Uranium Prices Have Renewed Momentum as Supply Risks Mount

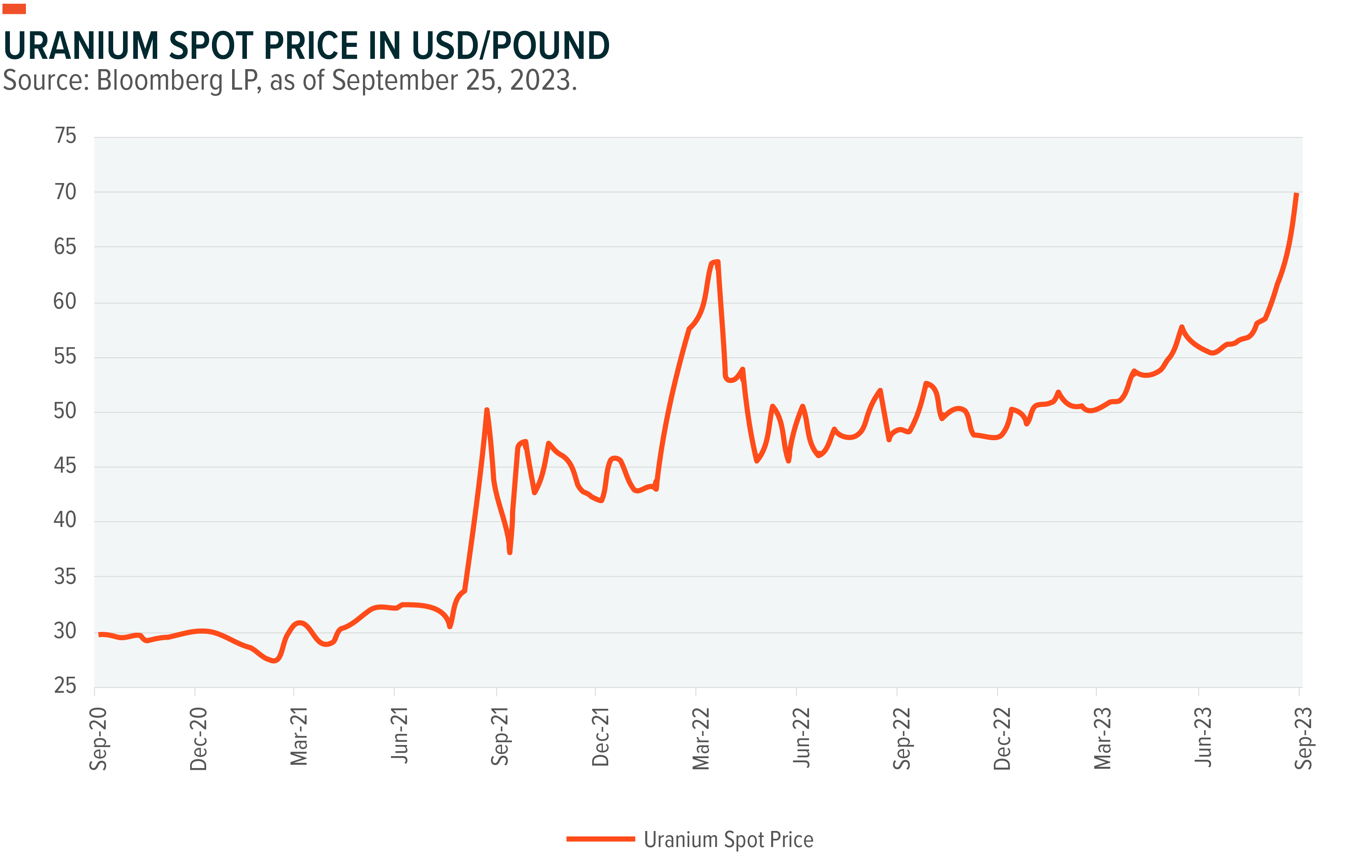

Major economies like China, India, Japan, Europe, and the United States embracing nuclear power and expanding their nuclear power capacities have uranium prices on an upswing. But with the demand for nuclear power rising, so are concerns about the global uranium supply chain. Spot uranium prices are up 47% year to date amid a host of favourable supply and demand dynamics.1 Sources of price pressures run the gamut, including lower production guidance from producers like Cameco, a coup in Niger potentially affecting its output, and uranium physical funds becoming more active. In line to benefit from these price trends are uranium mining, enrichment, and nuclear component players, who all contribute to the world turning to nuclear energy as a reliable and sustainable power source.

Key Takeaways

- Questions about current production capacity as the world turns towards uranium have supported prices in 2023. Demand is expected to climb significantly with the world embracing nuclear energy more and several nuclear projects restarting.

- Governments may increasingly incentivise uranium production. Cameco’s guidance update and the coup in Niger providing examples of supply dependability issues.

- ETFs could facilitate exposure to uranium and nuclear energy components, which seem poised for growth as part of the energy transition.

Supply and Demand Dynamics Supporting Uranium Prices

Concerns that existing capacity isn’t enough to meet bullish long-term demand is a supporting factor for current uranium prices. Geopolitics is another source of recent support, as the United States prohibited the purchase of uranium from Russia,2 a scenario that would burden the resources of the few converters and enrichers still operating in the West. Exploration expenditures for uranium increased by 60% in 2022. Also, the U.S. Department of Energy started to support a strategic domestic uranium reserve. 3

At current levels, uranium spot prices are unlikely to incentivise enough production increases in the near future from the many uranium miners that shuttered production in recent years. It may take mines 2–3 years before they begin producing at scale, which requires higher prices. While operating expenses vary by location and company, recently, supply chain disruption and cost inflation have raised the average breakeven for Western uranium mines to $90/lb.4.

On the demand side, over 121 million pounds of long-term contracting industry wide so far this year suggests a shift in the broader uranium market towards replacement-rate contracting. Long-term contracting volumes in 2023 could surpass those in each of the previous 10 years, based on the rate of contracting seen so far this year.5

Nuclear fuel market and analysis agency UxC predicts reactor uranium needs will rise to 190–200 million pounds in 2023, up from 165 million pounds in previous years. UxC estimates for primary output versus demand suggest that the market is 60–70 million pounds short.6 Also, UxC reports that almost 50% of the utilities anticipate an increase in inventory over the next two years, while just 6% anticipate a drop. The combined utility stockpiles in the European Union and the United States total just 190 million pounds, the lowest level since 2008. This tally suggests that substantial purchases may be necessary.7

Moreover, uranium physical funds could also be a source of price pressure. Around three or four uranium physical funds have been increasingly driving the uranium market since the summer of 2021. According to early indications this year, they will continue buying material and influence the market with a combined stockpile of around 100 million pounds of uranium. 8,9 Considering the accumulation of physical funds’ uranium reserves and the potential absence of a well-defined redemption mechanism, utilities may find themselves in even more need of their uranium supplies.

Despite Lower Production Guidance, Cameco is at the Forefront of the Uranium Industry’s Shift

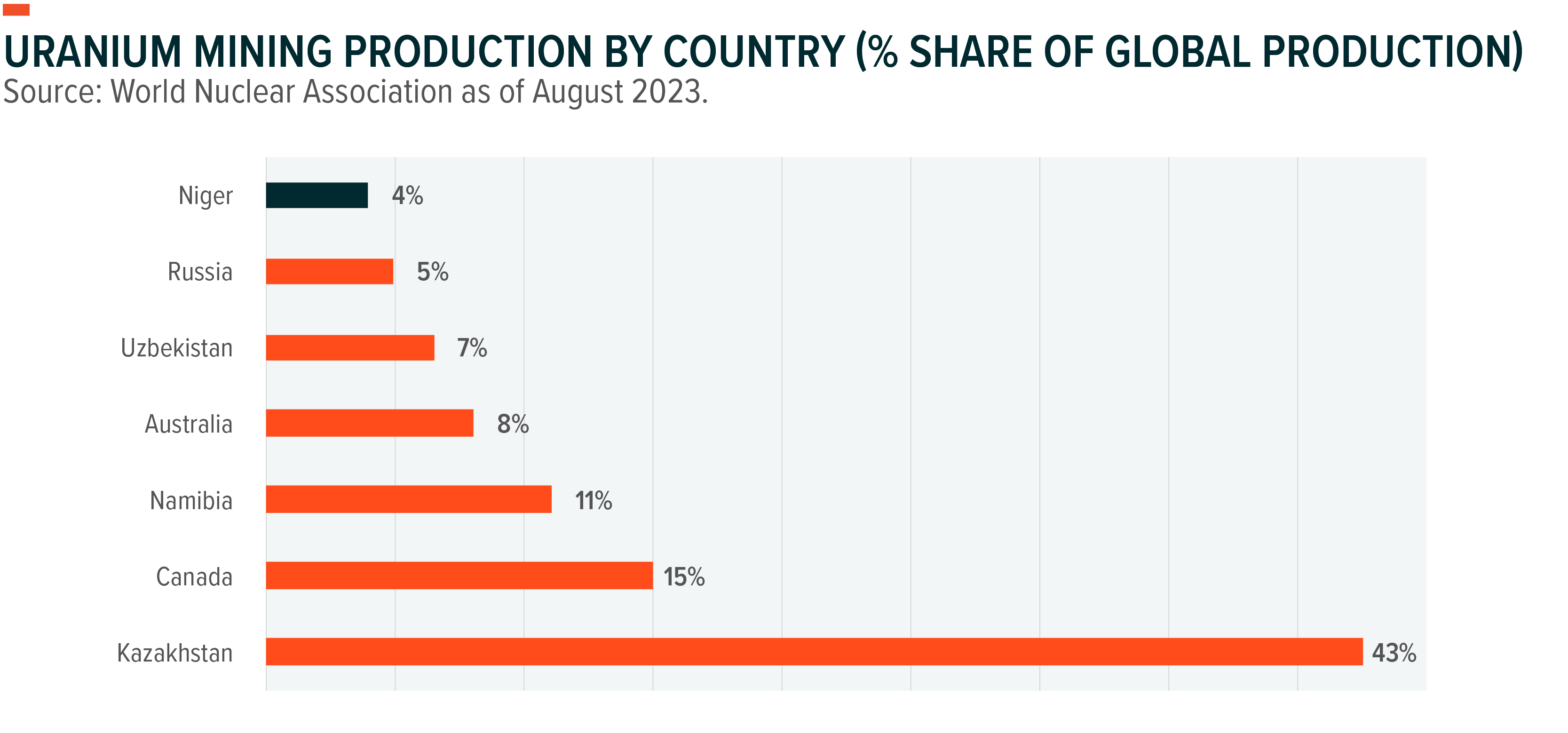

Cameco, which accounts for 12% of global mining production and is the world’s second-largest uranium miner behind Kazatomprom, announced on September 3rd a reduction in its production guidance for 2023 at its Cigar Lake and McArthur River mine and Key Lake mill facilities due to production difficulties. For this year, they now plan to produce 16.3 million pounds of uranium concentrate at Cigar Lake and 14 million pounds at McArthur River/Key Lake, down from 18 million pounds and 15 million pounds respectively. 10 Overall, Cameco’s updated 2023 output forecast implies a decrease of about 8% from its previous guidance.11

Cameco reported problems with equipment reliability at Cigar Lake, while Key Lake’s production rates are uncertain because of its ongoing ramp-up, the effect of operational modifications, a lack of qualified workers, and supply chain issues that limit the availability of materials and chemicals.12

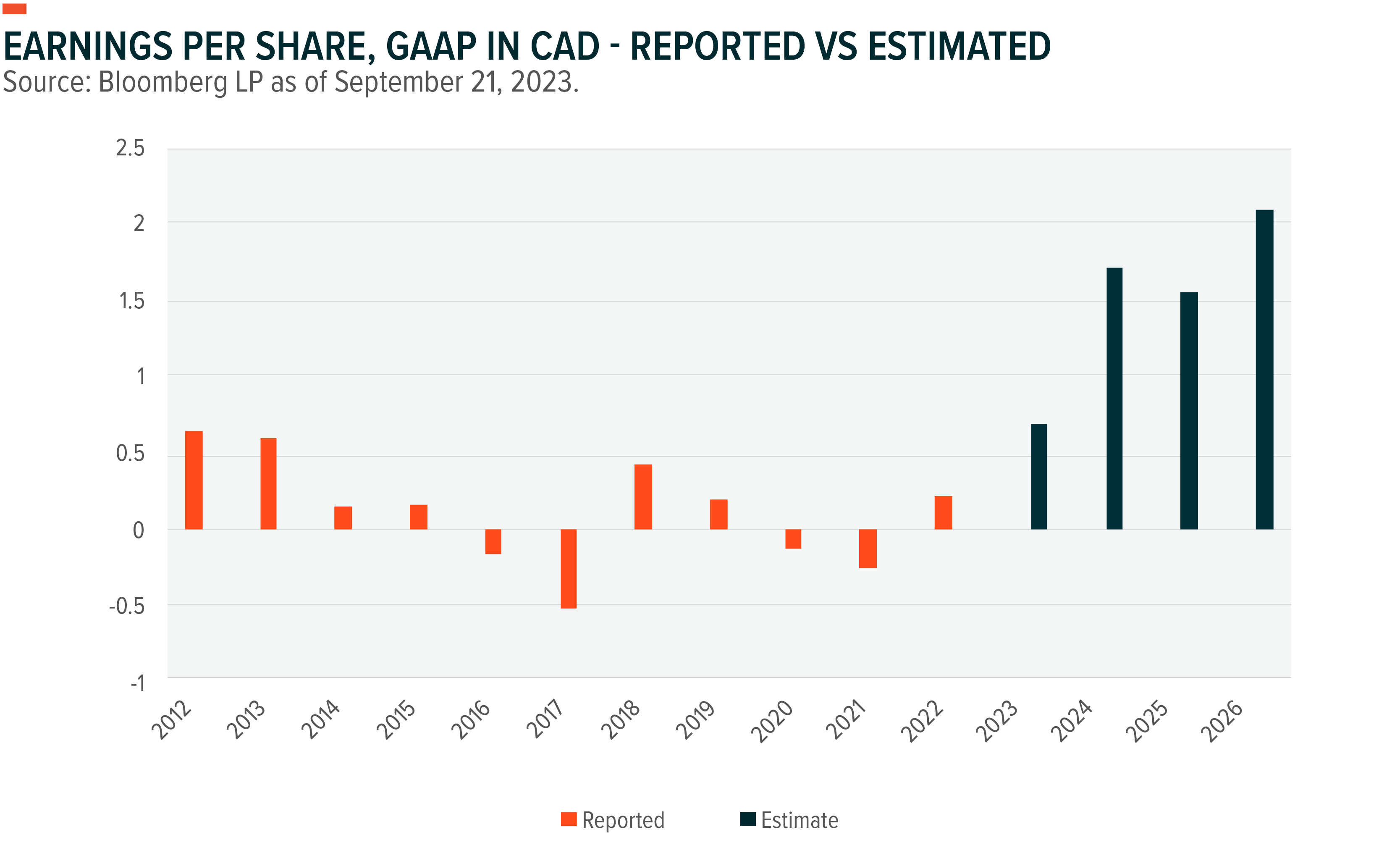

The effect of a decline in production guidance on Cameco’s earnings could be significant, but Cameco purchasing uranium in the spot market to make up for lost production should benefit uranium prices and, overall, be a net positive for the company. Indeed, since the announcement, Cameco’s stock price has seen a positive performance due to its advantageous position in the market.

From a valuation standpoint, Cameco appears attractive as earnings forward estimates are more appealing than recently reported ones. It might be argued that Cameco has the potential to achieve a higher market value as it seems to be currently undervalued: the Price to Earnings ratio estimate for the next fiscal year is 42% below the current one as earnings are projected to grow. 13 The recent earnings per share (EPS) of Cameco have already shown an increase, and the current projections for future earnings indicate a sustained growth trend in the upcoming fiscal years. This outlook is supported by the current market conditions, characterised by an upward trajectory in the spot price of Uranium. Consequently, it appears that Cameco has the potential to exceed expectations in terms of earnings and consequently align with its valuation by experiencing further growth.

Geopolitical Concerns Could Impact Uranium Supply: The Case of Niger and Russia

Around one-quarter of EU’s electricity comes from nuclear power,14 and France relies on nuclear energy to power the country, much of it fuelled by Nigerian uranium.15 While the coup in Niger could threaten Europe’s capacity, global reserves should be adequate to meet EU uranium demand in the medium term.16

More broadly, Niger accounts for only 4% of global uranium supply.17 How the coup affects Nigerian uranium output remains to be seen, but similar events in other resource-rich countries had minimal effects on mining. In terms of export revenues, Niger may begin to rely on other countries instead of France and the United States. This highlights the case for a more diversified approach to investing in uranium rather than betting on single companies.

When it comes to Russia, limiting its presence in the uranium industry might place a strain on the secondary supply. Russia holds the position of being the primary provider of uranium enrichment services in the international market, contributing for 35% of the world enrichment. 18 In the wake of Russia’s invasion of Ukraine, governments around the world revisited commodities supply chains, especially in the energy sector. On this path, US has banned uranium imports from Russia. On the primary supply, Russian uranium represents 5% of the global uranium supply, thus, limiting its exports is likely to affect the broader market, making it even tighter than it already is. 19

Correlation Between Uranium Spot Prices and Share Performance on Display

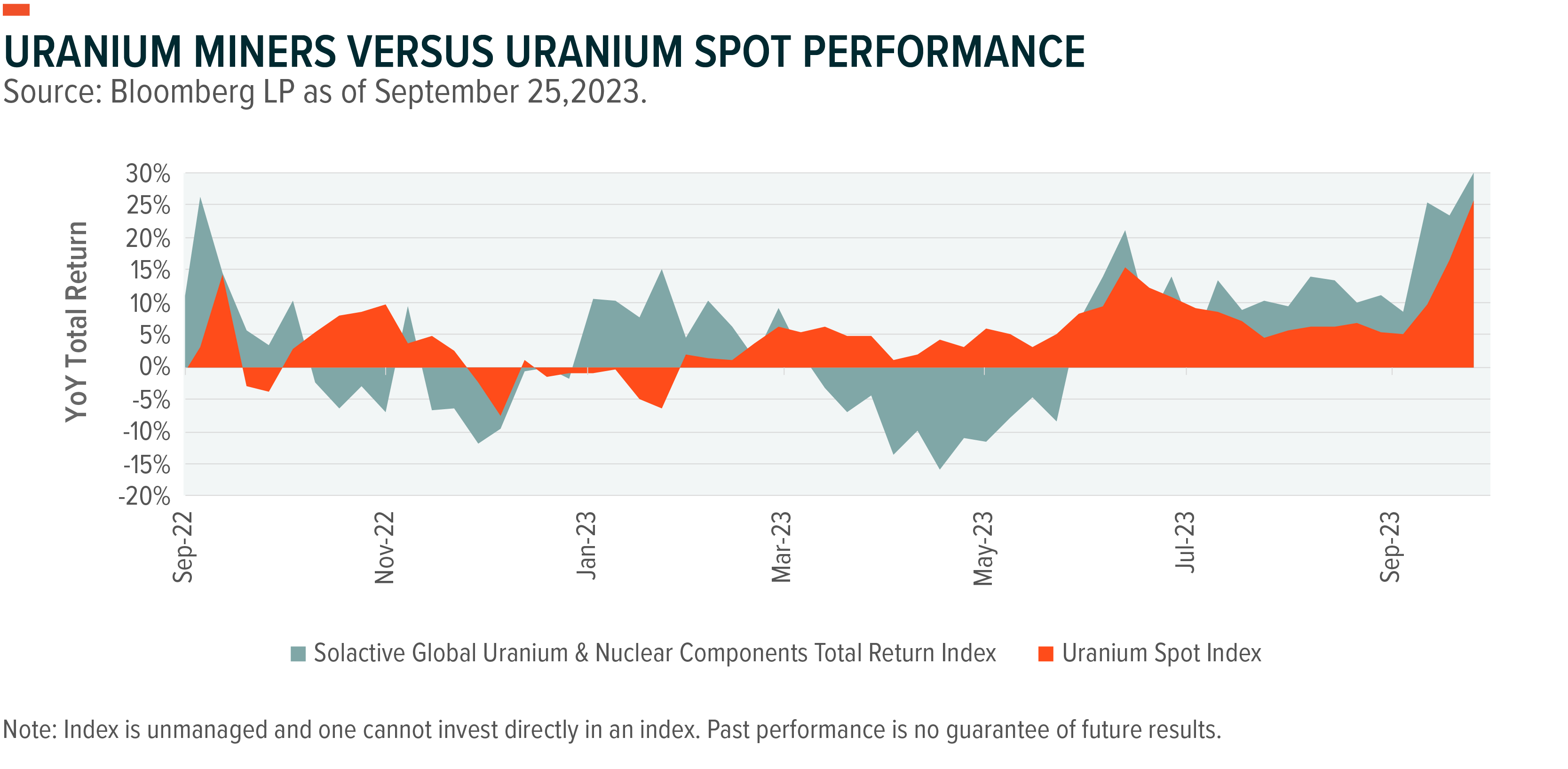

A supply and demand imbalance, the potential for lower production at a major player like Cameco, and geopolitical risks in a uranium-producing country like Niger could boost uranium spot prices. Dynamics like these could also positively affect share prices of companies in the nuclear and uranium supply chain, which are correlated with the spot price. For example, miners could outperform commodities spot prices in bullish markets due to the way these companies use their operating leverage to increase profits. In addition, miners can expand production as profit margins growth.

It is more difficult to obtain exposure to uranium than other commodities because of its low trading volume on futures exchanges and ownership restrictions. To gain exposure to uranium, ETFs could be effective in terms of helping with the liquidity issue, avoiding the rolling fees related to future investments, and offering low-cost exposure to the uranium supply chain.

Conclusion: The World Is Embracing Nuclear Energy and Its Input Uranium

Nuclear energy is increasingly seen as a stable and sustainable power source, capable of helping the global economy’s decarbonisation. This uptick in support calls uranium supply and demand dynamics into question. Spot prices are higher in 2023, and several factors, from production to the geopolitics, can continue to support and push them higher. 20 Decarbonising the global economy while ensuring a steady supply of electricity is a massive effort that requires support across the energy spectrum. In our view, compelling opportunities could be found in the role that the nuclear power supply chain plays in that effort.

This document is not intended to be, or does not constitute, investment research