Digital Transition: The Opportunity in Robotics & Artificial Intelligence

Technological advancements are enabling robotics and artificial intelligence (AI) to play an increasingly impactful role in a variety of industries and in our daily lives.

What Are Robotics and AI?

Robotics is a term for a mechanical device designed to perform an operation or task. These engineering feats are increasingly joined by advancements in software, which allow computers to work, learn, and problem-solve- an area of computer science called artificial intelligence. Together, these technologies are revolutionising the way we complete tasks, analyse data, and make decisions.

Many don’t realise just how little human oversight is required of today’s most advanced robots. One Japanese factory has been running in “lights out” mode for more than 15 years, meaning there are no human factory workers.1 Automated plants like this are capable of manufacturing everything from electric razors to even other robots. In addition, breakthroughs in AI allow computers to perform complex tasks by drawing on various data sets and inputs. For example, IBM’s Watson computer is able to generate sports highlight reels by analysing crowd noises and player gestures.2 Joining the mechanical abilities of robotics with the intelligence of AI has resulted in machines capable of cleaning, cooking, driving, and caretaking among other human-like tasks.

What Are The Drivers of Growth Within Robotics and AI?

Robots are getting smarter, cheaper, and more dexterous, helping to push adoption of robotics across multiple industries.

- The need for automation and AI is higher than ever. For the first time, job openings in the US outnumber people looking for jobs. Robotics is a potential solution for more industries today, including the Robotic Process Automation’s (RPA) impact on the services sector as well as automation in manufacturing. Further, companies that once avoided robotics due to low labor costs are often finding automation more attractive as wages rise and populations age. For example, wages in China increased 120% between 2010 and 2019, which hurts the country’s competitiveness in manufacturing compared to less developed nations.3

- Robotics can help counter tariffs. In a globally integrated supply chain, labour needs are often outsourced to low cost countries. Yet tariffs and other protectionist policies threaten this system, leading to higher costs of offshoring. Companies that face risks associated with these policies are likely to consider new processes that can reduce costs regardless of geography. Today, declining costs of technology and the growth of the robotics as a service (RaaS) model presents alternative solutions with the potential to offset the negative impacts from tariffs is through continued automation.

- Governments pushing for re-shoring through automation. Strategic policy initiatives like Made in China 2025 aim to improve the competitiveness of Chinese companies though automation. As part of its strategy, the government’s Robotic Industry Development Plan targets robot density of 150 by 2020.4 Similarly, in the US, robotics and AI are finally getting production costs down to levels similar to low-cost manufacturing countries, presenting the possibility of reinvigorating the US’s domestic manufacturing sector.

Yet macroeconomics, demographics and government policies are also driving a growing interest in robotics. Robotics and AI are addressing a host of problems characterised by an aging workforce, rising labour costs and quality improvement needs.

The demographics of the world are changing rapidly on two fronts. First, a greater portion of the population is entering retirement age while birthrates are plummeting. According to the World Health Organization, “Between 2015 and 2050, the proportion of the world’s population over 60 years will nearly double from 12% to 22%.”5 With a shortage of births to replace these retired workers, many countries are facing the prospect of shrinking workforces. Japan’s workforce, for example, is expected to decline to roughly half its peak level by 2060.6

Even adequate labour resources are not necessarily enough to sustain growth. Labour costs are expensive and rising, which is a particularly challenging prospect for competitive industries like manufacturing. While in recent decades many businesses turned to offshoring these jobs, many companies are finding robots to be even more cost efficient. It is estimated that outsourcing work to lower cost countries could save 15-30%, whereas automating tasks with robotics could save 40-75%.7

Lastly, robots and AI are drivers of improved productivity. Engaging these technologies can yield faster, higher quality outputs without cognitive and physical problems associated with fatigue or malpractice. The adoption of robotics in places like Germany, South Korea, China, Japan, and the U.S. is expected to boost productivity by up to 30% by just 2025.8

Which Sectors Are Being Disrupted?

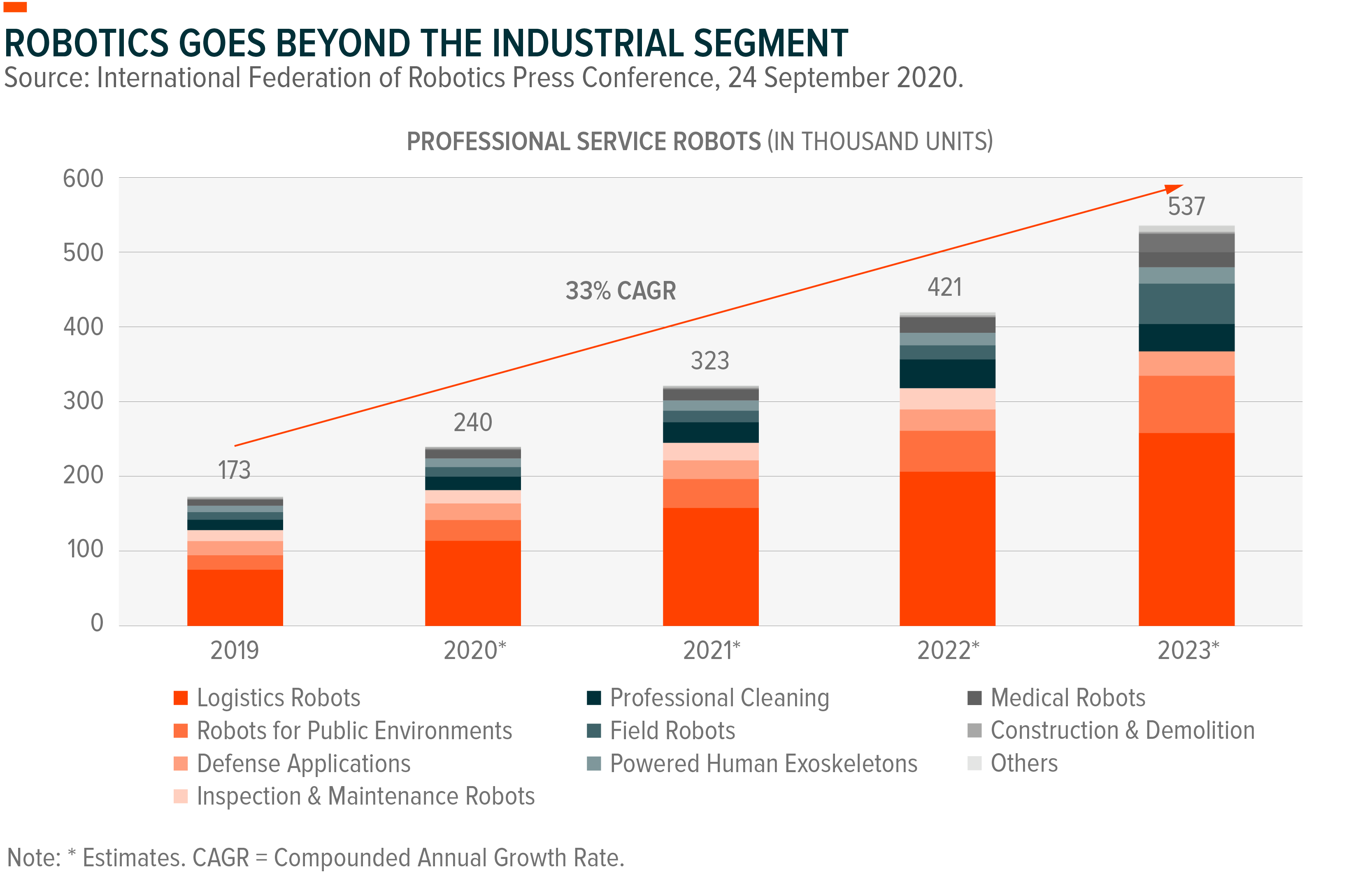

Nearly every industry can find ways to incorporate these innovative technologies in an effort to improve output or reduce costs. The global robotics technology market size was valued at US$62.75 billion in 2019, and is projected to reach US$189.36 billion by 2027.9 The AI Robots market is expected to represent US$12 billion by 2024.10

The industries that are at the forefront of this adoption include:

Manufacturing: Robots have a long history in manufacturing. Today, they can do more than ever, including vision-recognition and motion detection capabilities, which broaden their utility to both think and do. As a result, the global industrial robots market is expected to reach US$66.5 billion by 2027.11

Military And Defense: Drones are reducing the need to put soldiers in danger in major conflict zones. In addition, robots used for transportation, search and rescue, and reconnaissance are all seeing increased adoption.

Medicine: Robots and AI are making headway in administering procedures on patients and diagnosing illnesses. In one test Watson recommended the same treatment as human doctors 99% of the time. Yet, in 30% of cases, the AI supercomputer offered treatments ignored by human doctors, often because they had not read the research papers Watson analysed.12

Transportation: Autonomous cars are already appearing on streets. By 2030 autonomous cars could account for up to 15% of passenger vehicles sold worldwide.13

Agriculture: AI and robots are equipping farmers with new ways to analyse soil, irrigation, and crop yields. This data can make more efficient use of farmland while boosting harvests. By 2025, the global agricultural robots market is expected to exceed US$20.6 billion.14

Finance: The financial sector is at the fore of advancements in AI as Financial Technology (FinTech) such as the introduction of robo-advisors which can create and maintain customised portfolios for investors.

What Types of Companies Stand to Benefit The Most?

Just as computers and the internet became ubiquitous tools for virtually every industry, it is expected that AI and robotics will become equally as commonplace. The companies that stand to benefit the most from this development involve companies in a range of industries and countries that are at the forefront of developing or implementing these technologies. Such companies include those developing industrial manufacturing robots, medical device companies developing surgical robots, defense corporations producing drones, transportation companies involved in driverless vehicles, and software developers pushing the boundaries of artificial intelligence.

Conclusion

Today’s robots are handling an increasingly diverse set of tasks, given advancements in mechanical engineering, materials science, and artificial intelligence. As each of these areas progress, robotics should continue to gain new capabilities and decreasing costs, resulting in further adoption across a range of segments, whether it is in manufacturing, transportation, health care, or in our homes and offices. Presently, robotics and AI are still at the early stages of the adoption curve as companies across the global economy increasingly consider how to leverage such technologies in their businesses.

This document is not intended to be, or does not constitute, investment research