The Case for a Defined-Outcome Strategy

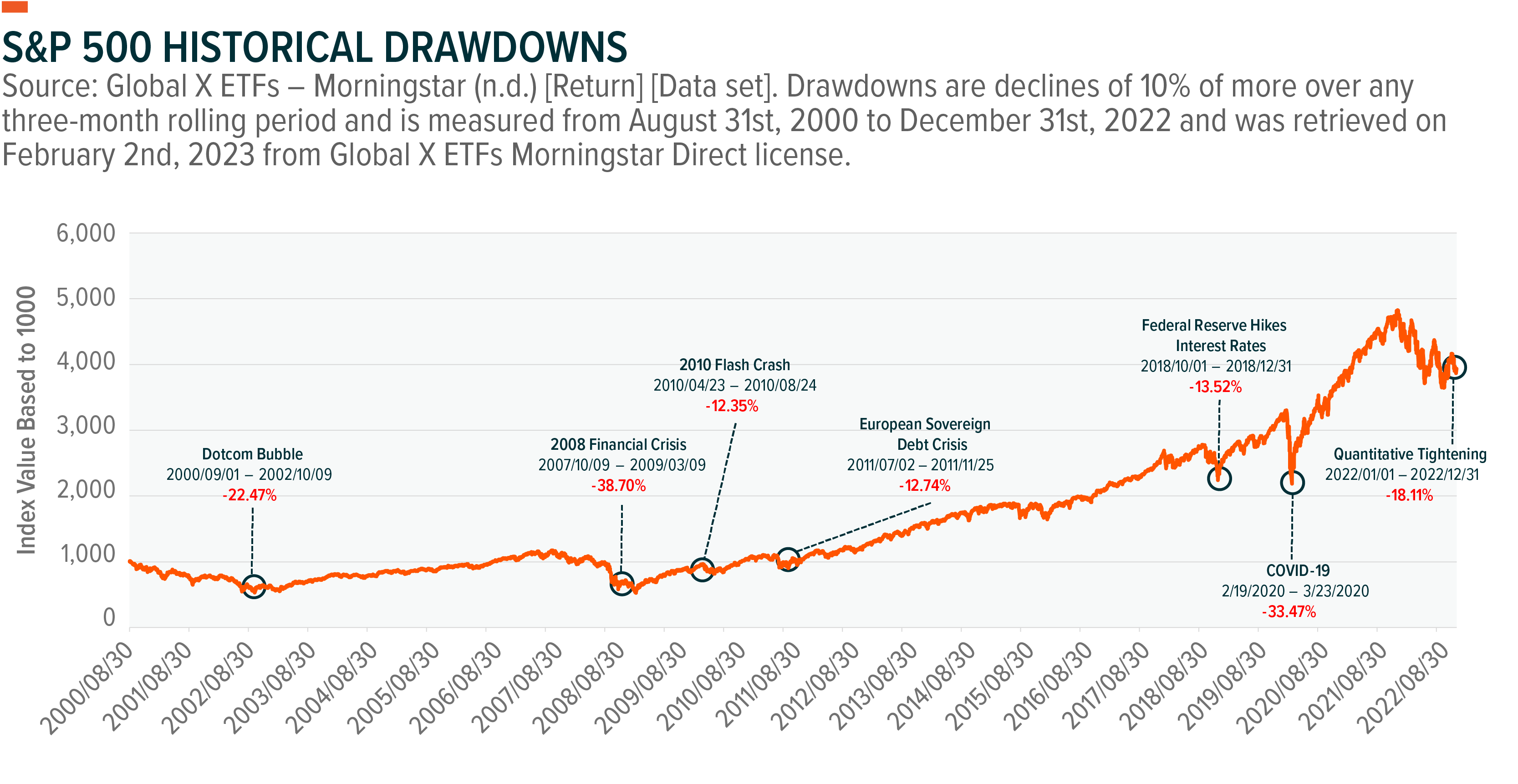

2022 finished as a challenging year for markets and investors, as concerns about a lower return environment proliferate. U.S. equity markets fell significantly after a decade plus long bull market and shifting interest rate policies globally. Central banks attempted to contain inflation by raising interest rates, consequently putting pressure on markets. This shifting regime stance is leading investors to adjust their equity portfolios towards a more defensive stance as 2023 begins with uncertainties still afoot. By accessing the options market via the implementation of a defined-outcome strategy, investors can seek to obtain a specified level of downside protection for their portfolios.

Key Takeaways

- In this challenging macroeconomic environment, defined-outcome strategies may provide investors with reduced equity risk while maintaining a level of upside participation.

- In a rising rate environment, defined-outcome strategies can help minimise equity volatility while avoiding fixed income duration risk.

- For investors looking for a specified level of downside protection, defined-outcome strategies can help investors stay invested in equities longer in as neutral cost a manner as possible.

What Are Defined-Outcome Strategies?

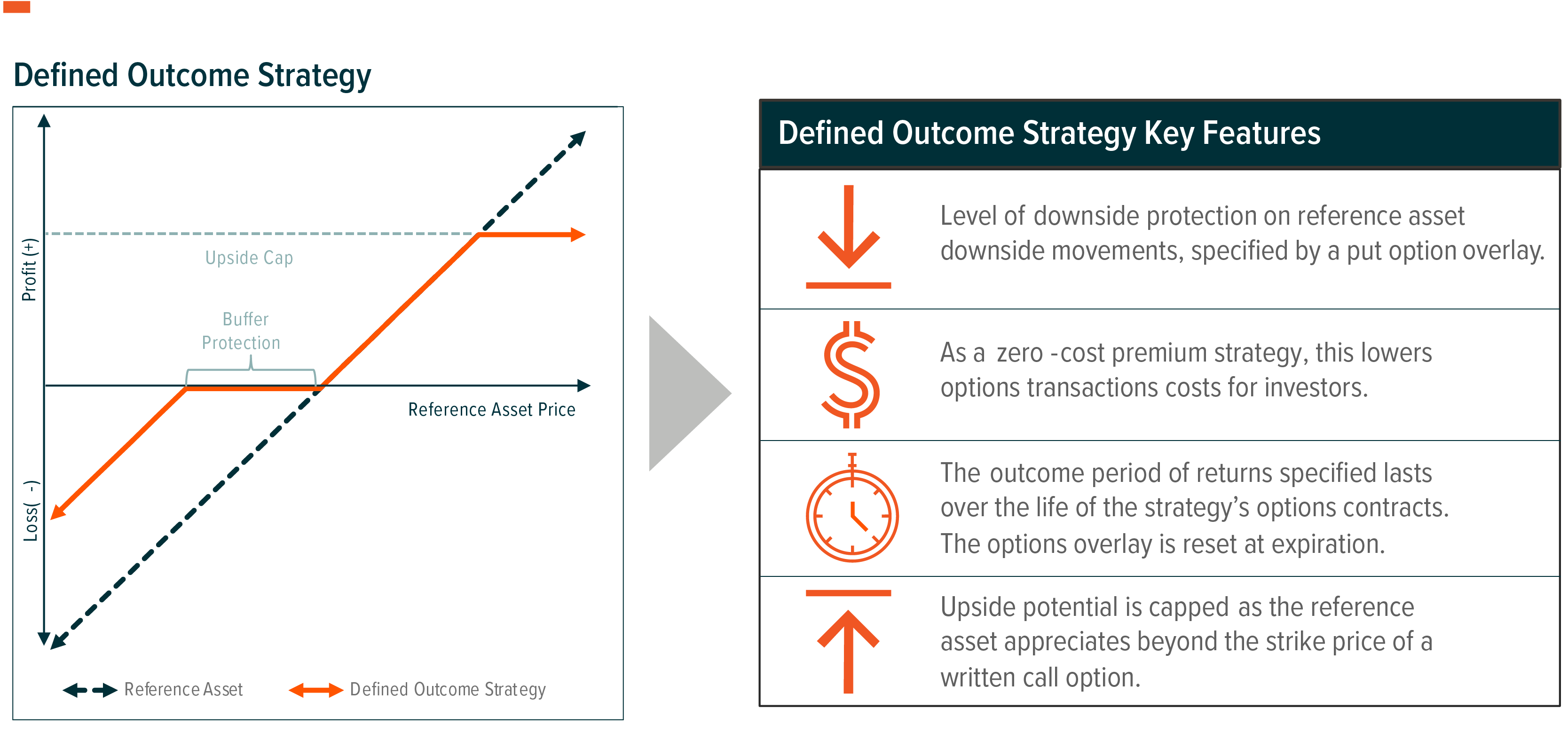

Certain defined-outcome strategies, utilising a combination of put options and call options on a specified reference asset, provide a specified level of downside protection with equity upside participation, up to a cap. The key purpose of this type of option overlay is to provide a level of risk mitigation that is predictable and specified to the investor, should this type of strategy be held from the initiation of the option contracts to contract expiration.

A defined-outcome strategy consists of the following positions that encompass the overarching exposure:

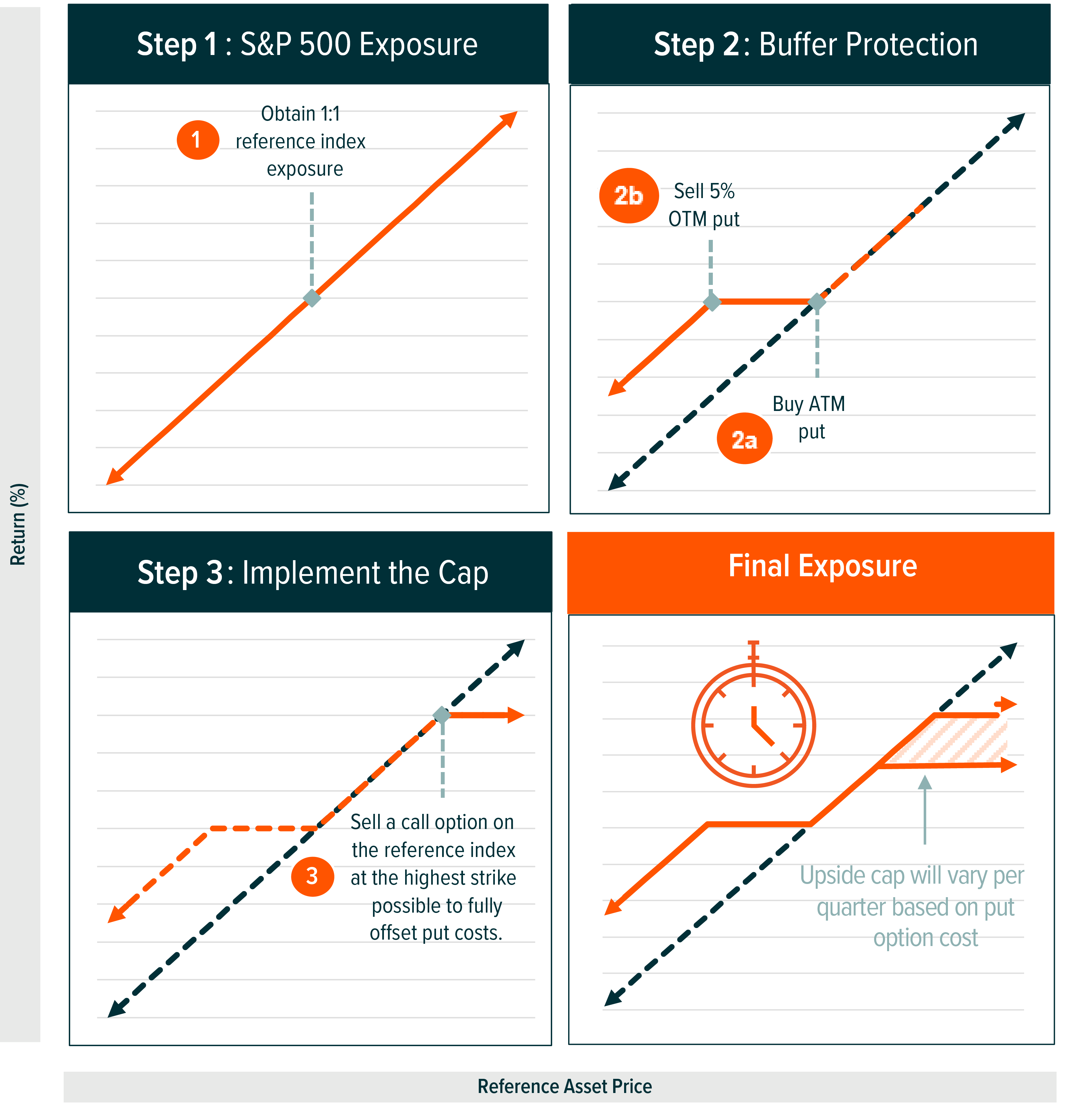

Step 1) Obtain 1:1 exposure to an underlying equity asset or index.

Step 2) The strategy will simultaneously buy a put option and sell a put option on this same underlying asset. This combination of buying a put and selling a put is known as a bear put spread where the strike price of the long put is higher than that of the short put position. The difference between the strike prices determines the degree to which the buffer protection is offered relative to the underlying asset.

Step 3) Lastly, the strategy will sell a call option at a strike price such that it offsets the costs of the bear put spread detailed in Step 2. This short call option position helps create the zero-cost put spread collar.

Defined-outcome strategies can be implemented with options of differing time expirations such as quarterly or annually. Since the premium costs of the bear put spread will change over time, this will result in a different call strike price and therefore a different upside cap during each outcome period. Ultimately, this results in a final payoff structure in which the strategy will achieve the full upside potential up to a cap, with the ability to provide a specified level of protection on losses. Hence, these multiple legs helps create the defined outcome characteristics of a strategy like this.

Investor Expectations of a Defined-Outcome Strategy

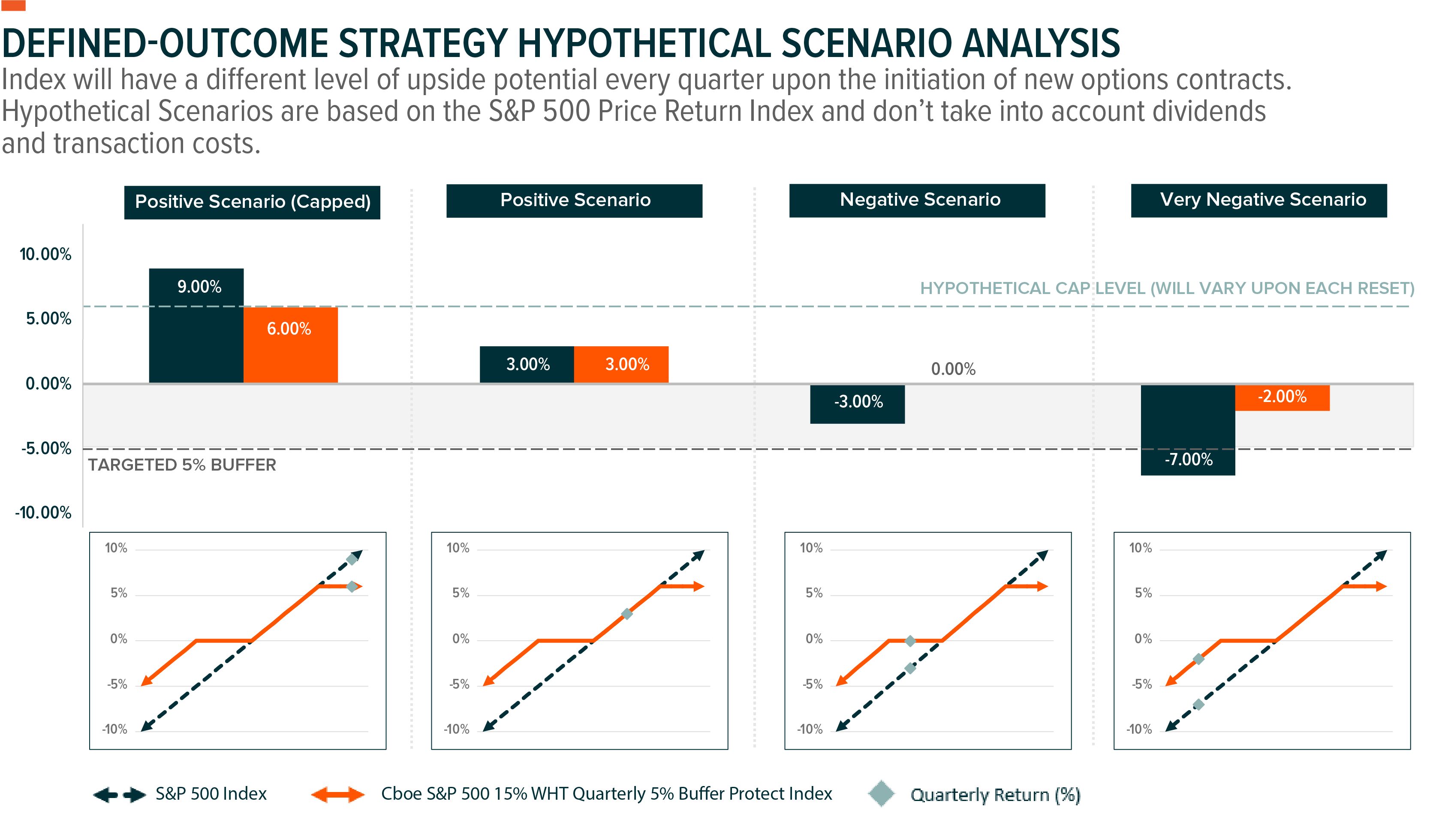

Given the specified level of downside protection offered from a defined-outcome strategy, an investor implementing it receives a “defined-outcome” of returns from the underlying asset should this strategy be held from contract initiation until contract expiration. For example, the Cboe S&P 500 15% WHT Quarterly 5% Buffer Protect Index, a representation of a quarterly defined-outcome strategy, has a 5% buffer that resets each calendar quarter. The index does this by implementing a hypothetical portfolio containing a put spread of a long “at-the-money” put option position paired with a short 5% “out-of-the-money” put option position. This means that in down markets, the investor will only take losses over a quarterly period should the losses of the S&P 500 exceed 5%. In an uptrend, the investor will receive full S&P 500 upside up to a specified cap, depending on the strike price of its covered call for the outcome period.

Why Should Investors Consider Defined-Outcome Strategies?

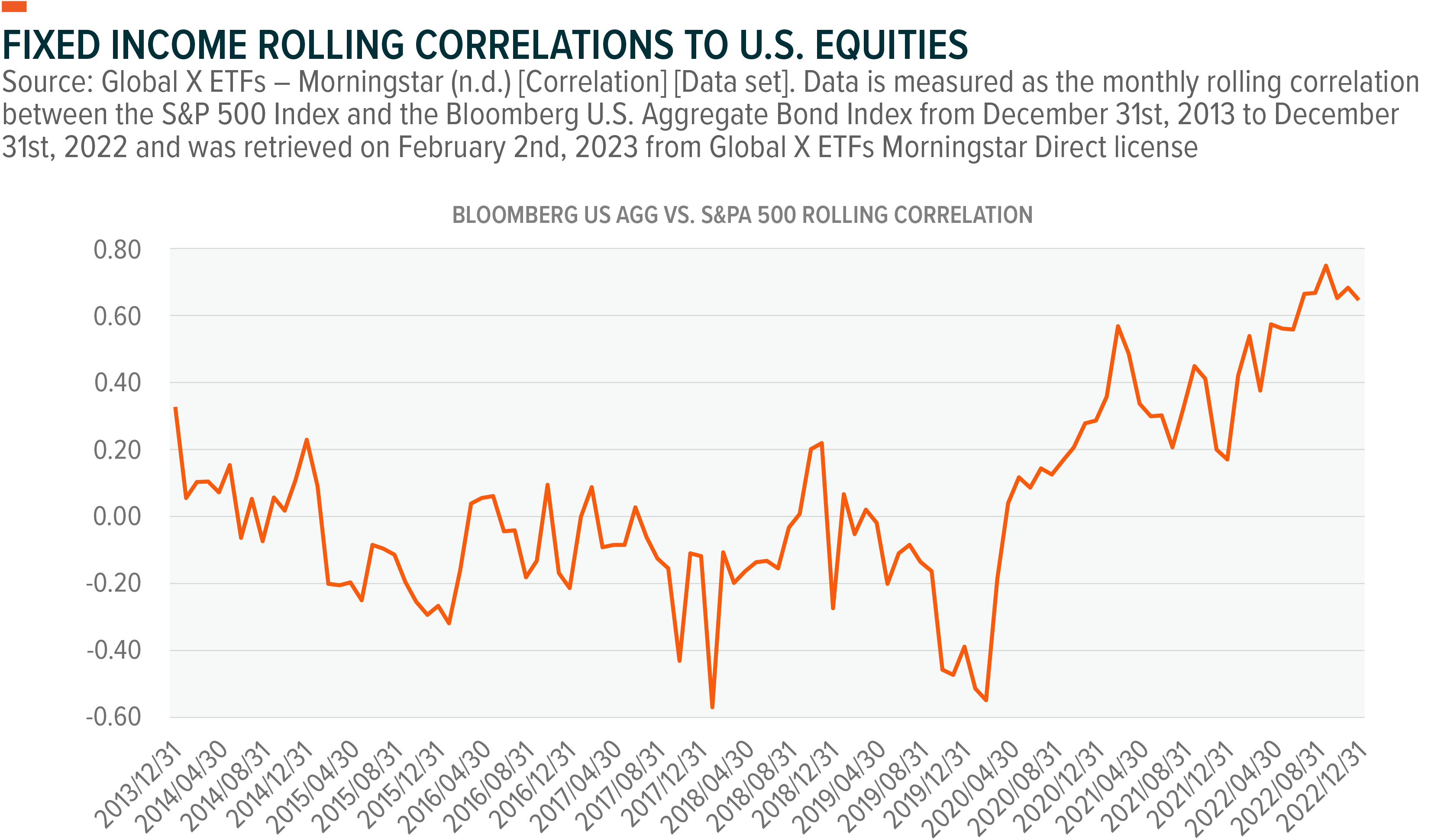

After a period of low interest rates and strong equity performance for most of the past decade, the current inflationary environment has resulted in central banks across the globe increasing interest rates at an enhanced pace, in an attempt to bring down inflation. Rate hikes may continue in the early stages of 2023 putting pressure on many of the same companies that benefitted from the previously low interest rate environment. The bond market has naturally been adversely affected as well, with substantial losses for the typical 60/40 portfolio and a side-effect of rising correlations between equity and fixed income markets. With the potential for higher volatility, it may make sense for investors to explore a defined-outcome strategy for additional sources of portfolio diversification beyond typical asset classes.

As the COVID-19 pandemic showed, the risk of an unknown event or a market correction could always be looming on the horizon. For risk-averse investors, expecting potential capitulation within equity markets, limiting left tail risk may be a priority as opposed to maximising gains. A defined-outcome strategy can potentially allow an investor to achieve multiple objectives. If equity markets were to fall, a defined-outcome strategy would be expected to provide its specified level of downside protection. However, if markets were to rise, the investor could still participate in the potential upside of the underlying asset.

Defined-Outcome Strategies Can Potentially Help Alleviate Portfolio Volatility

Investors have typically sought different types of strategies to lower their portfolio’s volatility and mitigate substantial downside movements on particular assets. One common example of this is by purchasing a protective put. These types of option strategies simply purchase a long position on an underlying asset paired with a long put option on the same asset for a level of downside protection. The difference between a protective put and a zero-cost put spread collar, such as a defined-outcome strategy, is that a protective put strategy is expected to have a net premium cost while this is not an expectation of a defined-outcome strategy that uses a covered call to offset costs. Therefore, the trade-off is that a protective put may offer higher potential upside, but a defined-outcome strategy may offer a higher level of equity risk reduction to the underlying asset.

For investors looking to mitigate broader volatility, they may seek a low volatility factor strategy. These types of portfolios tend to be constructed by filtering through a larger index universe to create a portfolio of low volatility equities over a specific period. Implementing a defined-outcome strategy on a broad index such as the S&P 500 may serve as another option to offset sector risks of low volatility factor strategies to achieve a more explicit level of volatility reduction. Furthermore, a defined-outcome strategy can potentially serve as a complement to the traditional 60/40 equity/fixed income split to improve diversification through the options market.

Conclusion

While markets tend to rise over the long term, there are opportunities for investors to endure a less volatile experience. Using a defined-outcome strategy within a portfolio may provide investors with a way to mitigate potential downside risks while also participating in rising markets. With an explicit level of downside protection over the life of the options overlay, defined-outcome strategies have historically been utilised by investors to minimise equity volatility while avoiding the duration risks of fixed income securities to stay invested in equities for longer.

This document is not intended to be, or does not constitute, investment research