across Europe, and in the US, through the Industrial and Materials sectors. However, these broad sectors provide exposure to companies that have significant infrastructure capital expenditure, rather than companies that can derive additional revenues from increased spending on publicly and privately funded infrastructure projects.

Companies like these are involved in the construction and engineering of infrastructure projects, raw materials production, composites and products used in building infrastructure, heavy equipment production and distribution, and the transportation of materials. In addition, multinational companies such as US Industrial Caterpillar derive more than half of their revenue outside of the US. As a result, these companies are less likely to benefit from specific macro level trends like the US infrastructure bill.3

European Infrastructure Today: Regional Gaps Evident

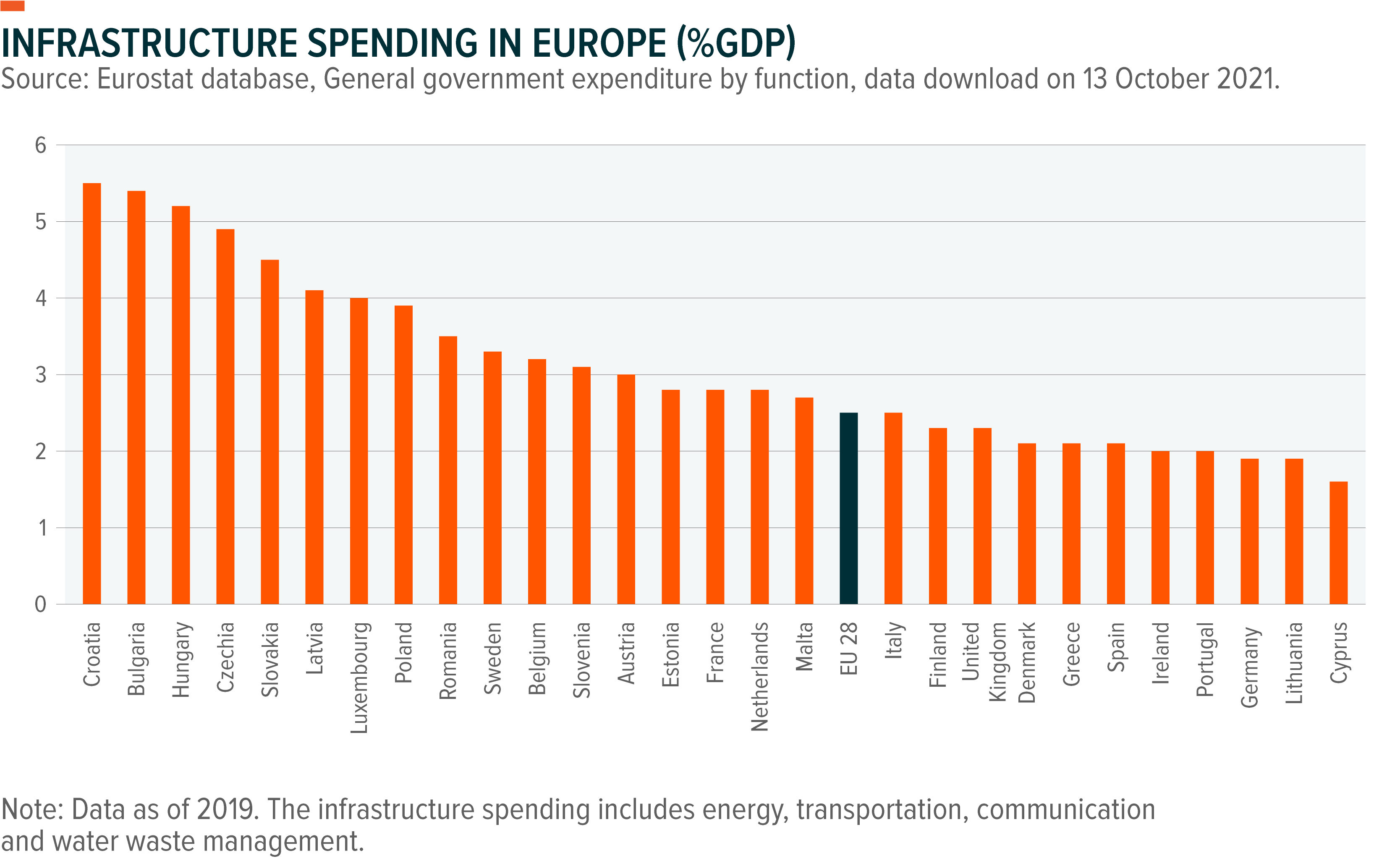

Currently, annual investment in European Union (EU) infrastructure is at 2.5% of GDP, which is 20% below its pre-2008 Global Financial Crisis level.4 The European Investment Bank (EIB) estimates that European infrastructure requires roughly 4.7% of the EU’s GDP annually to bring energy, transport, water and sanitation, and telecom services up to modern standards.5 Compared to the global infrastructure investment needs that range between 3.9% to 9.7% of GDP annually, the EU’s are on the lower end of the spectrum. However, several regional disparities within the EU potentially mask its actual needs. In recent years, Western European countries’ investments in infrastructure have been relatively lower than those in Central and Eastern Europe.6 Persistent underinvestment in infrastructure for much longer could have long-term negative impacts on potential growth and productivity, which makes these fiscal plans so consequential.

Ecological Transition: Steps Taken Toward Carbon Neutrality

At the centre of Europe’s green plans is the European Commission (EC). It intends to reduce greenhouse gas emissions by supporting industries within the energy and ecological transition sectors, such as CleanTech and Renewable Energy. The President of the EC, Ursula Von der Leyen, insists on “building a Green Europe, which protects our climate and our environment, and which creates sustainable jobs.”7

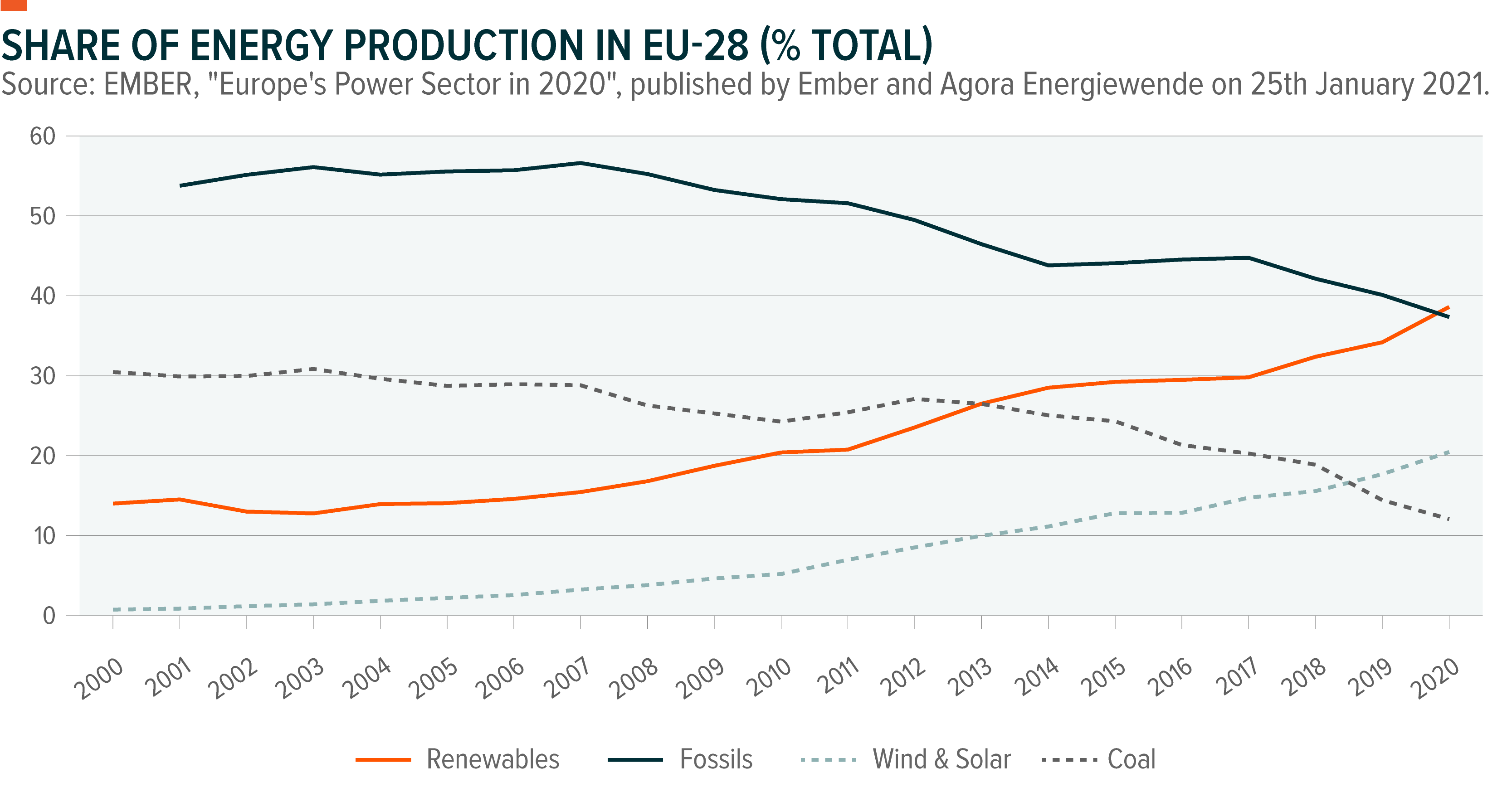

In 2020, Europe’s green transition achieved an important milestone. For the first time ever, renewables beat fossil fuel power plants for the most share of electricity produced, 38% to 37%.8 Germany, Spain and the UK led the way. The electricity generated by wind and solar rose 9% and 15%, respectively, while bioenergy and hydro generation growth stalled. Wind and solar generation must nearly triple from 38 terawatt-hours (TWh) per year in 2020 to 100 TWh per year to reach Europe’s 2030 green deal targets.9

Thirty-seven percent of the €724bn Recovery and Resilience Facility, the centrepiece of the NGEU, or about €266bn, will be allocated to climate change initiatives aligned with the Paris Climate Accords. The goal is to achieve carbon neutrality by 2050.10

The key areas of investment include:11

- Clean technologies and renewables

- Energy efficiency of buildings

- Sustainable transport and charging stations

To prevent greenwashing, a marketing technique that makes a company seem greener than it actually is, the EC implemented a taxonomy in November 2020 to classify economic activities according to their ecological impact. It also uses this taxonomy to direct investments towards projects it approves as “sustainable.” For example, the EC green label introduces the limit of 100 grams of CO2 emissions per kilowatt-hour, which a transitional energy like natural gas exceeds.12

However, nuclear energy could receive the green label with the support of many nuclear-powered countries, including France. In addition to being carbon-neutral, nuclear energy could protect European consumers from rising gas prices.13 Nuclear power suffers from a poor reputation, but it emits less carbon than fossil fuels and even solar power because its only direct emission is water vapour from a plant’s cooling system. Under the current taxonomy, nuclear energy received the “does not harm” label, which means that it is not yet eligible for investments with lower tax rates. The EC is expected to update its list of climate-friendly energy sources by year-end. If it deems nuclear green, it could trigger increased uranium demand from the EU, giving the nuclear sector a competitive advantage in green finance.

Digital Transition: People, Competitiveness, and Sustainability

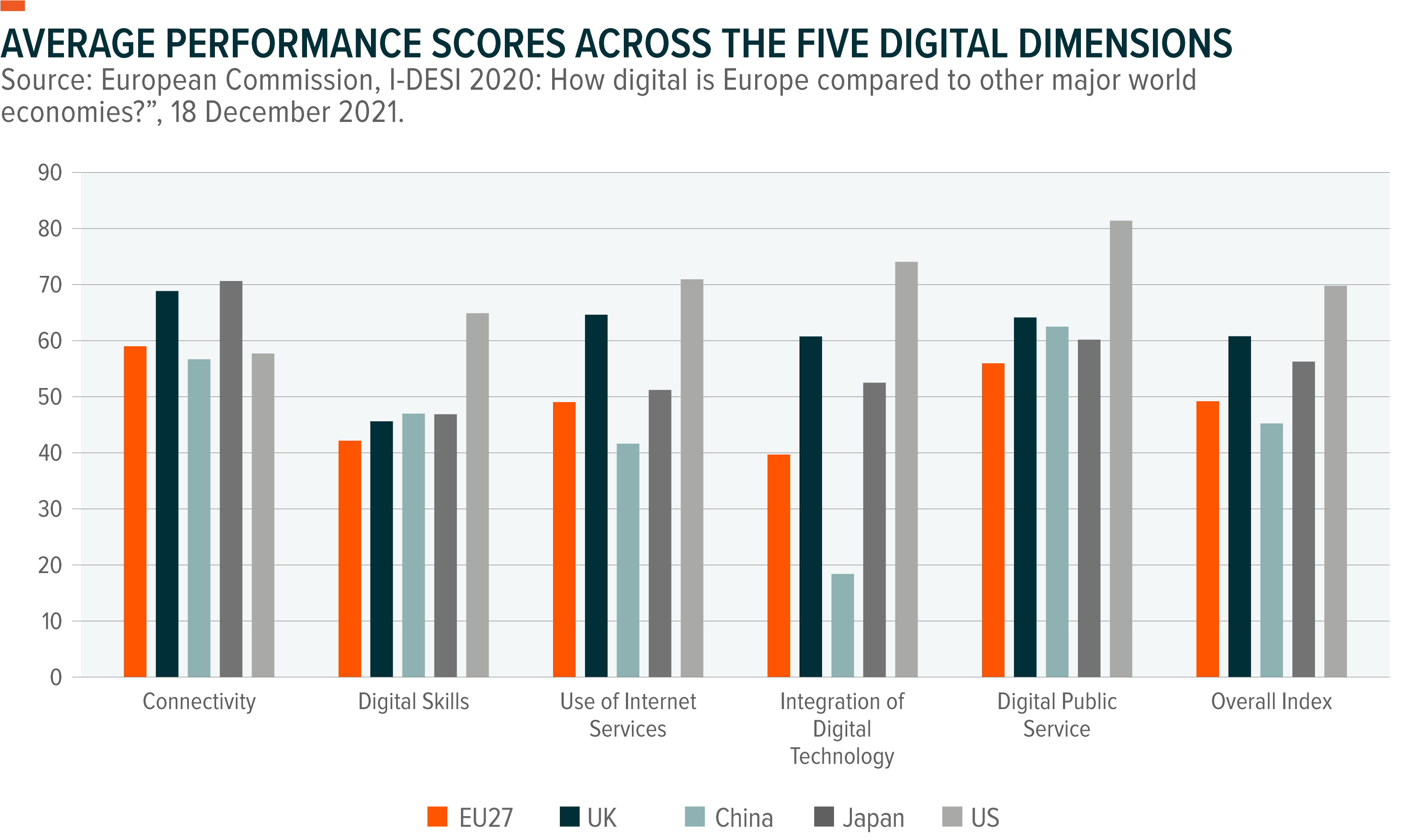

The International Digital Economy and Society Index (I-DESI) measures the digital performance of the EU’s 27 member states compared to other major countries around the world. Measures include connectivity, digital skills, use of the internet, integration of digital technology, and digital public services.14 A 2020 study by the EC concluded that the digital economy among the 27 EU is smaller than that of the US, Japan and the UK.

However, countries like the Netherlands, Denmark and Finland are on par with the US in terms of total digital advancement. The US outperformed its global counterparts across all categories except for connectivity. In region, most Eastern European countries lagged their Western European counterparts. In terms of connectivity, digital public services, and digital skills, the EU 27 compares well with non-EU countries. On integration of digital technology, the EU 27 average is below that of the US, Japan, and the UK.

At least 20% of the Recovery and Resilience Facility, or about €145bn, will be allocated to support the digital transition.15 The EU is also pursuing its objective to become a global role model for the digital economy by developing international standards.

The key areas of investment include:16

- Enhanced connectivity via broadband services expansion

- Digitalisation of public administration

- Data cloud capacities and sustainable processors

- A reskilled and upskilled workforce via education and training

Europe’s digital strategy has three main pillars: people, competitiveness, and sustainability.

- People: Innovation can have disruptive effects on society, both positive and negative. Policies and investments in digital skills, cybersecurity including fighting online disinformation, and increased regulation of AI can help manage the disruption and ensure that it doesn’t infringe on people’s rights. Large-scale investments to increase connectivity will reverberate across all sectors in Europe and affect people directly, including their healthcare. For example, the creation of the European Health Data Space is part of the EC’s Commission 2019–2025 initiative that will promote a connected system of electronic health records and genomics data in order to improve and modernise research, diagnostics, and treatments.17

- Competitiveness: With the Digital Services Act, the EU is creating a regulatory environment for digital economic activities that could attract innovative businesses and increase competition in the related industries.18 This legal backdrop could spur private investments in regional digital companies across all sectors. From an investment standpoint, investors may adopt a forward-looking approach to avoid being disrupted, as some innovative companies are likely to be underrepresented in traditional sectors. Companies that have been successful historically might not be the ones leading Europe’s transition. EU firms continue to adopt digital technologies, but they have yet to close the gap with the US. And in 2020, more than a third of European companies still had yet to adopt any new digital technologies, compared with 27% in the US.19 Among all sectors, European Construction and Services sectors are lagging the most.20

- Sustainability: Technology is at the core of the EU’s strategy to achieve carbon neutrality by 2050. The EU is likely to invest in sustainable production of components that enable its digital transition. Specifically, the EU wants to become self-sufficient in two critical areas: semiconductors and rare-earth materials.21 Semiconductors are integral to the production of clean technologies in solar panels, wind turbines, electric vehicles, energy-efficient lighting, and 5G networks. The EC aims to increase EU chip production to 20% of world supply by 2030.22

The EC has also worked with partners in the automotive, renewable energy, defence, and aerospace sectors to create a list of critical raw materials (CRMs). Securing a sustainable supply of these CRMs will be essential to the European Green Deal and supporting economic circularity, which is when products, materials, and energy stay in economic systems for extended periods.

Themes Likely to Benefit from Europe’s Twin Transition

These long-term infrastructure initiatives are likely to result in an overhaul of Europe’s physical structures, transportation, and next-generation projects like clean energy and digital infrastructure. The initiatives will likely require extensive raw materials, including aluminium for construction and transportation; cement, a key ingredient for making concrete; copper for electrification; and lithium for energy storage. Infrastructure investments typically have a long duration and provide opportunities for portfolio diversification because of the low correlation of returns with other assets.

Further downstream, companies exposed to physical infrastructure upgrades and clean energy capacity build-outs are likely to benefit from increased investment, including companies involved in construction and engineering, heavy equipment production, and manufacturing components in clean tech value chain. In addition, companies involved in the data and connectivity value chains should benefit from efforts to expand digital infrastructure.

The massive fiscal spending will likely boost demand in the short term, but more importantly, it will provide the perfect backdrop for the adoption of other disruptive technologies over the longer term.

Spending on natural resources and the environment from the MFF for 2021–2027 and the NGEU is expected to total €420bn over the next seven years.23 Spending on digital infrastructure from the MFF and the NGEU is expected to total €161bn over the next seven years.24

Themes poised to benefit from Europe’s ecological transition:

The EU Recovery and Resilience Facility allocates €266bn to climate-change initiatives.25

- Renewable Energy and Cleantech

- Wind and Solar

- Hydrogen

- AgTech & Food

Themes poised to benefit from Europe’s ecological transition:

The €21bn Connecting Europe Facility targets investments in Europe’s transport, energy, and digital infrastructure networks.26

- Autonomous & Electrical Vehicles

- Internet of Things

- 5G & Connectivity

The €8bn Digital Europe programme will support the strengthening of digital capacities for high-performance computing, AI, and cybersecurity, along with advanced digital skills and the accelerated adoption and best use of digital technologies.27

- E-Commerce

- Cloud computing

- Cybersecurity

- Data Centres

- Digital content

- Robotics and AI

- Fintech

The €86bn Horizon Europe funding programme for research and innovation will promote research in climate change, healthcare, and technologies to improve resilience. Europe is building on recent momentum to continue digitalising healthcare. The European Programme of Work for 2020–2025, called United Action for Better Health, sets priorities for the future of healthcare in Europe and identifies digital health as key to realising this vision. As part of its COVID response, the EU also created the €5bn EU4Health Programme to continue Horizon 2020’s work.28

- Genomics

- Telemedicine & Digital Health

Conclusion

Unprecedented fiscal stimulus will pave the way for Europe to upgrade its physical infrastructure, increase its clean energy capacity, and deploy large-scale connectivity to support its efforts to expand digital infrastructure. The US and China have similar ambitions about innovation, resilience, economic circularity, and climate-friendly policies. Investing in digital and green transitions through a thematic lens means targeting companies poised to directly benefit from the materialisation of these global themes, independently of any geographic or sector allocation.

This document is not intended to be, or does not constitute, investment research