Long-Term Electric Vehicle Growth Outlook Remains Strong Due to Structural Tailwinds

Electric vehicles (EVs) provide the world with an effective tool for chipping away at emissions throughout the transport sector, and fortunately the EV revolution is already well underway. Global sales of EVs in the passenger and light-duty vehicle segment are estimated to have increased 31% y-o-y in 2023, to 13.6 million units, despite macroeconomic headwinds and a contraction in the broader automobile industry.1 The long-term growth outlook for EVs also remains strong, supported by a range of factors. For example, automakers and battery producers are working hard to introduce new battery technologies that can bring more range and faster charging at a lower cost. As the future of mobility becomes increasingly electric, companies throughout the entire EV supply chain stand to potentially benefit.

This piece is part of a series that dives deeper into this year’s iteration of our flagship piece, Charting Disruption.

Key Takeaways

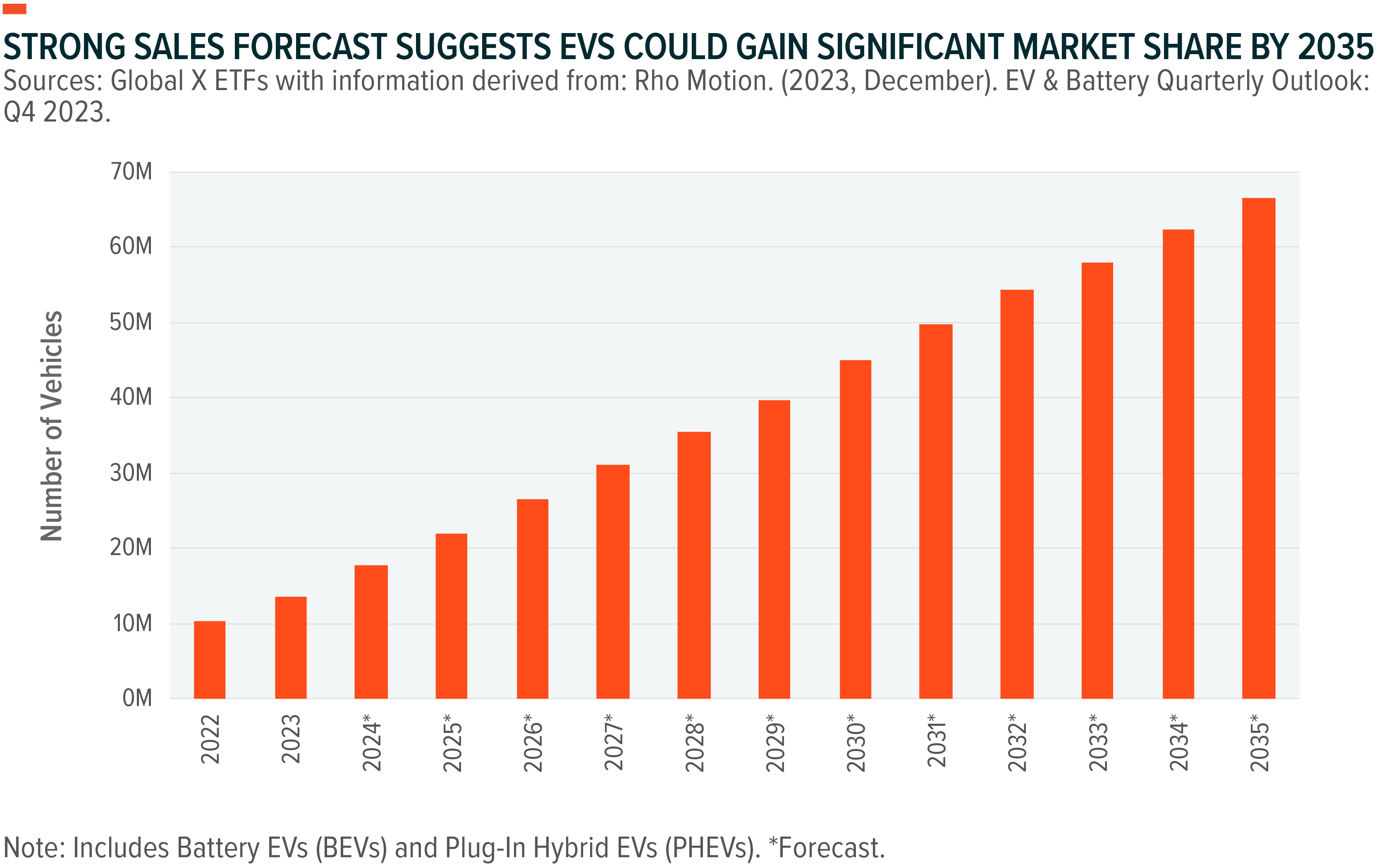

- Global EV sales are forecast to grow 5x from 13.6 million units in 2023 to nearly 67 million units by 2035, representing a compound annual growth rate (CAGR) of 14.2%.2

- Supportive policies by both governments and traditional automakers underpin the robust long-term growth outlook.

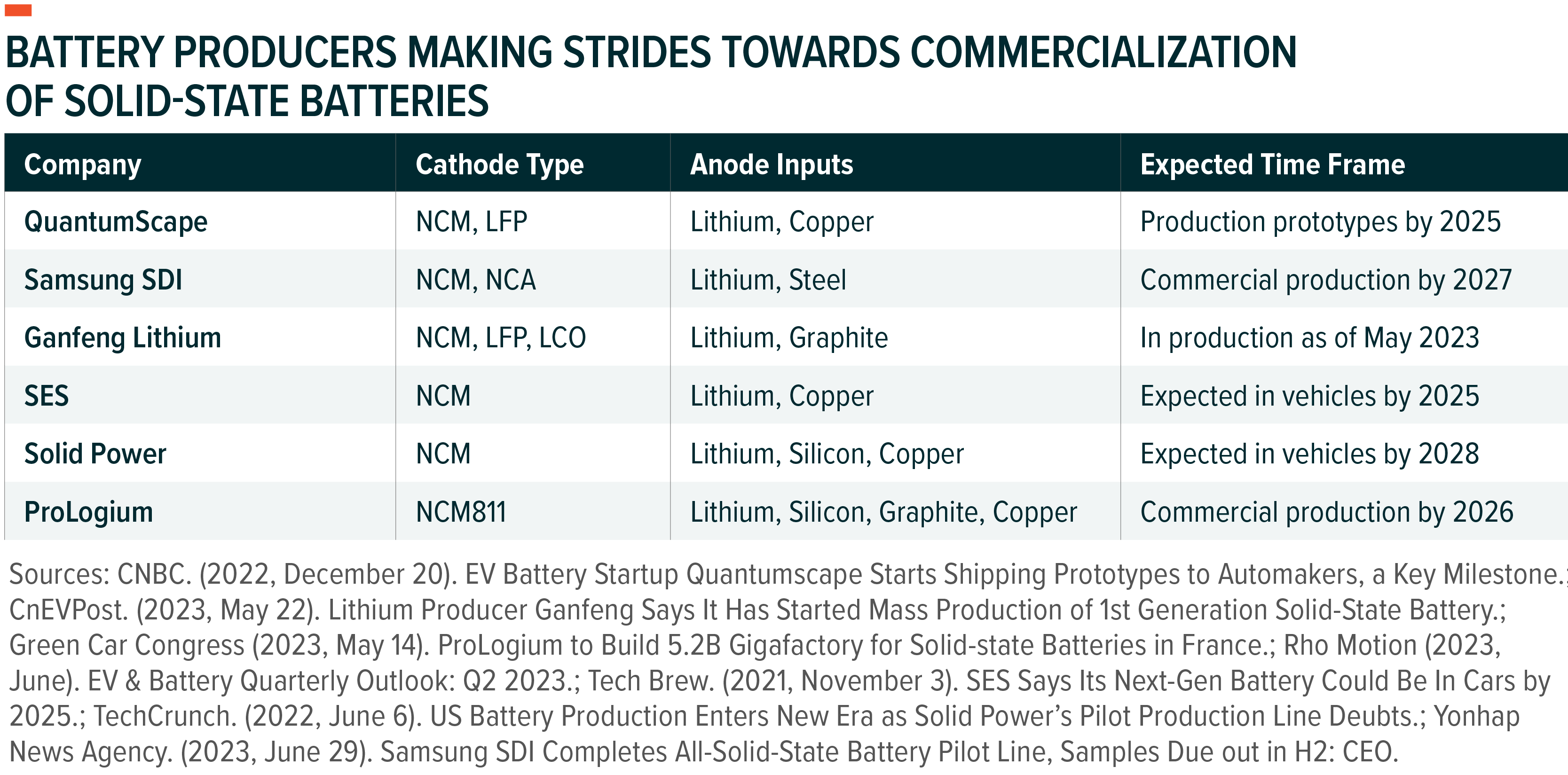

- Expectations for the commercialisation of next-generation battery technologies are also key to strong EV sales forecasts, and developers are making strides on semi-solid-state prototypes.

EVs Could Surpass a 50% Share of Global Light-Duty Vehicle Sales By 20323

The market share for EVs in the light-duty vehicle segment could grow from an estimated 17% in 2023 to more than 60% by 2035.4 The strong long-term growth outlook is supported by a range of factors, including supportive government policies in major auto markets. Many countries have set targets for partial or complete bans on sales of new internal combustion engine (ICE) vehicles. Germany is targeting new sales to be 100% zero-emission vehicles like battery or fuel cell EVs by 2030, while the U.S. is aiming for 50% of sales to come from EVs or hybrids by the end of the decade.5 The European Union has proposed an ICE ban starting in 2035, and China is also aiming for new sales to be 100% electrified by the same year.6

To encourage EV adoption, many governments have established EV subsidies or other support mechanisms. In the United States, individuals can receive a tax credit of up to $7,500 for qualifying new EVs and up to $4,000 for qualifying used EVs.7 Similarly, Germany and France also have subsidies in place for qualifying new EV purchases. In China, purchases of battery EVs and hybrids are exempt from a purchase tax of up to $4,175 per vehicle.8

Furthermore, automakers continue to invest heavily into electrifying their fleets. Original equipment manufacturers (OEMs) have announced more than $500 billion worth of investments towards meeting their electrification targets, even when factoring in a slight slowdown due to headwinds in 2023.9 For example, in April 2023, Kia and Honda increased their 2030 EV production targets to 1.6 million units and 2 million units annually, respectively.10 Toyota is targeting 1.5 million battery EV sales annually by 2026.11

Next-Gen Battery Technologies are Moving Closer to Commercialisation

Expectations for technology advancements also support the long-term outlook of growing EV sales, with battery producers making significant strides on next-gen solid-state batteries. Possible benefits of solid-state designs include faster charging capabilities, higher range, and improved safety, all of which could help boost consumer adoption.12

As seen in the table below, several key battery developers are already working on semi-solid-state or solid-state prototypes, though mass commercialisation is likely years away. Ganfeng started production on semi-solid-state prototypes in May 2023, with an initial annual production output of 4GWh.13 QuantumScape is developing a battery that could support a 400-mile range and a 15-minute charge, and the company is targeting the production of prototypes by 2025.14,15 Automakers are also making advancements. In September 2023, Toyota published its advanced battery technology roadmap, which shows its solid-state lithium-ion batteries could be ready for commercial use by 2027-28. The solid-state technology could improve Toyota’s EV cruising range by 20% and offer a charging time of 10 minutes or less.16

Conclusion: EV Growth Outlook Remains Strong

The long-term EV growth outlook remains positive due to structural tailwinds from government and corporate efforts. Additionally, technology advancements and expansions to the EV charging network can help address the top three factors that influence EV purchasing decisions – cost, charging infrastructure availability, and driving range. As the EV industry continues to mature, companies throughout the EV value chain are poised to potentially benefit, from lithium miners to battery producers and EV manufacturers.

This document is not intended to be, or does not constitute, investment research