Digital Transition: The Opportunity in Telemedicine & Digital Health

Telemedicine and digital health have received significant attention throughout the ongoing Covid-19 pandemic. With large swathes of the global population under stay-at-home orders, technology-based tools that facilitate remote communication with doctors and enable patient monitoring became critical.1 Beyond its support role to the traditional healthcare system during the pandemic, telemedicine and digital health are driving a revolution in healthcare. While the digitisation of healthcare is a global phenomenon, we will focus on the US healthcare system where we believe the adoption will accelerate due to the ongoing transition from a volume to value-based healthcare system.

Digital Revolution of Healthcare

Digital health has a large breadth including mobile health, health information technology, wearable devices, telemedicine, and personalised medicine that uses patient’s genes information to prevent, diagnose, or treat disease. Overall, digital health enables health care analytics which use data to optimise care for patients.

Telemedicine

Telemedicine refers to the delivery of medical care and health services from a distance. It has the potential to enhance access and quality of care for patients in unserved areas, reduce hospital admissions, and costs for both patients and providers. Prior to the Covid-19 pandemic, the use of telemedicine was minimal due to a lack of uniform coverage policies across insurers and regulators. The telemedicine landscape is complex, with many public and private stakeholders. Unlike many developed nations, the US healthcare system does not provide nationalised health insurance. Instead, most US citizens are covered by a combination of private insurance typically acquired through employers and several federal and state programs. The two main public health insurances, Medicare and Medicaid, were expanded by the Affordable Care Act (ACA) as known as Obamacare in 2010 and cover 19.8 % and 14.2% of the US population respectively in 2019. 2 The purpose of this law was to make healthcare more affordable and available to more people. It is specifically designed for the elderly, disabled, poor, and young population. In the US, the federal government regulates reimbursement and coverage of telemedicine for Medicare and self-insured plans, while Medicaid and private plans are mostly regulated on a state-by-state basis. In 2018, Medicaid in several states broadened its coverage for telemedicine services, providing a tailwind to the theme. For example, California approved reimbursement for drug use disorder telemedicine consultations. The shortage of health workers and stretched hospital capacities amid the exponential rise of Covid-19 cases in 2020 accelerated the adoption of telemedicine in the US and worldwide. Only 11% of US patients used telemedicine in 2019 against 46% today.3

We anticipate that telemedicine and other forms of virtual care will become preferred solutions for health providers as they eliminate much of the inefficiency in-person visits present – McKinsey & Company estimates that approximately US$250 billion of all US outpatient and office visit spend could be virtualised.4

Connected Medical Devices

Connected medical devices, wearables, and self-reporting mobile health applications also reduce the challenges of physical distance between providers and patients, allowing for monitoring away from traditional care centres. This is especially valuable when it comes to treating lifelong chronic conditions like diabetes. In the past, this condition required attentive monitoring of blood sugar levels and management of insulin administration. Today, devices like connected continuous glucose monitors (CGM) and insulin pumps automatically check blood sugar levels, delivering predictively dosed medication.5

Healthcare Analytics

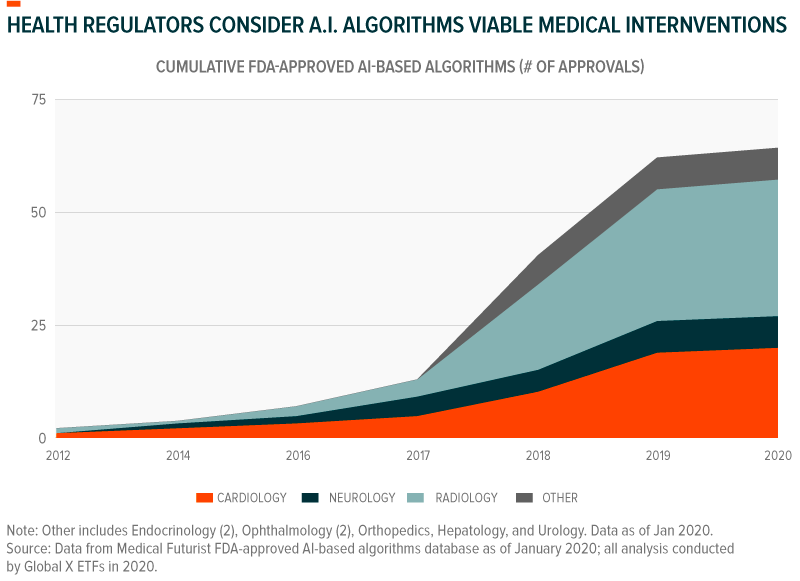

The plethora of data from these connected devices, health applications, and other sources can offer preventative health benefits when paired with genomic information and data from the broader health community. Artificial intelligence (AI) can put this data to use, finding patterns that can lead to precision treatments and smart diagnoses. By January 2020, the US Food and Drug Administration (FDA) approved over 60 different AI algorithms for medical treatment. These mostly included algorithms that analyse medical scans and images, including ones that characterise thyroid nodules, find lesions in the liver and lungs, and detect breast cancer with similar accuracy to that of radiologists.6

Healthcare data analytics also provide integrated data across physicians, clinicians, hospitals, laboratories, imaging systems, electronic health records (EHRs), and wearables. The aggregated data give insightful information about treatment efficacy and offer guidance for optimal care with clinical decision support (CDS) systems. Besides, data collected can also be used to hasten the transition towards a value-base system. For example, the Accountable Care Organisations (ACOs) developed standards which provide financial incentives and penalties based on performance, encouraging evidence-based treatment and outcome-based care. With access to broader and large-scale data, pharmaceutical companies can develop more accurate formulations, further accelerating the focus on evidence-based outcomes.

Digitisation of Healthcare Administration

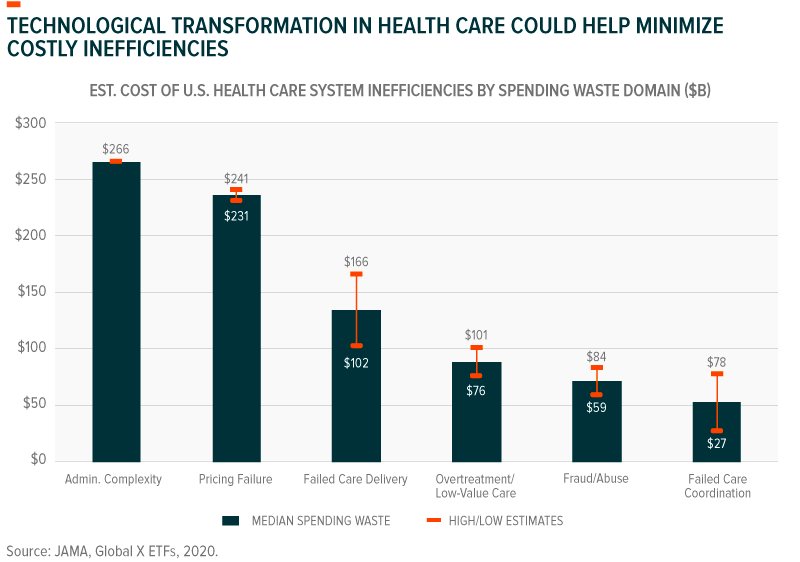

In the US, approximately 30% of health care spending could be considered wasteful, annually amounting to between US$760 billion to US$930 billion.7 With ageing populations increasing demand for health services and costs rising faster than inflation, technology-driven health solutions may present the best remedy to these shortcomings.

Healthcare administration is one area where digitisation could improve efficiency by reducing administrative operating cost and enhancing record keeping processes. Decades-long efforts to digitise health records mean that health systems produce as much as 30% of all electronic data.8 However, 80% of that data is unstructured while the remaining structured 20% lacks standardisation, with an estimated 5-10% of all health care data coming from duplicate records.9 These characteristics present issues when it comes to accurate data querying, processing, and the seamless sharing of data between health stakeholders. In many cases, poorly implemented digitisation creates complex administrative tasks that misallocate resources. AI can analyse unstructured data like scanned hand-written notes, convert it to digital text, and derive meaning from it. Amazon Web Services, for example, successfully uses machine learning natural language processing algorithms to this end.10 Other healthcare IT services can standardise data for compatibility across digital health platforms, devices, jurisdictions, and data exchange mediums. One such standard, HL7’s Fast Healthcare Interoperability Resources (FHIR) is widely regarded as a significant step in making the vast trove of global health care data useful.11 Integrated digital health platforms serve as repositories for patient data, clinical data, and genomic data, allowing stakeholders to exchange information that enables better care and optimises processes.12 Access to health data beyond the local purview can give providers and other stakeholders an idea of possible or impending health scenarios.

The Drivers of Growth of Telemedicine and Digital Health in the US

The United States lags many other developed nations in several important health indicators. After 2010, US life expectancy plateaued and in 2014 it began reversing, declining for three consecutive years from 78.9 years in 2014 to 78.6 in 2017, despite the US spending the most on healthcare than any other country in the world.13 The US total spending for healthcare is by far the highest of the developed economies, with 17% of GDP spent in 2019 against an average of 8.8% for the rest of the OECD countries.14 Most of the decline in life expectancy has been attributed to smoking-related illness, obesity, homicides, opioid overdoses, suicides, road accidents, and infant deaths. However, poverty and inequal access to healthcare results in more deadly consequences among low-income households compared to other developed countries.15

Part of the reason for the inequal access to healthcare is that private healthcare insurance companies negotiate covered services and rates with health care providers, while the uninsured can be charged very different rates. In the US, the reliance on private insurance exceeds by far those of countries that have a universal health care coverage where private insurance is usually used to fill in the gaps of public plans. Besides, most advanced economies have national cost-control programmes which keep prices lower and consistent across the population. Unlike these countries, healthcare professionals and businesses in the US are relatively free with regards to pricing for their services and can charge high costs to uninsured patients. The average American household spent almost US$5,000 per person on healthcare in 2018, which accounts for or 8.1% of its total spending.16 Dollars spent on healthcare almost doubled in the past decade. Over two thirds of the households’ healthcare spending is allocated to health insurance. Insurance costs, which have grown by 740% since 1984.17 As a result, 29.6 million of Americans or 9.2% of the population were uninsured in 2019.18 Thus, low-income populations are less likely to receive preventive health care and care for various conditions and illnesses.

The growth of telemedicine and digital health requires critical foundations including broad connectivity infrastructures, supportive regulation, accessible patient records, and systematised data collection to quantitatively improve healthcare treatment and quality. Digital health could thus play a major role in the shift from a service or fee-based model to an outcome-oriented healthcare system in the US, while potentially lowering costs. The progress in healthcare data analytics (i.e. in how data is generated, aggregated and used) now provides reliable information about a patients’ journey that can be shared between all health professional. The declining cost of technology such as, Software as a Service (SaaS) and Infrastructure as a Service (IaaS), are also providing tailwinds to the digitisation of healthcare.

The digitisation of healthcare is still in its early stage and is mutually dependent on the shift towards a value-based system. The change in paradigm is occurring in the US with volume-based care being gradually replaced by value-based reimbursement structure. According to a report from the US Department of Health and Human Services, the percentage of health care payments tied to some type of value-based care only represent a third of the source of compensation for US healthcare providers. Value-based reimbursement structures include bundled payments, shared savings, shared risk, procedural episode-based payment, or capitation.19 The main challenge for adopting a broad value-based system is the resulting pressure on profit margins for health providers compared to a volume-based system. Besides, the availability and use of data-driven tools to support physicians in practicing value-based care continue to lag. Only half of US physicians are aware of the costs of treatments they select. Clinical pathways are aimed at increasing the evidence-based practice and yet reduce variation in care. Despite being widely available (77% of physicians in 2016), less than half of respondents to the Deloitte 2020 Survey of US Physicians say they follow clinical pathways adopted at their organisation. This suggests physicians underappreciate the improvements in outcomes, quality, and the cost that can result from healthcare standardisation. Education and adequate training of physicians in digital tools appear to be another critical condition for a drastic digitisation of the sector and shift towards an outcome-orientated healthcare system.

During his campaign, President Biden supported a public option for health insurance, which we believe would be an accelerant to the shift towards an outcome-based system as well. Biden wants to give all Americans the option to purchase a low-cost public health insurance option like Medicare. As in Medicare, the Biden public option would likely reduce costs for patients. This public option will essentially be price-setting most health services. Most of the telemedicine and digital health companies are based in the US and will likely benefit from the massive growth opportunities resulting from this paradigm shift.

Digitisation of Healthcare: A Global Phenomenon

But the growth of the telemedicine and digital health theme is not just limited to the United States. We believe there are several long-term drivers for a global shift towards digitisation of healthcare, including:

- Unequal access to health care across demographics and geographies highlights opportunities for technology to expand the industry’s reach. To this point, 15.6M excess deaths occurred in low- and middle-income countries in 2016, 55% from inadequate care and 45% from non-utilization of health care.20

- People are living longer, and populations are getting older. Life expectancy rates grew faster between 2000 to 2015 than in any period since the 1960s.21 And by 2050, 16% of the global population could be over the age of 65, compared to just 9% in 2019.22 Older populations have greater health care needs and health care providers will need to innovate to treat those patients effectively and efficiently.

- Inefficiency and stagnation in global health care systems result in sub-optimal outcomes for both health providers and patients. The OECD estimates that $1.3 trillion, or 20% of annual health care expenditures in OECD countries comes from systemic inefficiencies that include administrative complexities, pricing failure, redundancies, and fraud.23

- Increased connectivity makes the delivery of virtual health services possible. Today, there are 4.6 billion active internet users globally.24

In our view, these trends are driving significant opportunity in telemedicine and digital health across geographies and regulatory environments. The market for these technologies reached an estimated US$175 billion in 2019 and is expected to grow to over US$657 billion by the end of 2025.25

Conclusion

Half of the global population lacks access to essential health services.26 A portion of this is attributable to geographic location and physical distance from health care resources and professionals. Telemedicine and digital health can expand access to healthcare by making it more geographically and financially accessible, presenting opportunities for large scale adoption. The digitisation of healthcare is still at an early stage but is benefiting from structural tailwinds such as the increased focus on improving quality of care and reducing inefficiencies and waste in the sector. While a drastic change of paradigm in the US healthcare will require public and private cooperation to adopt a dominant value-based approach, we believe this trend will accelerate with the low-cost technology and wider availability of data to support optimal care. From an investment standpoint, investing in the companies that stand to benefit from the digitisation of healthcare can represent a powerful growth opportunity as well as a hedge against the possible lower profits from traditional healthcare companies as the value-based system become dominant in the US.

This document is not intended to be, or does not constitute, investment research